How much should you be saving for retirement?

The amount you should be saving for retirement depends on various factors, including your age, income, desired retirement lifestyle, and financial goals. While there is no one-size-fits-all answer, here are some general guidelines to help you determine how much to save for retirement:

Set Retirement Goals:

- Determine your retirement goals, including the age at which you want to retire and the lifestyle you envision. Will you be traveling extensively, downsizing, or maintaining a similar lifestyle?

Calculate Retirement Expenses:

- Estimate your expected annual retirement expenses, including housing, healthcare, transportation, food, entertainment, and any other costs. Don't forget to account for inflation, which can erode your purchasing power over time.

Consider Retirement Income Sources:

- Identify potential sources of retirement income, such as Social Security, pensions, and other retirement accounts. Calculate the income you expect to receive from these sources.

Determine the Retirement Income Gap:

- Calculate the difference between your estimated retirement expenses and your expected retirement income. This gap represents the amount you need to save to maintain your desired lifestyle in retirement.

Use Retirement Calculators:

- Online retirement calculators can help you estimate your retirement savings needs more accurately. These tools take into account factors like investment returns, inflation, and life expectancy.

Set a Savings Target:

- Based on your retirement income gap and other financial considerations, set a specific retirement savings target. Aim to save enough to cover your projected expenses during retirement.

Start Early:

- The earlier you start saving for retirement, the better. Compound interest and investment growth can significantly boost your savings over time. If you're young, prioritize saving a percentage of your income consistently.

Contribute to Retirement Accounts:

- Take advantage of retirement savings accounts like 401(k)s, IRAs, or similar plans offered by your employer. These accounts offer tax advantages and can help you save efficiently.

Review and Adjust:

- Periodically review your retirement savings goals and progress. Life circumstances change, so be prepared to adjust your savings plan as needed.

Consult a Financial Advisor:

- Consider consulting a financial advisor or retirement planner who can provide personalized guidance based on your unique situation and goals.

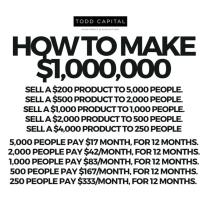

While there is no one-size-fits-all savings target for retirement, a common guideline is to aim for a retirement nest egg that is 10 to 15 times your annual pre-retirement income. However, this figure can vary widely based on individual circumstances.

Ultimately, the key to successful retirement planning is to start saving early, be consistent in your contributions, and regularly reassess your progress toward your retirement goals. The sooner you begin, the more time your investments have to grow, potentially making it easier to achieve your desired retirement lifestyle.

Retirement Savings: How Much Should You Be Setting Aside?

The amount of money you need to save for retirement depends on a variety of factors, including your desired lifestyle in retirement, your current income and expenses, your age, and your expected life expectancy.

A general rule of thumb is to save 10-15 times your final pre-retirement salary. However, this is just a general guideline. You may need to save more or less depending on your individual circumstances.

Financial Planning for Retirement: Determining Your Savings Goals

To determine your retirement savings goals, you should consider the following factors:

- Your desired lifestyle in retirement. Do you plan to travel extensively? Downsize your home? Move to a warmer climate? Your desired lifestyle in retirement will have a big impact on how much money you need to save.

- Your current income and expenses. What is your current income? What are your current expenses? Understanding your current financial situation will help you to create a realistic savings plan.

- Your age. The younger you are when you start saving for retirement, the more time your money has to grow.

- Your expected life expectancy. How long do you expect to live? The longer you expect to live, the more money you will need to save for retirement.

Building a Secure Future: Calculating Your Retirement Nest Egg

Once you have considered all of these factors, you can start to calculate how much money you need to save for retirement. There are a number of retirement calculators available online that can help you with this task.

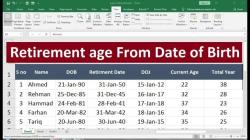

To calculate your retirement nest egg, you will need to input the following information:

- Your desired lifestyle in retirement.

- Your current income and expenses.

- Your age.

- Your expected life expectancy.

- Your investment return.

The retirement calculator will then estimate how much money you need to save for retirement based on the information you have provided.

It is important to note that this is just an estimate. Your actual retirement savings needs may vary depending on a number of factors, such as changes in your income, expenses, and investment returns.

Here are some additional tips for building a secure retirement:

- Start saving early. The earlier you start saving for retirement, the more time your money has to grow.

- Save consistently. Even if you can only save a small amount each month, it will add up over time.

- Invest your savings wisely. Consider investing your retirement savings in a diversified portfolio of stocks, bonds, and other investments.

- Rebalance your portfolio regularly. As you age and your retirement needs change, you may need to rebalance your portfolio to ensure that it is still aligned with your goals.

- Get professional help. If you need help creating a retirement savings plan or investing your savings, consider working with a financial advisor.

By following these tips, you can build a secure future and enjoy a comfortable retirement.