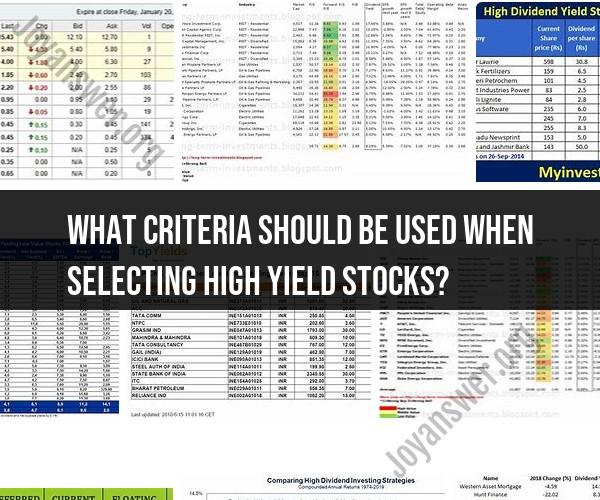

What criteria should be used when selecting high yield stocks?

Selecting high-yield stocks for investment requires careful consideration of several criteria to balance the potential for income with the associated risks. Here are some key criteria to evaluate when choosing high-yield stocks:

Dividend Yield: The dividend yield is the annual dividend payment divided by the stock's current price. A high yield, typically measured as a percentage, is a primary criterion for selecting high-yield stocks. However, be cautious of extremely high yields, as they may indicate financial distress or unsustainable payouts.

Dividend History: Examine the company's dividend history to assess its consistency and growth. A track record of increasing or stable dividends over several years is often a positive sign. Look for companies with a history of maintaining or growing dividends even during economic downturns.

Payout Ratio: The payout ratio measures the percentage of a company's earnings paid out as dividends. A sustainable high yield should be supported by a reasonable payout ratio, typically below 70% of earnings. A very high payout ratio may indicate an unsustainable dividend.

Earnings Growth: Analyze the company's historical and projected earnings growth. A company with a growing earnings stream is more likely to sustain and potentially increase its dividend payments over time.

Financial Health: Assess the company's financial health, including its balance sheet, debt levels, and cash flow. A financially stable company is better positioned to maintain dividend payments during challenging economic conditions.

Industry and Sector: Consider the industry and sector in which the company operates. Some sectors, such as utilities and consumer staples, are known for their stable and high-yield dividend stocks. Others, like technology and healthcare, may offer growth potential but lower yields.

Competitive Position: Evaluate the company's competitive position within its industry. Companies with a strong market presence and competitive advantage are more likely to maintain stable dividend payments.

Regulatory Environment: Be aware of regulatory factors that could affect the company's ability to pay dividends. Some industries, like financial services, are subject to regulatory changes that may impact dividend policies.

Market Capitalization: Consider the company's market capitalization. Smaller companies may offer higher yields but may also come with higher risks. Larger, more established companies tend to have more stable dividend policies.

Diversification: Diversify your portfolio by selecting high-yield stocks from different industries and sectors. This helps spread risk and reduce the impact of adverse events in any single sector.

Management Quality: Assess the quality and track record of the company's management team. Effective leadership can contribute to a company's ability to maintain and grow dividends.

Valuation: Evaluate the stock's valuation relative to its peers and historical averages. A stock that appears overvalued may not provide an attractive total return, even with a high dividend yield.

Market Conditions: Consider the broader economic and market conditions. High-yield stocks may perform differently in various market environments, so align your investments with your overall investment strategy and risk tolerance.

Tax Implications: Understand the tax implications of dividend income in your jurisdiction. Tax rates on dividends can vary, and this may impact your net return.

Remember that high-yield stocks often come with higher risk, so it's essential to conduct thorough research and due diligence before investing. Diversify your portfolio to spread risk, and consider consulting with a financial advisor or investment professional to tailor your high-yield stock selection to your specific financial goals and risk tolerance.