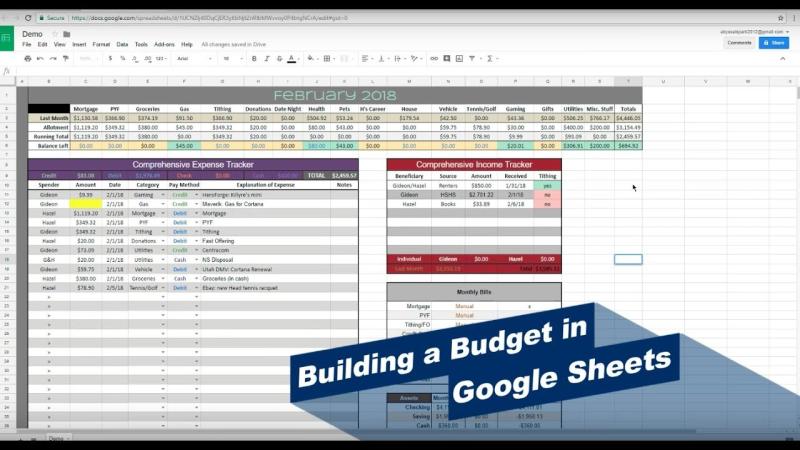

How to make monthly budget on Google Sheets?

Creating a monthly budget on Google Sheets is a practical way to manage your finances. Here's a step-by-step guide:

Open Google Sheets:

- Go to Google Sheets (sheets.google.com) and log in to your Google account.

Start a New Spreadsheet:

- Click on the "+" sign to create a new spreadsheet.

Set Up Your Columns:

- Label columns for categories such as "Income," "Expenses," "Category," "Amount," and "Notes." You can customize these based on your needs.

Enter Your Income:

- In the "Income" section, enter your sources of income for the month. This can include your salary, freelance income, or any other sources.

List Your Expense Categories:

- In the "Category" column under "Expenses," list categories such as rent/mortgage, utilities, groceries, transportation, entertainment, etc.

Estimate Expenses:

- Estimate how much you plan to spend in each category for the month. You can break down fixed and variable expenses.

Enter Amounts:

- In the "Amount" column, enter the estimated amount for each expense. You can update these as you make actual payments.

Include Notes (Optional):

- Use the "Notes" column to add any additional information or reminders related to your income or expenses.

Calculate Totals:

- Use the SUM function to calculate the total income and total expenses. For example, in the cell next to "Total Income," enter "=SUM(YourIncomeRange)" and do the same for expenses.

Calculate the Difference:

- Deduct your total expenses from your total income to calculate the difference. This will show whether you have a surplus or a deficit.

Format and Customize:

- Format your spreadsheet for clarity. You can use bold fonts for headers, add borders, and use color-coding for better visualization.

Use Formulas for Auto-Update:

- Use formulas like SUM and others to automate calculations. For example, you can set up a running total for your expenses as you add new entries.

Set Up Charts (Optional):

- If you want visual representations of your budget, create charts using the Chart tool in Google Sheets.

Save and Share:

- Save your budget spreadsheet, and you can share it with family members or collaborators if needed.

Update Regularly:

- Regularly update your budget with actual income and expense figures. This will help you track your spending and adjust your budget as needed.

Creating a monthly budget on Google Sheets provides a flexible and accessible way to manage your finances effectively.

Budgeting made easy: Creating a monthly budget on Google Sheets

In today's fast-paced world, managing finances effectively is essential for achieving financial stability and peace of mind. Creating a monthly budget is a crucial step towards taking control of your finances and ensuring that your income is being spent wisely. Google Sheets, a free spreadsheet application available through Google Drive, provides a user-friendly platform for creating and maintaining a comprehensive monthly budget.

Step-by-step guide to setting up a budget spreadsheet on Google Sheets

1. Create a New Spreadsheet:

- Open Google Drive and click on "New" > "Google Sheet."

2. Create Income and Expense Categories:

In the first row, create columns for different categories of income, such as "Salary," "Interest Income," and "Side Hustles."

In the second row, create columns for different categories of expenses, such as "Housing," "Food," "Transportation," and "Entertainment."

3. Enter Income Amounts:

- In the appropriate rows, enter the corresponding income amounts for each category.

4. Enter Expense Amounts:

- In the appropriate rows, enter the corresponding expense amounts for each category.

5. Calculate Total Income and Expenses:

In the last row, create columns for "Total Income" and "Total Expenses."

Use the SUM function to calculate the total income and expenses for each month.

6. Calculate Net Income:

- In a separate column, calculate the net income by subtracting total expenses from total income.

7. Add Budget Goals:

Create columns for target or budgeted amounts for each expense category.

Use conditional formatting to highlight areas where expenses exceed or fall below budget goals.

Utilizing Google Sheets features for efficient tracking and analysis of monthly expenses

Google Sheets offers various features that can enhance your budgeting experience:

1. Charts and Graphs:

- Create charts and graphs to visualize your income and expenses trends, making it easier to identify areas for improvement.

2. PivotTables:

- Utilize pivot tables to summarize and analyze your expenses by category, date, or other criteria.

3. Conditional Formatting:

- Apply conditional formatting to highlight specific cells or rows, such as those exceeding budget limits.

4. Formulas and Functions:

- Leverage formulas and functions to automate calculations, such as calculating percentages of income allocated to different expenses.

5. Google Sheets Templates:

- Explore Google Sheets templates specifically designed for budgeting, providing a pre-formatted structure and formulas.

6. Sharing and Collaboration:

- Share your budget spreadsheet with others for collaboration, allowing for joint tracking and feedback.

By effectively utilizing these features, you can transform your Google Sheets budget into a powerful tool for financial management and analysis.

Remember, budgeting is an ongoing process that requires regular review and adjustments. As your income and expenses fluctuate, revisit your budget periodically to ensure it aligns with your current financial situation and goals.