How do you estimate your pension?

Estimating your pension, particularly for a defined benefit plan (the traditional type of pension where your employer promises a specific payout in retirement), typically involves a formula that takes into account several key factors.

Here's a breakdown of how pensions are typically estimated and the factors involved:

The General Pension Formula

Most defined benefit pension plans use a variation of this formula:

Annual Pension Benefit = (Years of Service) x (Final Average Salary) x (Multiplier/Accrual Rate)

Let's look at each component:

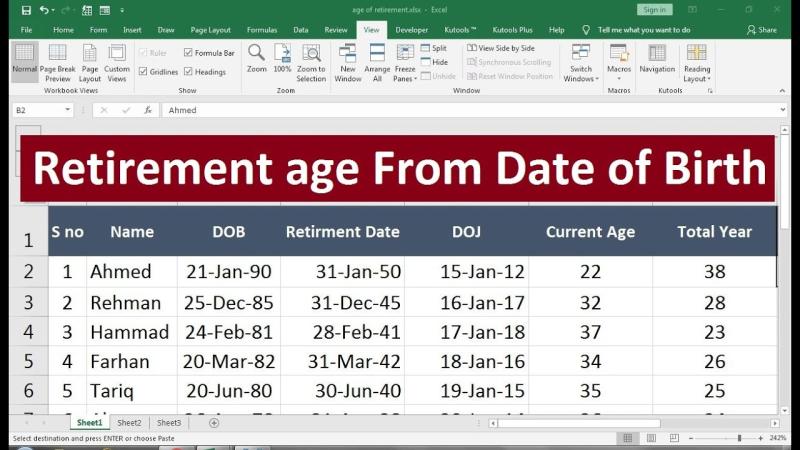

Years of Service (Credited Service):

- This refers to the total number of years you've worked for the employer that sponsors the pension plan.

- Some plans may have a maximum number of years that count towards the pension calculation (e.g., 30 or 35 years).

- Purchasing service credit from previous employment or military service may also be possible, which would increase your years of service.

Final Average Salary (FAS) or Highest Average Salary:

- This is typically the average of your highest earnings over a specific period, often the last 3 or 5 consecutive years of your employment.

- Some plans might use the highest 3 or 5 years of salary, regardless of whether they were consecutive or at the end of your career.

- This figure usually includes your basic salary but generally excludes things like overtime, bonuses, or other non-regular pay.

- This is typically the average of your highest earnings over a specific period, often the last 3 or 5 consecutive years of your employment.

Multiplier (Accrual Rate/Crediting Rate/Benefit Rate):

- This is a percentage (often between 1% and 2.5%) that the plan uses to determine what percentage of your final average salary you will receive per year of service.

- The higher the multiplier, the larger your pension benefit.

- This rate can sometimes vary based on your age at retirement or your "tier" in the pension system (common in public sector pensions).

Example Calculation:

Let's use a common example:

- Years of Service: 30 years

- Final Average Salary: $75,000

- Multiplier: 2% (or 0.02)

Annual Pension Benefit = 30 x $75,000 x 0.02 = $45,000 per year

This $45,000 would typically be your guaranteed annual income for life in retirement.

Other Factors That Can Affect Your Pension Estimate:

- Vesting Period: You must work for a certain number of years (the vesting period) to be eligible to receive any pension benefits.

If you leave before being fully vested, you might forfeit your employer's contributions. - Retirement Age:

- Normal Retirement Age (NRA): This is the age at which you can retire and receive your full, unreduced pension benefit (often 65, but can vary).

- Early Retirement: If you retire before your NRA, your pension benefit may be reduced.

The reduction percentage varies by plan and can be significant. - Delayed Retirement: If you continue working past your NRA, your pension benefit might increase due to more years of service and potentially a higher final average salary.

- Normal Retirement Age (NRA): This is the age at which you can retire and receive your full, unreduced pension benefit (often 65, but can vary).

- Pension Payment Options: Most pension plans offer various payment options that can affect the monthly amount you receive:

- Single Life Annuity: Pays the highest monthly benefit for your lifetime, but payments typically stop upon your death.

- Joint and Survivor Annuity: Provides a lower monthly benefit but continues to pay a percentage (e.g., 50% or 100%) to a surviving spouse or beneficiary after your death.

- Period Certain: Guarantees payments for a specific number of years (e.g., 5, 10, or 20 years), even if you die before the period ends.

- Single Life Annuity: Pays the highest monthly benefit for your lifetime, but payments typically stop upon your death.

- Cost-of-Living Adjustments (COLAs): Some pensions include COLAs, which can increase your benefit payments over time to help combat inflation.

Not all pensions offer this, and the adjustment amount can vary. - Coordination with Social Security: Some pension plans are "integrated" or "coordinated" with Social Security, meaning your pension benefit might be reduced once you start receiving Social Security benefits.

- Transfers/Buybacks: As mentioned, transferring service from previous employers or buying back years of service (e.g., for military service) can impact your total credited service.

- Plan-Specific Rules: Every pension plan has its own unique rules and formulas. Public sector pensions (state, local, federal) often have different structures than private company pensions.

How to Get an Accurate Pension Estimate:

- Contact Your Plan Administrator: This is the most reliable way to get an accurate estimate. Your HR department or the pension plan's administrative office can provide you with statements or use their internal tools to generate estimates based on your specific employment history and the plan's rules. Many plans also have online portals where you can log in and generate your own estimates.

- Review Annual Statements: Many pension plans send out annual benefit statements that include an estimated retirement benefit.

- Use Online Calculators: Your pension plan's website might have an online calculator where you can input different retirement ages and scenarios to see how your benefit changes.

Understanding these factors will help you make more informed decisions about your retirement planning and how your pension will fit into your overall retirement income strategy.

What methods are available for estimating the value of one's pension?

Good question — estimating the value of your pension can help you plan for retirement more realistically. Here’s a clear breakdown of the main methods to estimate a pension’s value:

Common Methods to Estimate Pension Value

Use Your Pension Plan’s Benefit Statement

Easiest & most accurate (if available)

Many employers or pension administrators send annual statements.

These show your accrued benefit to date and often give a projection at your normal retirement age.

Some plans have online calculators where you can input retirement age and income assumptions.

Use the Pension Formula Manually

Good for defined benefit plans (traditional pensions)

Many pensions use a formula like:

Annual Pension=Years of Service×Final Average Salary×Benefit Multiplier (%)Example:

30 years of service

Final average salary: $60,000

Multiplier: 1.5%

Then:

30 × $60,000 × 1.5% = $27,000 per year.

Estimate Present Value (Lump Sum Equivalent)

Useful if you want to compare with your 401(k) or IRA

To get the lump sum equivalent, you estimate the present value of the future pension payments.

Basic steps:

Calculate annual pension benefit (from the formula above).

Choose an estimated life expectancy and discount rate (e.g., 4–5%).

Use a present value formula or an online annuity calculator.

Example:

$27,000/year for 20 years, discounted at 4% ≈ $374,000 present value.

Use an Online Pension Calculator

Quick & user-friendly

Many government sites, financial institutions, or pension plan websites offer calculators.

For example: Pension Benefit Guaranty Corporation (PBGC) estimator for certain plans.

These tools estimate your benefit based on age, years of service, and salary.

Bonus: Consult a Professional

If your pension has complex options (early retirement penalties, survivor benefits, COLAs), a financial planner or actuary can help you get a precise estimate and advice for when to claim.

Key Tips

✔ Keep your plan documents handy.

✔ Check if your benefit includes cost-of-living adjustments (COLA).

✔ Understand if your benefit changes with early or late retirement.