Where is the best place to put money?

The best place to put your money depends on your financial goals, risk tolerance, and the amount of access you need to your funds. Here are some common options to consider:

Savings Account: A savings account is a safe and easily accessible place to store your money. It typically offers a modest interest rate. It's a good choice for your emergency fund or short-term savings goals.

Checking Account: A checking account is ideal for everyday expenses and bills. It offers easy access to your funds through checks, debit cards, and online banking.

Certificate of Deposit (CD): CDs offer a higher interest rate than regular savings accounts but require you to lock in your money for a fixed term, typically ranging from a few months to several years. They are good for longer-term savings goals when you don't need immediate access to your funds.

Money Market Account: Money market accounts combine some features of savings and checking accounts. They typically offer higher interest rates than regular savings accounts and allow limited check-writing capabilities.

High-Yield Savings Account: Some online banks offer high-yield savings accounts with competitive interest rates. These can be a good option for both emergency funds and saving for specific goals.

Investment Accounts: If you have longer-term financial goals (e.g., retirement, buying a home), consider investment accounts like a 401(k) or an Individual Retirement Account (IRA) for retirement savings or a brokerage account for other investments. These offer the potential for higher returns but come with varying levels of risk.

Real Estate: Buying property, such as a home or rental property, can be an investment that appreciates over time while providing a place to live or generating rental income.

Pay Off Debt: Paying off high-interest debt, like credit card debt, is often one of the best investments you can make. The interest savings can be substantial.

Health Savings Account (HSA): If you have a qualifying high-deductible health plan, an HSA can be an excellent way to save for medical expenses with pre-tax dollars.

Emergency Fund: Prioritize building an emergency fund with 3-6 months' worth of living expenses in a liquid and easily accessible account.

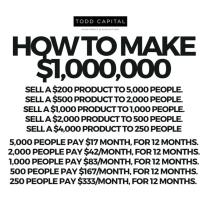

Diversified Investments: For long-term wealth building, consider a diversified investment portfolio that includes a mix of stocks, bonds, and other assets. Many people use mutual funds or exchange-traded funds (ETFs) for diversification.

The best strategy is often a combination of these options that aligns with your financial goals. Diversifying your investments, having an emergency fund, and paying off high-interest debt are usually wise financial moves regardless of your specific goals. Consult with a financial advisor to create a personalized plan based on your unique circumstances.