How does a monthly budget worksheet help you?

A monthly budget worksheet is a valuable tool for personal financial management, providing numerous benefits:

Financial Awareness:

- A budget worksheet helps you become more aware of your financial situation by detailing your income, expenses, and savings. This awareness is crucial for making informed financial decisions.

Expense Tracking:

- By categorizing and recording your expenses, a budget worksheet allows you to track where your money is going. This helps identify areas where you can cut back or make adjustments.

Goal Setting:

- A budget helps you set and prioritize financial goals. Whether it's saving for a vacation, paying off debt, or building an emergency fund, a budget guides your spending to align with your objectives.

Financial Planning:

- With a budget, you can plan for both short-term and long-term financial needs. This includes planning for major purchases, investments, and retirement.

Debt Management:

- A budget worksheet assists in managing and reducing debt. By allocating funds specifically for debt repayment, you can work towards becoming debt-free more efficiently.

Emergency Preparedness:

- Budgeting allows you to set aside money for emergencies and unexpected expenses. This helps create a financial safety net, reducing stress during unforeseen circumstances.

Identifying Trends:

- Over time, budgeting helps you identify spending patterns and trends. Recognizing these patterns enables you to make proactive adjustments to your financial habits.

Increased Savings:

- By prioritizing savings in your budget, you can build up your savings account or contribute to investment accounts. This financial discipline contributes to long-term wealth-building.

Reduced Stress:

- Knowing where your money is going and having a plan in place can significantly reduce financial stress. A budget provides a sense of control and confidence in your financial decisions.

Improved Decision Making:

- With a clear understanding of your financial situation, you can make more informed decisions about spending, saving, and investing. This leads to better financial outcomes in the long run.

Accountability:

- A budget holds you accountable for your financial choices. It serves as a guide and encourages responsible money management.

Improved Relationships:

- If you share finances with a partner, a budget can improve communication and collaboration on financial goals. It ensures that both individuals are on the same page regarding spending and saving priorities.

Financial Freedom:

- Ultimately, a well-managed budget can contribute to financial freedom. It allows you to allocate resources efficiently, reduce debt, and build wealth over time.

In summary, a monthly budget worksheet is a practical and effective tool for achieving financial stability, planning for the future, and working towards your financial goals.

Taking control of your finances: How does a monthly budget worksheet benefit you?

In today's world, where financial obligations and spending opportunities abound, it's crucial to have a clear understanding of your income and expenses. A monthly budget worksheet serves as a valuable tool for achieving financial stability, helping you track your spending habits, plan for the future, and make informed financial decisions.

Benefits of Using a Monthly Budget Worksheet:

Gain Clarity on Your Financial Situation: A budget worksheet provides a comprehensive overview of your income and expenses, allowing you to see where your money is going each month. This clarity can help you identify areas where you can cut back on spending and reallocate funds towards more essential needs or financial goals.

Set and Track Financial Goals: Whether it's saving for a down payment on a home, paying off debt, or simply building an emergency fund, a budget worksheet allows you to set specific financial goals and track your progress towards achieving them. This visualization of your progress can be a powerful motivator to stay on track.

Make Informed Spending Decisions: With a clear understanding of your income and expenses, you can make more informed decisions about how you allocate your money. This can help you avoid impulse purchases, overspending, and financial strain.

Identify and Manage Debt: If you have debt, a budget worksheet can help you create a plan for paying it off. By tracking your debt repayments and interest charges, you can develop a strategy to reduce your overall debt burden.

Plan for Unexpected Expenses: Unexpected expenses can easily derail your financial plans. By budgeting for potential emergencies, you can be better prepared to handle unexpected costs without disrupting your financial stability.

Tips for Creating and Utilizing a Monthly Budget Worksheet:

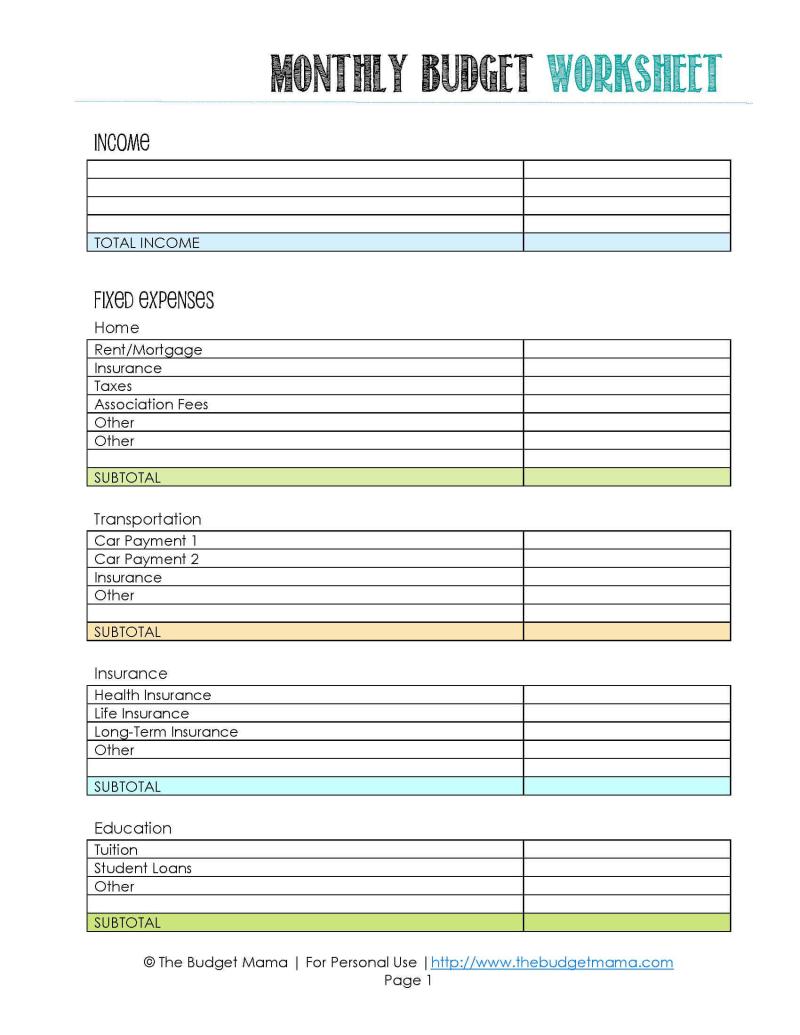

Choose a Format: There are various budget worksheet formats available, including digital spreadsheets, printable templates, and mobile apps. Choose a format that suits your preferences and is readily accessible for regular updates.

List Income Sources: Accurately list all sources of income, such as salaries, wages, interest earnings, and any additional income streams.

Categorize Expenses: Divide your expenses into categories, such as housing, food, transportation, utilities, debt repayments, entertainment, and personal care.

Track Expenses Regularly: Regularly record your expenses in the appropriate categories. This can be done daily, weekly, or monthly, depending on your spending habits.

Reconcile Your Accounts: Regularly reconcile your budget worksheet with your bank and credit card statements to ensure accuracy and identify any discrepancies.

Review and Adjust: Regularly review your budget worksheet to assess your spending patterns and make adjustments as needed. As your income or expenses change, update your budget accordingly.

Common Pitfalls to Avoid When Using Monthly Budget Worksheets:

Overestimating Income: Be realistic when estimating your income. Avoid relying on anticipated income sources that may not materialize.

Underestimating Expenses: Be conservative when estimating expenses. Account for potential fluctuations in expenses, such as seasonal variations or unexpected costs.

Not Including All Expenses: Ensure you include all expenses, even small or infrequent ones. Overlooking minor expenses can distort your budget's accuracy.

Neglecting Debt Repayments: Prioritize debt repayment in your budget. Allocate a significant portion of your income towards reducing debt and improving your financial standing.

Failing to Review and Adjust: Regularly review and adjust your budget as your income, expenses, and financial goals evolve. A static budget may not reflect your current financial situation and needs.

Remember, a monthly budget worksheet is a dynamic tool that should be tailored to your unique financial circumstances and goals. By following these tips and avoiding common pitfalls, you can effectively utilize a monthly budget worksheet to gain control of your finances, achieve your financial aspirations, and secure a more stable financial future.