How financial counseling can help you?

Financial counseling can provide individuals and families with a wide range of benefits by helping them manage their finances, reduce financial stress, and achieve their financial goals. Here are key ways in which financial counseling can help:

Budgeting and Money Management:

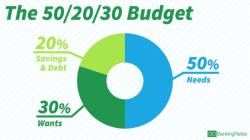

- Financial counselors can assist you in creating a personalized budget that aligns with your financial goals. They help you allocate your income effectively, prioritize expenses, and find opportunities for saving.

Debt Management:

- If you're struggling with debt, financial counselors can develop debt repayment plans tailored to your situation. They may negotiate with creditors on your behalf to lower interest rates or arrange more favorable terms.

Credit Score Improvement:

- Counselors can provide guidance on improving your credit score by managing debt responsibly, addressing errors on your credit report, and establishing healthy credit habits.

Financial Education:

- Financial counselors educate clients about various financial topics, including saving, investing, retirement planning, and insurance. This knowledge empowers you to make informed financial decisions.

Financial Goal Setting:

- Setting and achieving financial goals is an essential aspect of financial counseling. Counselors help you define clear, achievable goals and develop strategies to reach them.

Emergency Fund Planning:

- Financial counselors emphasize the importance of building an emergency fund to cover unexpected expenses. They assist you in creating a plan to establish and grow this fund.

Retirement Planning:

- Counselors can help you create a retirement savings plan by assessing your retirement needs, recommending suitable retirement accounts, and determining how much you need to save for a comfortable retirement.

Investment Guidance:

- For those interested in investing, financial counselors can provide basic investment education and guidance on selecting appropriate investment options based on your risk tolerance and financial goals.

Tax Planning:

- Financial counselors can offer tax planning advice to help you minimize your tax liability and take advantage of tax-advantaged savings and investment opportunities.

Estate Planning:

- If you have concerns about estate planning, financial counselors can introduce you to the basics of wills, trusts, and estate planning strategies.

Financial Crisis Management:

- During financial crises or unexpected events, such as job loss or medical emergencies, financial counselors can help you develop strategies to navigate these challenges.

Behavioral Finance Support:

- Financial counselors address behavioral finance issues, helping you understand your financial behaviors, identify any emotional or psychological factors affecting your decisions, and develop healthier financial habits.

Support and Accountability:

- Financial counselors provide emotional support and accountability as you work toward your financial goals. They can help you stay motivated and on track even during challenging times.

Financial Security and Peace of Mind:

- Ultimately, the goal of financial counseling is to improve your overall financial well-being, reduce financial stress, and provide you with greater financial security and peace of mind.

Financial counseling is tailored to your unique financial situation and goals. Whether you're facing financial challenges, looking to improve your financial literacy, or simply want to optimize your financial strategy, seeking the guidance of a certified financial counselor can be a valuable step toward achieving your financial objectives.

Improving Your Financial Well-being: The Benefits of Financial Counseling

Financial counseling can be a valuable resource for people of all financial backgrounds. It can help you to improve your financial well-being in a number of ways, including:

- Creating a budget: A budget is a plan for how you will spend your money. Financial counselors can help you to develop a budget that works for you and that will help you to reach your financial goals.

- Managing debt: Debt can be a major financial burden. Financial counselors can help you to develop a plan to manage your debt and pay it off.

- Improving your credit score: Your credit score is a number that lenders use to assess your creditworthiness. Financial counselors can help you to understand your credit score and develop a plan to improve it.

- Saving for retirement: Retirement planning can be a daunting task. Financial counselors can help you to develop a retirement savings plan that meets your needs and goals.

- Reaching your financial goals: Whatever your financial goals are, financial counselors can help you to develop a plan to achieve them.

How Financial Counseling Can Transform Your Money Management Skills

Financial counseling can help you to transform your money management skills by teaching you how to:

- Budget effectively: Financial counselors can teach you how to create a budget that works for you and that will help you to reach your financial goals.

- Spend wisely: Financial counselors can teach you how to track your spending and identify areas where you can cut back.

- Save money: Financial counselors can teach you how to set financial goals and develop a savings plan to achieve them.

- Manage debt: Financial counselors can teach you how to develop a debt management plan and pay off your debt.

- Build your credit: Financial counselors can teach you how to understand your credit score and develop a plan to improve it.

A Path to Financial Success: The Role of Financial Counseling

Financial counseling can play an important role in helping you to achieve financial success. Financial counselors can help you to:

- Develop a financial plan: A financial plan is a roadmap for how you will achieve your financial goals. Financial counselors can help you to develop a financial plan that meets your individual needs and goals.

- Make sound financial decisions: Financial counselors can help you to understand the financial implications of your decisions and to make sound financial choices.

- Stay on track: Financial counselors can provide you with support and accountability as you work to achieve your financial goals.

If you are serious about improving your financial well-being and achieving financial success, consider working with a financial counselor. Financial counselors can provide you with the knowledge, skills, and support you need to reach your financial goals.

How to find a financial counselor

There are a number of ways to find a financial counselor. You can ask your friends, family, or colleagues for recommendations. You can also search for financial counselors online or through the National Foundation for Credit Counseling (NFCC).

When choosing a financial counselor, it is important to find someone who is qualified and experienced. You should also find someone who you feel comfortable with and who you can trust.

Be sure to ask the financial counselor about their fees and services before you begin working with them. You should also ask about their qualifications and experience.