What are the benefits of a deferred annuity?

A deferred annuity is a financial product that offers several potential benefits, especially when it comes to long-term financial planning and retirement income. Here are some of the benefits of a deferred annuity:

Tax-Deferred Growth: One of the primary benefits of a deferred annuity is that it allows your money to grow on a tax-deferred basis. This means you don't pay taxes on the earnings and interest until you start receiving payments. Tax deferral can help your savings grow faster over time.

Income for Retirement: Deferred annuities are often used as a retirement income tool. You can choose to receive periodic payments (annuitization) from the annuity once you retire, providing a steady stream of income to supplement other retirement funds, such as Social Security or pensions.

Lifetime Income Options: Some deferred annuities offer lifetime income options, ensuring that you receive income for as long as you live, no matter how long that may be. This can provide peace of mind against outliving your savings.

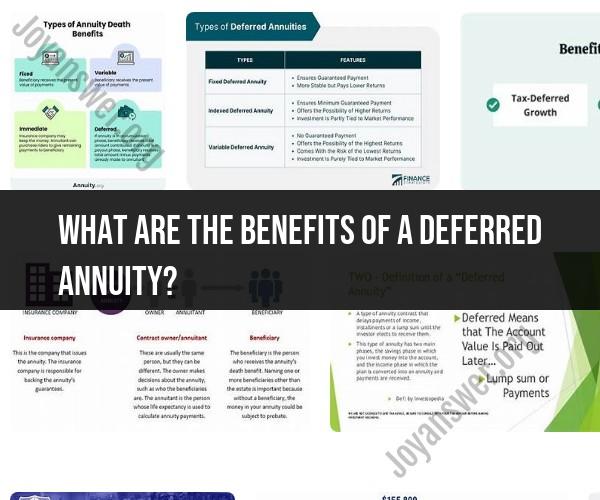

Flexibility: Deferred annuities come in various forms, including fixed, variable, and indexed annuities. This variety allows you to choose an annuity that matches your risk tolerance and financial goals.

Death Benefit: Many deferred annuities offer a death benefit, which means that if you pass away before you begin receiving income payments, your beneficiaries will receive a death benefit. This can provide financial security to your loved ones.

Creditor Protection: In some cases, annuities offer protection from creditors, which means your annuity funds may be shielded from certain legal claims or judgments.

No Contribution Limits: Unlike retirement accounts like IRAs and 401(k)s, deferred annuities typically have no contribution limits, allowing you to invest a substantial amount of money for retirement.

Guaranteed Minimum Interest Rate: Fixed deferred annuities provide a guaranteed minimum interest rate on your principal, offering stability and predictability in your investment returns.

Diversification: Variable deferred annuities allow you to invest in a variety of sub-accounts, similar to mutual funds, which can provide diversification and the potential for higher returns.

Optional Riders: Some annuities offer optional riders that can enhance the product's features. These may include inflation protection, long-term care benefits, or enhanced death benefits.

It's important to note that while deferred annuities offer several advantages, they also come with fees, surrender charges, and complex terms and conditions. Therefore, it's crucial to thoroughly understand the product you're considering, compare it to other retirement savings options, and consult with a financial advisor to ensure it aligns with your overall financial goals and needs.

Retirement Planning: The Advantages of a Deferred Annuity

A deferred annuity is a type of annuity contract that allows you to save money for retirement and then receive a guaranteed income stream after you retire. Deferred annuities offer a number of advantages for retirement planning, including:

- Tax-deferred growth: The money you invest in a deferred annuity grows tax-deferred, which means you don't have to pay taxes on your earnings until you withdraw the money in retirement. This can help you save money on taxes and grow your retirement savings faster.

- Guaranteed income: Deferred annuities can provide you with a guaranteed income stream in retirement, no matter how long you live. This can give you peace of mind knowing that you will have a reliable source of income to cover your living expenses in retirement.

- Flexibility: Deferred annuities offer a variety of flexibility options, so you can choose the payment schedule and withdrawal options that best meet your needs. For example, you can choose to receive your payments monthly, quarterly, or annually. You can also choose to withdraw money from your annuity tax-free if you need to for certain expenses, such as qualified medical expenses.

Delayed Gratification: Exploring the Benefits of Deferred Annuities

Deferred annuities require you to delay gratification in order to reap the benefits in retirement. When you invest in a deferred annuity, you are essentially putting money away for the future and agreeing to leave it there until you retire. This can be difficult to do, especially if you are used to spending your money now.

However, the benefits of deferred annuities can make the delay in gratification worthwhile. Deferred annuities can help you save more money for retirement, reduce your tax burden, and provide you with a guaranteed income stream in retirement.

Financial Security in the Future: How Deferred Annuities Work

Deferred annuities work by allowing you to invest money on a tax-deferred basis. The money you invest grows over time, and you can choose to receive your payments as a lump sum or as a stream of income in retirement.

Deferred annuities are offered by insurance companies, and they are backed by the financial strength of the insurance company. This means that you can be confident that you will receive your payments, even if the insurance company goes out of business.

Conclusion

Deferred annuities can be a valuable tool for retirement planning. They offer a number of advantages, including tax-deferred growth, guaranteed income, and flexibility. However, it is important to understand the fees associated with deferred annuities and to choose an annuity that is right for your needs.

If you are considering purchasing a deferred annuity, it is important to speak with a financial advisor to discuss your options. A financial advisor can help you choose the right annuity for your needs and help you understand the fees associated with deferred annuities.