What does deferred annuity mean?

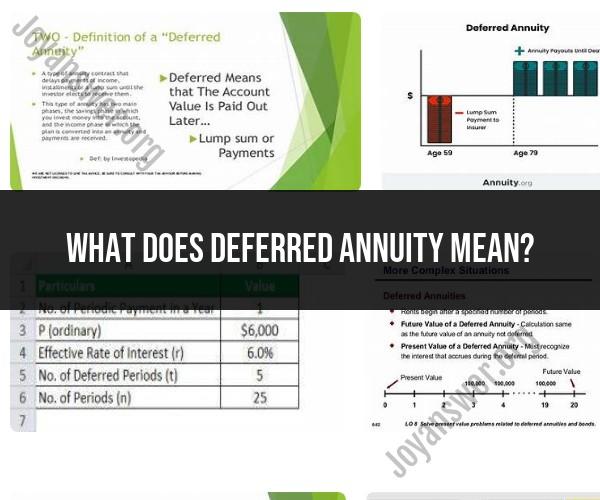

A deferred annuity is a financial product that provides a delayed income stream, typically used as a retirement planning tool. In a deferred annuity, you make one or more payments, known as premiums or contributions, to an insurance company or financial institution. These payments are typically made over a period of time or in a lump sum.

Here's how a deferred annuity works:

Accumulation Phase: During the accumulation phase, you invest your money into the annuity. Your contributions grow on a tax-deferred basis, meaning you don't pay taxes on the earnings and interest as they accumulate. This allows your money to potentially grow faster compared to taxable investments.

Earnings and Growth: The insurance company or financial institution invests the funds from the annuity into various investments, which can include bonds, stocks, or other assets, depending on the type of deferred annuity you choose. The rate of return on these investments affects the growth of your account.

Delaying Income: The key feature of a deferred annuity is that you delay receiving income payments from the annuity until a future date. This future date can be a specific time in the future, such as when you retire, or it can be a date you choose.

Annuitization: When you decide to start receiving income, you can choose to annuitize the annuity. Annuitization means converting the accumulated value of the annuity into a series of periodic payments, which can be monthly, quarterly, annually, or at other intervals. These payments can last for a specific number of years or for your lifetime, depending on the terms of the annuity.

Deferred annuities can come in various forms, including:

Fixed Deferred Annuities: These provide a guaranteed minimum interest rate on your contributions during the accumulation phase. Your principal is protected, and your returns are stable.

Variable Deferred Annuities: With these, you have the opportunity to invest in a variety of sub-accounts, similar to mutual funds. The returns are not guaranteed and can vary based on the performance of the underlying investments.

Indexed Deferred Annuities: These offer returns linked to a specific market index, such as the S&P 500. They may provide the potential for higher returns compared to fixed annuities but with some protection against market downturns.

Deferred annuities are often used as a retirement income strategy, as they allow you to accumulate funds during your working years and then receive a steady income stream in retirement. However, it's essential to understand the terms, fees, and features of the annuity, as well as consider your individual financial goals and needs before purchasing one. Consulting with a financial advisor can be helpful in making an informed decision about whether a deferred annuity is suitable for your retirement planning.

Decoding Deferred Annuities: What Does the Term Mean?

A deferred annuity is a type of annuity contract that allows you to save money for retirement and then receive a guaranteed income stream after you retire. The money you invest in a deferred annuity grows tax-deferred, which means you don't have to pay taxes on your earnings until you withdraw the money in retirement.

Annuities and Time: Understanding Deferred Annuity Contracts

Deferred annuity contracts typically have two phases: the accumulation phase and the payout phase. During the accumulation phase, you invest money in the annuity and it grows over time. During the payout phase, you receive a guaranteed income stream from the annuity.

Deferred Annuities Demystified: A Closer Look at the Concept

Deferred annuities can be a complex financial product, but they can be a valuable tool for retirement planning. Here are some of the key things to understand about deferred annuities:

- Types of deferred annuities: There are two main types of deferred annuities: fixed annuities and variable annuities. Fixed annuities offer a guaranteed interest rate, while variable annuities invest in the stock market and offer the potential for higher returns.

- Fees: Deferred annuities typically have fees associated with them, such as surrender charges and annual maintenance fees. It is important to understand the fees associated with a deferred annuity before you purchase one.

- Benefits: Deferred annuities offer a number of potential benefits, including tax-deferred growth, guaranteed income, and flexibility.

Conclusion

Deferred annuities can be a valuable tool for retirement planning, but it is important to understand the fees and risks associated with them. If you are considering purchasing a deferred annuity, it is important to speak with a financial advisor to discuss your options.

Here are some additional things to consider when evaluating a deferred annuity:

- Your financial goals: What are you hoping to achieve with your deferred annuity? Do you want to supplement your retirement income? Create a legacy for your heirs? Once you know your goals, you can choose a deferred annuity that is right for you.

- Your risk tolerance: How much risk are you comfortable with? Fixed annuities offer a guaranteed interest rate, while variable annuities invest in the stock market and offer the potential for higher returns, but also more risk.

- Your retirement time horizon: How long do you expect to be in retirement? If you have a long time horizon, you may be able to invest in a variable annuity for the potential for higher returns. If you have a shorter time horizon, you may want to choose a fixed annuity for the guaranteed interest rate.

It is also important to note that there are other retirement planning options available, such as 401(k)s and IRAs. Before you purchase a deferred annuity, it is important to compare all of your options to choose the best one for you.