What are the benefits of an annuity?

Annuity benefits can play a significant role in providing financial security and retirement planning for individuals. An annuity is a financial product offered by insurance companies that provides regular payments to the annuitant (the person who owns the annuity) over a specified period, often for the rest of their life. Here's an exploration of the benefits of annuities in terms of financial security and retirement planning:

Lifetime Income: One of the primary benefits of annuities is the guarantee of receiving regular payments for life. This can provide peace of mind, especially for retirees concerned about outliving their savings.

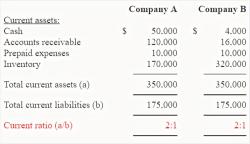

Stability and Predictability: Annuity payments are typically fixed or can have a predictable growth rate. This stability can help individuals budget and plan their expenses with confidence.

Tax Advantages: Annuities often offer tax-deferred growth, meaning the money invested in the annuity grows without being taxed until withdrawals are made. This can be advantageous for long-term retirement planning.

Variety of Payment Options: Annuities come in various forms, including immediate annuities (which start payments immediately) and deferred annuities (which allow for accumulation before payments begin). Different payment options are available, such as fixed, variable, or indexed payments, allowing individuals to choose what suits their needs.

Protection Against Market Volatility: Fixed annuities provide a guaranteed minimum interest rate, shielding annuitants from market downturns. Variable annuities allow for investments in sub-accounts, offering potential growth but with some level of risk.

Legacy Planning: Some annuities offer options for beneficiaries to receive payments after the annuitant's death, ensuring that any remaining value is passed on to heirs.

Long-Term Care Coverage: Some annuities have riders or features that can provide funds for long-term care expenses, offering additional financial security for retirees.

Creditor Protection: In many jurisdictions, annuities can offer protection from creditors, making them a secure financial asset.

Flexibility: Annuities can be tailored to meet specific needs and goals. For example, individuals can structure annuities to cover essential expenses while allowing other investments to grow.

Diversification: Annuities can be part of a diversified retirement portfolio, providing a steady income stream alongside other investments like stocks and bonds.

No Contribution Limits: Unlike retirement accounts like IRAs and 401(k)s, there are generally no contribution limits on annuities, allowing individuals to invest significant sums for retirement.

Personalized Planning: Annuities can be integrated into a comprehensive retirement plan, taking into account an individual's unique financial situation, goals, and risk tolerance.

While annuities offer several benefits, it's essential to consider potential downsides, such as fees, surrender charges, and the lack of liquidity in some cases. The suitability of an annuity depends on an individual's financial goals, risk tolerance, and overall retirement plan.

Before purchasing an annuity, it's advisable to consult with a financial advisor or insurance professional who can assess your specific needs and help you make an informed decision regarding whether an annuity is an appropriate component of your retirement strategy.