What is an annual escrow analysis?

An annual escrow analysis is a review conducted by mortgage servicers to assess and adjust the amount of money held in an escrow account associated with a mortgage loan. Escrow accounts are established to cover expenses such as property taxes, homeowners insurance, and sometimes mortgage insurance.

Here's how the annual escrow analysis typically works:

Collecting Information: The mortgage servicer collects information about the property taxes, insurance premiums, and other expenses paid from the escrow account over the past year.

Estimating Future Expenses: Based on the previous year's expenses and any anticipated changes (such as property tax rate adjustments or insurance premium changes), the servicer estimates the upcoming year's expenses.

Comparing Funds to Expenses: The servicer compares the estimated upcoming expenses to the funds available in the escrow account. They aim to ensure that there's enough money in the escrow account to cover future expenses.

Adjustments: Depending on the outcome of the analysis, adjustments might be necessary:

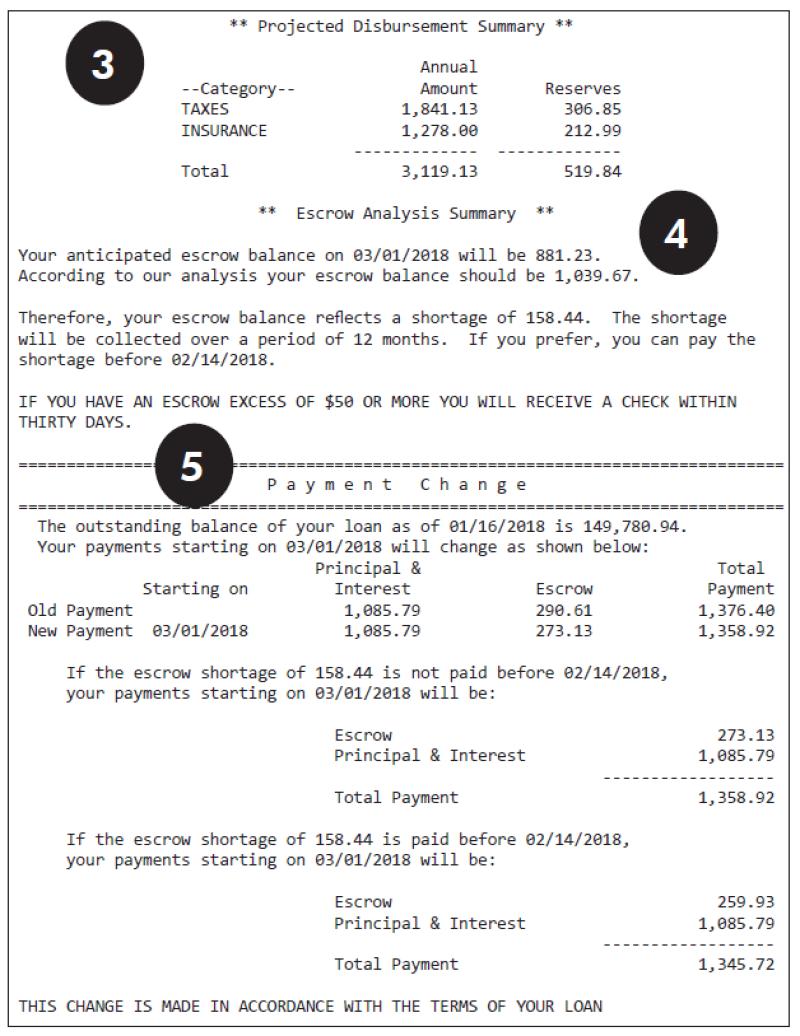

Shortage: If there's a shortage, meaning that the projected expenses exceed the funds available in the escrow account, the servicer might increase your monthly escrow payments to cover the shortfall.

Surplus: If there's a surplus in the escrow account after covering expenses, you might receive a refund or have lower monthly payments. However, some servicers might adjust the payments downward, while others might refund the surplus.

Notification: After the analysis is completed, the mortgage servicer typically sends an escrow account statement detailing any changes to the escrow account and how they will affect your mortgage payments.

The annual escrow analysis ensures that there's enough money in the escrow account to cover property-related expenses associated with the mortgage. It's essential for homeowners to review these statements carefully to understand any changes in their mortgage payments and to ensure that their escrow accounts are adequately funded to cover future expenses.

An annual escrow analysis plays a crucial role in ensuring that homeowners have sufficient funds to cover their property taxes and homeowners insurance premiums. This comprehensive review of the escrow account helps to prevent potential financial burdens and maintain accurate financial records for property ownership.

Purpose of an annual escrow analysis

Reviewing Escrow Account Balances: An annual escrow analysis thoroughly examines the escrow account balance to determine its current status. This includes identifying any discrepancies or errors in the account.

Adjusting Escrow Account Balances: Based on the review, the escrow account balance is adjusted to ensure that there are enough funds to cover upcoming property taxes and insurance premiums. This may involve adding or removing funds from the account.

Ensuring Adequate Escrow Funds: By projecting future property tax and insurance premiums, the escrow analysis ensures that there will be adequate funds to cover these expenses throughout the year. This helps to prevent escrow shortages and potential penalties.

Preventing Escrow Shortages and Penalties: Escrow shortages occur when there are not enough funds in the escrow account to cover upcoming property taxes or insurance premiums. This can lead to late fees, penalties, and even legal action. An annual escrow analysis helps to prevent these issues by ensuring that the account is properly funded.

Maintaining Accurate Financial Records: The escrow analysis serves as an important record of the escrow account's activity over time. This information is valuable for tax purposes and helps homeowners track their financial obligations related to property ownership.

In summary, an annual escrow analysis is a valuable tool for homeowners to manage their escrow accounts effectively. By ensuring that the account is properly funded and preventing potential issues, homeowners can maintain financial stability and peace of mind.