What is the purpose of the chart of accounts?

The chart of accounts (COA) is a foundational tool in accounting that serves several crucial purposes for businesses and organizations. It provides a structured framework for organizing and categorizing financial transactions, ensuring consistency, accuracy, and clarity in financial reporting. Here are the primary purposes of the chart of accounts:

Organizing Financial Information:

- The COA organizes financial transactions into categories, making it easier to classify and track various types of income, expenses, assets, liabilities, and equity. This organizational structure helps create a systematic and standardized way of recording financial data.

Facilitating Financial Reporting:

- By providing a standardized framework, the COA simplifies the process of generating financial statements, such as the balance sheet, income statement, and cash flow statement. It ensures that all financial transactions are classified correctly, enabling accurate and consistent reporting.

Enhancing Financial Analysis:

- The chart of accounts facilitates financial analysis by providing a detailed breakdown of different financial elements. This breakdown allows stakeholders, including management, investors, and creditors, to analyze specific aspects of the company's financial performance and make informed decisions.

Supporting Budgeting and Planning:

- A well-organized COA is essential for budgeting and financial planning. It allows organizations to allocate resources, set financial goals, and monitor budget performance by providing a clear structure for budget categories.

Streamlining Auditing and Compliance:

- Auditors rely on the COA to review and verify financial records. A well-structured chart of accounts makes the auditing process more efficient, helps ensure compliance with accounting standards and regulations, and provides transparency for external stakeholders.

Enabling Cost Tracking:

- The COA helps organizations track costs by categorizing expenses into specific accounts. This tracking is vital for understanding where resources are allocated and for identifying areas where cost management or efficiency improvements may be needed.

Facilitating Decision-Making:

- Management uses the COA to gain insights into the financial health of the organization. It enables decision-makers to analyze trends, identify areas of strength or concern, and make informed strategic decisions based on accurate financial information.

Adapting to Business Changes:

- The COA is flexible and can be adapted to accommodate changes in the business structure, operations, or reporting requirements. As a company evolves, the chart of accounts can be modified to reflect new accounts, departments, or cost centers.

Ensuring Consistency:

- The COA promotes consistency in financial record-keeping. It provides a standardized framework that all employees involved in accounting and financial reporting can follow, reducing the risk of errors and inconsistencies in recording transactions.

In summary, the chart of accounts is a fundamental tool that plays a central role in maintaining organized and accurate financial records, supporting financial analysis and decision-making, and ensuring compliance with accounting standards and regulations. Its design and implementation are critical for the effective financial management of an organization.

Sure, here are the answers to your questions:

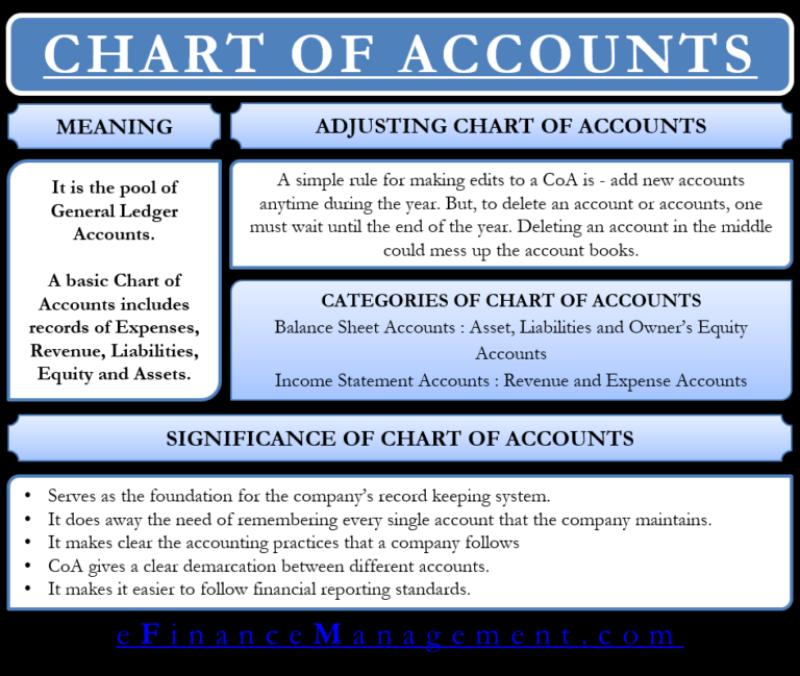

What is the significance of a chart of accounts in accounting?

A chart of accounts is a list of all the financial accounts that a company uses to record its transactions. It is a crucial tool for organizing and managing financial information, and it plays a vital role in financial reporting and analysis.

Here are some of the key reasons why a chart of accounts is important in accounting:

It provides a standardized framework for classifying financial transactions. This ensures that all transactions are recorded consistently and categorized correctly, making it easier to track financial performance and prepare accurate financial statements.

It facilitates the preparation of financial statements. The chart of accounts serves as the foundation for generating financial statements such as the balance sheet, income statement, and cash flow statement.

It enhances internal controls and reduces the risk of errors. By clearly defining the accounts to be used for different types of transactions, a chart of accounts helps to prevent errors and misuse of funds.

It improves financial analysis and decision-making. By providing a clear overview of the company's financial position and performance, the chart of accounts helps managers make informed financial decisions.

How does a chart of accounts organize financial information for businesses?

A chart of accounts organizes financial information for businesses by categorizing transactions into different accounts. These accounts are typically grouped into five main categories:

Assets: Assets represent the resources that a company owns or controls, such as cash, accounts receivable, inventory, property, plant, and equipment.

Liabilities: Liabilities represent the debts that a company owes to others, such as accounts payable, short-term loans, and long-term debt.

Equity: Equity represents the ownership interest in a company, including capital stock and retained earnings.

Revenue: Revenue represents the income that a company generates from its operations, such as sales of goods or services.

Expenses: Expenses represent the costs incurred by a company in generating revenue, such as salaries, rent, and utilities.

By classifying transactions into these categories, the chart of accounts provides a clear picture of the company's financial health and performance.

Are there standardized formats or classifications for a chart of accounts?

While there are no universally standardized formats or classifications for charts of accounts, there are several widely accepted accounting frameworks that provide guidelines for structuring charts of accounts. These frameworks include:

General Ledger (GL) accounts: GL accounts are the most common type of account used in business accounting. They are typically organized into a hierarchical structure with five main categories: assets, liabilities, equity, revenue, and expenses.

Industry-specific charts of accounts: Some industries have developed their own standardized charts of accounts to address the unique accounting needs of their businesses. For example, the healthcare industry uses the Uniform Chart of Accounts (UCOA), while the construction industry uses the Construction Contractors' Chart of Accounts (CCCOA).

International financial reporting standards (IFRS): IFRS provide a comprehensive framework for financial reporting, including guidelines for structuring charts of accounts. Companies that are required to adhere to IFRS must use a chart of accounts that complies with IFRS standards.

How does a chart of accounts aid in financial reporting and analysis?

A chart of accounts plays a critical role in financial reporting and analysis by providing a structured and organized way to collect, summarize, and analyze financial data. Here are some specific ways in which a chart of accounts aids in financial reporting and analysis:

Generating financial statements: The chart of accounts serves as the source data for generating financial statements such as the balance sheet, income statement, and cash flow statement.

Tracking financial performance: By analyzing trends in the accounts over time, businesses can assess their financial performance and identify areas for improvement.

Identifying financial risks: By analyzing the balance of different types of accounts, businesses can identify potential financial risks and take steps to mitigate them.

Making informed financial decisions: A well-structured chart of accounts provides managers with the information they need to make informed financial decisions, such as budgeting, resource allocation, and investment planning.

Can businesses customize their chart of accounts to suit specific needs?

Yes, businesses can and should customize their charts of accounts to suit their specific needs and industries. While there are standardized frameworks and industry-specific guidelines available, businesses may need to add or modify accounts to reflect the unique nature of their operations.

For example, a retail business may need to add accounts to track inventory levels, while a manufacturing company may need to add accounts to track production costs. By customizing their charts of accounts, businesses can ensure that they are capturing all of the relevant financial information for their operations.

In conclusion, a chart of accounts is an essential tool for organizing, managing, and analyzing financial information for businesses. It plays a crucial role in financial reporting,