How to set up the cash flow chart of accounts?

Setting up a cash flow chart of accounts is an essential step in managing and understanding the financial health of a business. The chart of accounts is a structured list of all the financial accounts used by an organization, and it provides a framework for organizing and categorizing financial transactions. Here are steps to help you set up a cash flow chart of accounts:

Understand Your Business:

- Before creating a chart of accounts, have a clear understanding of your business operations, revenue streams, and expense categories. Identify the key components of your cash flow, such as operating activities, investing activities, and financing activities.

Select a Chart of Accounts Structure:

- Choose a chart of accounts structure that aligns with your business needs. A common structure includes categories such as assets, liabilities, equity, revenue, and expenses. For cash flow, you may want to create specific sub-accounts under the operating, investing, and financing categories.

List Cash Flow Categories:

- Identify and list the main categories that impact your cash flow. Common cash flow categories include:

- Operating Activities: Revenue, expenses, accounts receivable, accounts payable.

- Investing Activities: Capital expenditures, asset purchases, asset sales.

- Financing Activities: Loans, equity financing, dividend payments.

- Identify and list the main categories that impact your cash flow. Common cash flow categories include:

Create Account Codes:

- Assign unique account codes to each category and sub-category. These codes help organize and reference accounts systematically.

Establish Account Names:

- Create clear and descriptive names for each account. Use names that are easy to understand and reflect the nature of the transactions.

Set Up Sub-Accounts:

- Under each main category, consider setting up sub-accounts for more detailed tracking. For example, under operating activities, you might have sub-accounts for different types of revenue and expense categories.

Consider the Timing of Transactions:

- Recognize whether transactions are immediate (e.g., cash sales) or if they have a timing difference (e.g., accounts receivable). This understanding helps in accurately tracking the timing of cash inflows and outflows.

Use Accounting Software:

- Consider using accounting software to streamline the process of setting up and managing your chart of accounts. Many accounting software programs offer predefined templates for various industries.

Consult with a Professional:

- If you're unsure about the best structure for your chart of accounts, or if your business has unique financial considerations, consider consulting with an accounting professional. They can provide guidance tailored to your specific needs.

Regularly Review and Update:

- The chart of accounts is not a static document. Regularly review and update it to ensure it accurately reflects changes in your business structure and financial activities.

By carefully setting up your cash flow chart of accounts, you create a valuable tool for monitoring your business's financial performance and making informed decisions about managing cash flow effectively.

What steps are involved in setting up a cash flow chart of accounts?

Setting up a cash flow chart of accounts involves the following steps:

Gather financial data: Collect data on all cash inflows and outflows for the period being analyzed. This data can be obtained from bank statements, check registers, and other financial records.

Identify cash inflows and outflows: Classify each cash transaction as either an inflow or an outflow. Inflows are sources of cash, such as sales revenue, investment income, and loans. Outflows are uses of cash, such as expenses, purchases, and loan repayments.

Categorize transactions: Group cash inflows and outflows into relevant categories. Common categories include operating activities, investing activities, and financing activities.

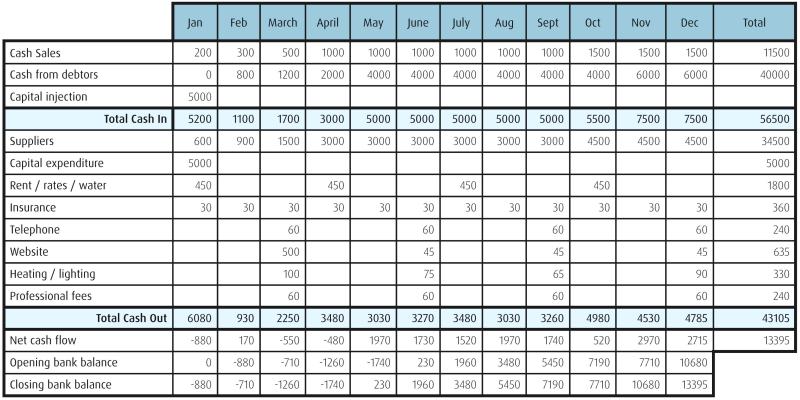

Create a table: Create a table with columns for each category of cash flows.

Enter amounts: Enter the amounts of each cash inflow and outflow into the corresponding category columns.

Calculate net cash flow: Calculate the net cash flow for each category by subtracting outflows from inflows.

Analyze results: Analyze the cash flow statement to identify trends, patterns, and potential areas of concern.

How does a cash flow chart of accounts differ from other types of financial charts?

A cash flow chart of accounts differs from other types of financial charts, such as a balance sheet or an income statement, in that it focuses specifically on the movement of cash during a specific period. This information is crucial for understanding the financial health of a business and its ability to generate cash to meet its obligations.

Are there software tools or templates available to assist in creating a cash flow chart of accounts?

Yes, there are various software tools and templates available to assist in creating a cash flow chart of accounts. These tools can help automate the process of gathering data, categorizing transactions, and generating the chart. Examples of such tools include accounting software, spreadsheet templates, and online tools.

Can businesses tailor a cash flow chart of accounts to track specific income and expenses?

Yes, businesses can tailor a cash flow chart of accounts to track specific income and expenses that are relevant to their operations. This customization allows businesses to gain insights into specific areas of their financial performance.

How does a well-organized cash flow chart of accounts benefit financial management?

A well-organized cash flow chart of accounts provides several benefits for financial management:

Improved cash flow forecasting: It allows businesses to forecast future cash flows, enabling them to make informed financial decisions and manage liquidity effectively.

Identification of financial trends: It helps identify trends and patterns in cash flows, allowing businesses to spot potential problems or areas for improvement early on.

Enhanced budgeting and planning: It provides valuable information for budgeting and planning purposes, ensuring that businesses have sufficient cash to meet their obligations and pursue growth opportunities.

Improved financial decision-making: It contributes to better financial decision-making by providing a clear picture of the company's cash flow position and its ability to generate cash in the future.