What is weighted average of inventory valuation method?

The weighted average inventory valuation method is a cost flow assumption used in accounting to determine the value of inventory on a company's balance sheet and the cost of goods sold (COGS) on its income statement. This method calculates an average cost for all units of inventory, taking into account the cost of both old and new inventory items. It is particularly useful when a company's inventory consists of similar items with varying purchase prices.

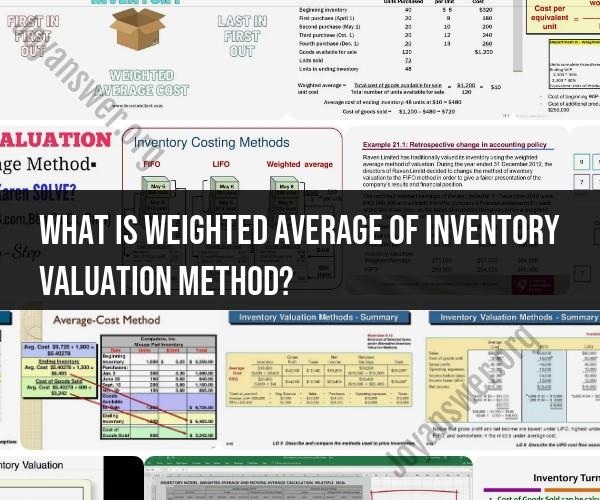

Here's how the weighted average inventory valuation method works:

Determine the Total Cost: Calculate the total cost of all units of inventory on hand. This is done by multiplying the quantity of each item in inventory by its respective unit cost.

Calculate Total Units: Determine the total number of units in inventory, considering all items.

Compute the Weighted Average Cost: Divide the total cost of inventory by the total number of units. The result is the weighted average cost per unit.

Weighted Average Cost = Total Cost of Inventory / Total Number of Units in Inventory

Apply the Weighted Average Cost: Use this calculated weighted average cost to value the inventory on the balance sheet and to calculate the cost of goods sold (COGS) on the income statement during a specific accounting period.

To calculate the value of ending inventory on the balance sheet, multiply the number of units in ending inventory by the weighted average cost.

To calculate the cost of goods sold (COGS) on the income statement, multiply the number of units sold during the period by the weighted average cost.

The weighted average method assumes that all units of inventory, whether old or new, are mixed together and have an equal influence on the average cost. It is particularly useful when a company experiences fluctuations in purchase prices, as it smoothens out the impact of price changes on the reported inventory value and cost of goods sold.

Advantages of the weighted average method:

- Simplicity: It is relatively easy to calculate compared to other methods.

- Smoothened Costs: It provides a cost that falls between the oldest and newest inventory costs, which can be more representative of the cost of goods sold during periods of price fluctuations.

However, it's important to note that the weighted average method may not reflect the actual cost of individual units and may not be suitable for certain industries or situations where specific identification of costs is required (e.g., for tracking high-value items with distinct costs). Therefore, businesses should carefully consider their inventory valuation method based on their unique circumstances and accounting requirements.