How much down payment do you need for a VA loan?

For most situations, the VA (U.S. Department of Veterans Affairs) loan program typically doesn't require a down payment. This is one of the key benefits offered to eligible veterans, active-duty service members, National Guard members, Reservists, and some surviving spouses.

No Down Payment Requirement:

- Most VA Loans: In general, qualified borrowers can obtain a VA loan without making a down payment, potentially financing up to 100% of the home's purchase price.

- Avoidance of PMI: Additionally, VA loans don't require private mortgage insurance (PMI), which is usually mandatory for loans with lower down payments.

Funding Fee:

- Funding Fee Consideration: While a down payment isn't mandatory, VA loans may involve a funding fee, which varies based on factors like military service category, down payment amount (if any), and whether it's the borrower's first VA loan.

- Funding Fee Exemptions: Certain individuals, such as disabled veterans or surviving spouses, might be exempt from the funding fee.

Benefits of No Down Payment:

- Accessibility: The absence of a down payment requirement makes homeownership more accessible for eligible veterans and service members.

- Financial Flexibility: It allows borrowers to retain savings or allocate funds to other expenses rather than a down payment.

Exceptions and Loan Limits:

- Jumbo Loans: In certain cases involving loan amounts exceeding VA loan limits, a down payment might be necessary to cover the difference between the purchase price and the VA loan limit.

- Lender Requirements: Some lenders might have their own requirements, although the VA itself doesn't mandate a down payment for most loans.

Eligibility and Loan Approval:

- Eligibility Requirements: Borrowers must meet specific VA eligibility criteria regarding service history, duty status, and other qualifications.

- Lender Approval: Ultimately, loan approval depends on the lender's assessment of creditworthiness and the borrower's ability to repay the loan.

Before applying for a VA loan, individuals should explore their eligibility, understand the associated fees, and consult with VA-approved lenders to gain a comprehensive understanding of the loan terms and requirements.

Unlike conventional loans, VA loans typically do not require a down payment. This means that you can purchase a home with zero down payment if you are eligible for a VA loan. However, there are a few exceptions to this rule.

Funding Fee: If you are making a down payment of less than 5%, you will be required to pay a VA funding fee. The funding fee is a one-time charge that helps to offset the cost of the VA loan program for taxpayers. The funding fee is calculated as a percentage of the loan amount, with the exact percentage varying depending on the amount of your down payment and whether you are a first-time homebuyer or not.

Cash Reserve: In some cases, you may be required to have a cash reserve in addition to your down payment. This is typically only required for borrowers with lower credit scores or who are buying a home in a high-risk area. The cash reserve is typically equal to two months of mortgage payments.

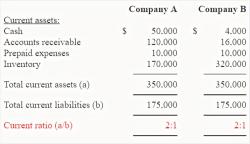

Here is a table summarizing the down payment requirements for VA loans:

| Down Payment | Funding Fee | Cash Reserve |

|---|---|---|

| 0% | 2.15% | May be required |

| 5% | 1.50% | Not required |

| 10% | 1.25% | Not required |

| 20% | 0% | Not required |

As you can see, the VA loan program is very flexible when it comes to down payments. You can purchase a home with zero down payment, and if you do make a down payment, you will still have to pay a relatively low funding fee. This makes VA loans a great option for borrowers who are short on cash.

Here are some additional things to keep in mind about VA loan down payments:

- The funding fee is non-refundable.

- The cash reserve can be used for closing costs or other expenses related to the purchase of your home.

- You can make a larger down payment than the minimum required. This will reduce the amount of your loan and the amount of interest you will pay over the life of the loan.

If you are considering purchasing a home with a VA loan, it is important to talk to a lender to get specific information about the down payment requirements and funding fee. Your lender can help you determine how much you need to save for a down payment and whether you need to have a cash reserve.