What is the definition of business structure?

A business structure refers to the legal and organizational framework within which a business operates. It defines how the business is organized, managed, and controlled, as well as how its financial and legal obligations are structured. Choosing the right business structure is a crucial decision for entrepreneurs, as it can impact various aspects of the business, including taxation, liability, and operational flexibility.

Here are some common types of business structures:

Sole Proprietorship: A sole proprietorship is a business owned and operated by a single individual. It's the simplest form of business structure, and the owner has full control over the business. However, the owner is personally responsible for all the business's debts and liabilities.

Partnership: A partnership is a business structure in which two or more individuals manage and operate a business in accordance with the terms and objectives set out in a Partnership Deed. Each partner is personally liable for the business's debts.

Limited Liability Company (LLC): An LLC is a flexible form of business organization that combines elements of a corporation and a partnership. It provides limited liability to its owners (members) while allowing for pass-through taxation, where profits and losses are passed through to the owners' personal tax returns.

Corporation: A corporation is a legal entity that is separate from its owners (shareholders). It provides limited liability to shareholders, meaning their personal assets are generally protected from business debts. Corporations can issue stock and are subject to complex regulatory and tax requirements.

S Corporation: An S Corporation is a type of corporation that, to obtain certain tax advantages, meets specific Internal Revenue Service (IRS) requirements. It allows for pass-through taxation similar to an LLC while maintaining the limited liability of a corporation.

Nonprofit Organization: Nonprofits are structured to serve a charitable, educational, religious, or other public purpose. They operate for the benefit of the community and are exempt from certain taxes.

Cooperative: A cooperative is a business owned and operated by its members, who share in the profits and decision-making. Cooperatives can take various forms, such as agricultural cooperatives or consumer cooperatives.

The choice of business structure depends on factors such as the nature of the business, the number of owners, liability considerations, and tax implications. Each structure has its advantages and disadvantages, and entrepreneurs should carefully consider their goals and circumstances before selecting the most appropriate business structure for their venture.

Building a solid foundation: What is the definition of business structure?

A business structure is the legal and organizational framework for a business. It defines the ownership, management, and tax liability of the business.

There are four main types of business structures:

- Sole proprietorship: This is the simplest and most common type of business structure. A sole proprietorship is owned and operated by one person.

- Partnership: A partnership is a business owned and operated by two or more people.

- Limited liability company (LLC): An LLC is a hybrid business structure that combines features of a sole proprietorship or partnership with features of a corporation.

- Corporation: A corporation is a separate legal entity from its owners. It is the most complex and expensive type of business structure to set up and maintain.

Exploring the various forms and models of business structures

Within each of the four main types of business structures, there are different forms and models. For example, there are general partnerships, limited partnerships, and limited liability partnerships. There are also C corporations, S corporations, and B corporations.

The specific form or model of business structure that is right for a particular business will depend on a variety of factors, including the size and type of business, the number of owners, and the owners' personal goals and needs.

Here is a brief overview of the four main types of business structures and their common forms and models:

- Sole proprietorship: The most common form of sole proprietorship is the single-member LLC.

- Partnership: The most common forms of partnerships are general partnerships and limited partnerships.

- Limited liability company (LLC): The most common forms of LLCs are single-member LLCs and multi-member LLCs.

- Corporation: The most common forms of corporations are C corporations and S corporations.

Tips for selecting the right business structure based on individual goals and needs

When choosing a business structure, it is important to consider the following factors:

- Liability protection: Some business structures, such as LLCs and corporations, offer liability protection to their owners. This means that the owners' personal assets are shielded from business liabilities.

- Taxation: Different business structures are taxed differently. For example, sole proprietors and partnerships are taxed as pass-through entities, meaning that the business income is passed through to the owners and taxed on their personal tax returns. Corporations, on the other hand, are taxed as separate legal entities.

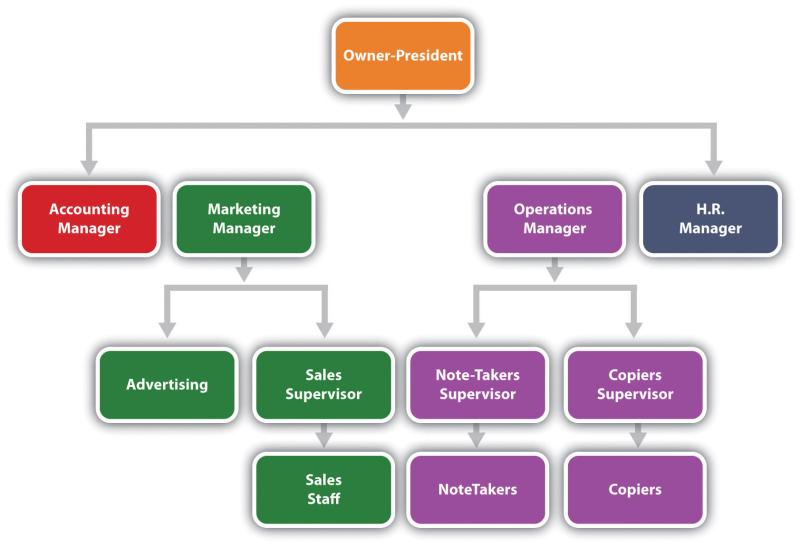

- Management and ownership structure: Different business structures have different management and ownership structures. For example, in a sole proprietorship, the owner has complete control over the business. In a partnership, the partners typically share ownership and control of the business. In a corporation, the shareholders own the business and the board of directors manages the business.

It is important to consult with an attorney or accountant to get advice on the best business structure for your specific needs.

Here are some additional tips for selecting the right business structure:

- Consider your personal liability exposure. If you are concerned about your personal assets being at risk, you may want to choose a business structure that offers liability protection, such as an LLC or corporation.

- Think about your tax liability. Some business structures are taxed more favorably than others. For example, S corporations can be a good option for businesses that want to avoid double taxation.

- Consider your management and ownership structure. Do you want to have complete control over your business? Or do you want to share ownership and control with other people? Choose a business structure that is compatible with your management and ownership goals.

By carefully considering the factors involved, you can choose the right business structure for your needs and help your business succeed.