How does the government pay for its programs?

Governments fund their programs through a combination of revenue sources, and the specific methods can vary depending on the country and its economic system. Here are some common ways governments generate funds for their programs:

Taxation: The primary source of government revenue is taxation. This can include income taxes, corporate taxes, sales taxes, property taxes, and various other levies on goods and services. Taxes are collected from individuals, businesses, and other entities within the country.

Borrowing: Governments often borrow money by issuing bonds and other debt instruments. Investors purchase these bonds, essentially lending money to the government. In return, the government pays interest on the borrowed funds and eventually repays the principal amount.

Customs and Duties: Revenue can be generated through customs duties and tariffs imposed on imported goods. This is a common practice, especially in international trade.

Fees and Charges: Governments may charge fees for specific services or permits. This could include licensing fees, user fees for public services, and charges for regulatory compliance.

Natural Resource Revenues: Some governments derive a significant portion of their income from the extraction and sale of natural resources such as oil, gas, minerals, and timber. These revenues are often referred to as resource rents.

Seigniorage: This is the profit a government makes by issuing currency. If the government can produce money at a lower cost than its face value, the difference represents seigniorage.

Grants and Aid: In some cases, governments receive financial assistance from other countries or international organizations in the form of grants or aid packages. This is particularly true for developing countries.

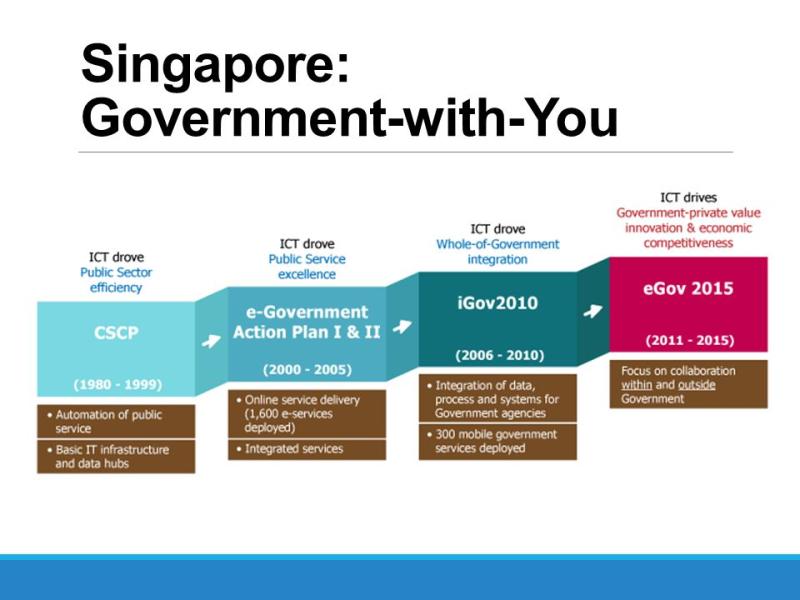

Public-Private Partnerships (PPPs): Governments may collaborate with private sector entities to fund and manage certain projects. In these partnerships, private companies often invest capital in exchange for the right to operate or receive revenue from the project.

Lotteries and Gambling: Some governments generate revenue through state-sponsored lotteries, casinos, and other forms of legalized gambling.

The mix of these funding sources varies depending on economic conditions, government policies, and the specific needs of the country. Governments must carefully manage their revenue streams to ensure they can meet their obligations and fund essential programs and services.

Funding government initiatives: How does the government pay for its programs?

Governments pay for their programs through a variety of means, including:

- Taxation: This is the primary source of government revenue. Governments collect taxes from individuals and businesses in a variety of ways, such as income taxes, payroll taxes, sales taxes, and excise taxes.

- Borrowing: Governments can also borrow money to finance their programs. This is typically done by selling bonds to investors.

- Fees and user charges: Governments may also charge fees for certain services, such as passport fees, driver's license fees, and tuition for public universities.

- Seigniorage: This is the profit that governments make from printing money. It is generally a minor source of revenue for most governments.

The specific mix of funding sources that a government uses will vary depending on its circumstances. For example, governments with high levels of debt may be more reliant on taxation to finance their programs, while governments with strong economic growth may be able to borrow more easily.

Understanding the sources and mechanisms through which governments finance their programs

The following are some of the most common sources and mechanisms of government funding:

- Individual income taxes: These are taxes levied on the income of individuals. They are typically the largest source of government revenue in developed countries.

- Corporate income taxes: These are taxes levied on the profits of corporations. They are another major source of government revenue in developed countries.

- Payroll taxes: These are taxes that are paid on wages and salaries. They are typically used to fund social security and other social insurance programs.

- Sales taxes: These are taxes that are levied on the sale of goods and services. They are a major source of revenue for state and local governments in the United States.

- Excise taxes: These are taxes that are levied on specific goods or services, such as tobacco, alcohol, and gasoline. They are often used to discourage consumption of certain goods or to raise revenue for specific programs.

- Borrowing: Governments can borrow money to finance their programs by selling bonds to investors. The government will then pay interest on the bonds to the investors over time.

- Seigniorage: This is the profit that governments make from printing money. It is generally a minor source of revenue for most governments.

Exploring the economic implications and considerations of government funding sources

The choice of government funding sources can have a significant impact on the economy. For example, high taxes can discourage investment and economic growth. On the other hand, government borrowing can lead to inflation and higher interest rates.

Governments must carefully consider the economic implications of their funding choices. They need to balance the need for revenue with the need to avoid harming the economy.

Here are some of the specific economic implications and considerations of the most common government funding sources:

- Individual income taxes: High income taxes can discourage people from working and investing. They can also lead to income inequality.

- Corporate income taxes: High corporate income taxes can discourage businesses from investing and creating jobs. They can also lead to higher prices for consumers.

- Payroll taxes: High payroll taxes can reduce disposable income and consumer spending. They can also lead to higher labor costs for businesses.

- Sales taxes: Sales taxes are regressive, meaning that they disproportionately burden lower-income households. They can also lead to higher prices for consumers.

- Excise taxes: Excise taxes can be used to discourage consumption of certain goods or to raise revenue for specific programs. However, they can also lead to higher prices for consumers.

- Borrowing: Government borrowing can lead to inflation and higher interest rates. However, it can also be used to finance important investments in infrastructure and education.

- Seigniorage: Seigniorage is a minor source of revenue for most governments. However, it can be a source of inflation if governments print too much money.

Governments need to carefully consider the economic implications of their funding choices when making budget decisions.