What is fidelity extended market index fund?

The Fidelity Extended Market Index Fund is a mutual fund offered by Fidelity Investments. This fund is designed to track the performance of the U.S. stock market, specifically the mid-cap and small-cap segments. It is sometimes referred to as the Fidelity Extended Market Index Fund - Institutional Class (FSMAX) or the Fidelity Extended Market Index Fund - Premium Class (FSEVX).

Here are some key points to understand about the Fidelity Extended Market Index Fund:

Objective: The primary objective of the fund is to provide investors with broad exposure to the U.S. stock market beyond the large-cap stocks included in major stock market indices like the S&P 500. It aims to replicate the performance of the Dow Jones U.S. Completion Total Stock Market Index, which includes mid-cap and small-cap stocks.

Investment Strategy: The fund typically invests in a diversified portfolio of U.S. stocks that are not part of the S&P 500 Index. This means it includes stocks of companies with smaller market capitalizations. The fund employs a passive investment strategy, aiming to closely match the performance of its benchmark index.

Diversification: By investing in mid-cap and small-cap stocks, the Fidelity Extended Market Index Fund offers investors exposure to a broader range of companies than funds that focus solely on large-cap stocks. This diversification can help spread risk across different sectors and industries.

Expense Ratio: The expense ratio is the annual fee charged by the fund to cover its operating expenses. Fidelity is known for offering low-cost investment options, and the Fidelity Extended Market Index Fund typically has a competitive expense ratio compared to many actively managed funds.

Dividends and Capital Gains: Like many mutual funds, the Fidelity Extended Market Index Fund may distribute dividends and capital gains to investors periodically, usually on a quarterly or annual basis. These distributions can be reinvested or taken as cash.

Investor Class Options: Fidelity offers different share classes for its mutual funds, including Institutional Class and Premium Class shares, which may have varying minimum investment requirements and expense ratios. The availability of these share classes depends on the type of account and the amount you intend to invest.

Before investing in the Fidelity Extended Market Index Fund or any mutual fund, it's essential to carefully review the fund's prospectus, which provides detailed information about the fund's objectives, holdings, expenses, risks, and historical performance. Additionally, consider your investment goals, risk tolerance, and overall portfolio strategy to determine whether this fund is a suitable addition to your investment portfolio. If you have specific questions or need personalized investment advice, it's advisable to consult with a financial advisor.

Fidelity Extended Market Index Fund: What You Need to Know

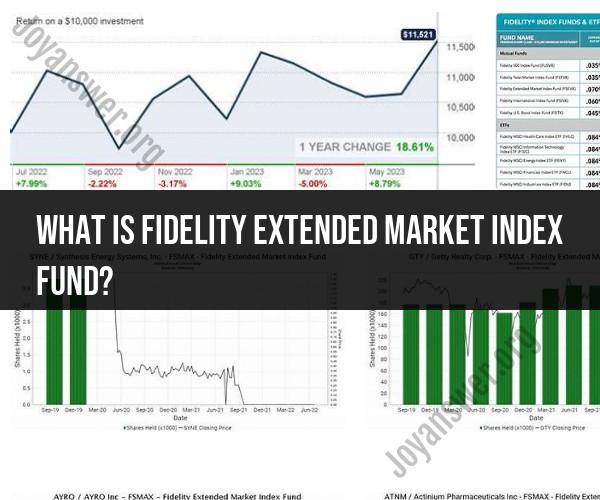

The Fidelity Extended Market Index Fund (FSMAX) is a passively managed index fund that tracks the Dow Jones U.S. Completion Total Market Index. This index includes all publicly traded companies in the United States, not just those in the large-cap S&P 500 index.

FSMAX is a good choice for investors who want broad exposure to the US stock market, including mid- and small-cap companies. The fund has a low expense ratio of 0.05% and a dividend yield of 1.83%.

Diving into Investments: Understanding the Fidelity Extended Market Index Fund

Index funds are a type of mutual fund or ETF that track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds are passively managed, meaning that the fund manager does not try to pick individual stocks to outperform the market. Instead, the fund manager simply buys and holds the stocks in the index in the same proportion as they appear in the index.

Index funds are a good choice for investors who want to invest in the stock market without having to pick individual stocks. Index funds are also a good choice for investors who want to diversify their portfolios. By investing in an index fund, investors are essentially investing in a basket of stocks, which reduces their risk.

Investing with Fidelity: A Closer Look at the Extended Market Index Fund

Fidelity is one of the largest investment companies in the world. Fidelity offers a wide range of investment products, including mutual funds, ETFs, stocks, and bonds.

The Fidelity Extended Market Index Fund is a good choice for investors who want broad exposure to the US stock market, including mid- and small-cap companies. The fund has a low expense ratio of 0.05% and a dividend yield of 1.83%.

To invest in the Fidelity Extended Market Index Fund, you can open a brokerage account with Fidelity. Once you have opened an account, you can buy and sell shares of the fund just like you would any other stock.

Here are some things to consider before investing in the Fidelity Extended Market Index Fund:

- Your investment goals: What are you hoping to achieve with your investment? Are you saving for retirement or for a short-term goal?

- Your risk tolerance: How much risk are you comfortable with? Index funds are generally considered to be less risky than individual stocks, but there is still some risk involved.

- Your time horizon: How long do you plan to invest for? Index funds are a good choice for long-term investors.

If you are considering investing in the Fidelity Extended Market Index Fund, it is a good idea to talk to a financial advisor. A financial advisor can help you to assess your investment goals, risk tolerance, and time horizon. They can also help you to create an investment plan that is right for you.