What are IRS tax tables?

IRS tax tables are a set of charts provided by the Internal Revenue Service (IRS) that outline the income tax rates based on a taxpayer's filing status and taxable income. These tables serve as a quick reference for individuals to determine their federal income tax liability without having to perform complex calculations. Tax tables are typically published annually and are based on the most recent tax laws.

Here's how to understand and use IRS tax tables:

Filing Status:

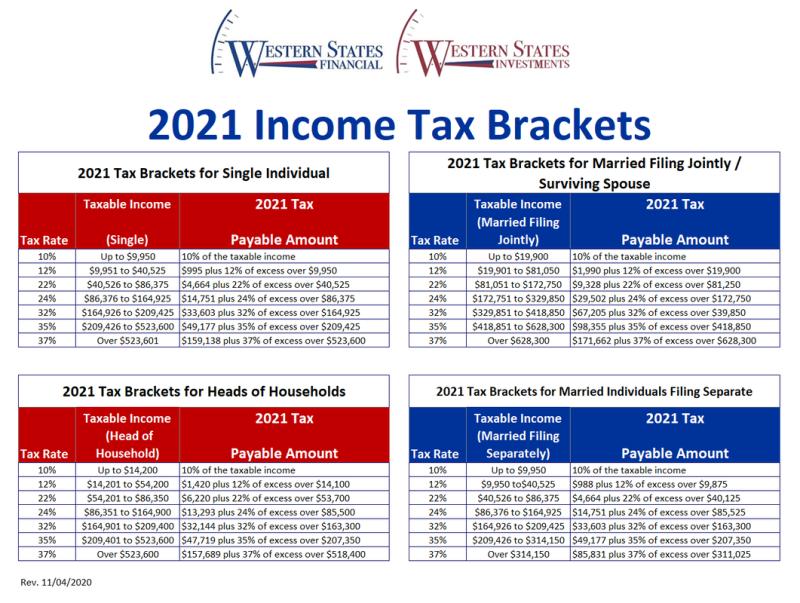

- Tax tables are organized by filing status, which includes categories such as Single, Married Filing Jointly, Head of Household, etc.

Taxable Income:

- Tax tables display ranges of taxable income in increments. Taxable income is your total income minus any deductions and exemptions.

Income Ranges and Tax Rates:

- Within each filing status, the tax tables show different income ranges and the corresponding tax rates for those ranges.

- Tax rates are often progressive, meaning that different portions of your income are taxed at different rates.

Determine Tax Liability:

- Locate your filing status and taxable income in the tax table.

- The intersection of your income and filing status will show your tax liability.

Tax Credits and Deductions:

- Tax tables provide a quick overview of the tax liability, but it's important to consider tax credits and deductions that may reduce your actual tax liability.

Example:

- As an example, if you are a single filer with a taxable income of $40,000, you would find the range that includes $40,000 in the tax table. The table would then show the applicable tax rate for that income range, and you can calculate your tax liability accordingly.

Updated Annually:

- Tax tables are updated annually to reflect changes in tax laws, inflation adjustments, and other factors.

Additional Forms and Considerations:

- Note that certain situations may require additional forms or calculations, especially if you have complex income sources, deductions, or tax credits.

It's important to understand that the tax tables provide a simplified method for calculating tax liability. For more accurate and personalized calculations, especially in complex financial situations, taxpayers may use tax software or consult with a tax professional.

Tax tables are usually included in IRS publications, such as IRS Publication 17, which is a comprehensive guide to federal income tax for individuals. Always refer to the most recent IRS publications and guidelines for the latest information.

The purpose and function of IRS tax tables in determining federal income tax liability

IRS tax tables are a set of predetermined tax rates used to calculate federal income tax liability for individuals and married couples filing jointly. These tables are based on taxable income, filing status, and the number of dependents. The purpose of IRS tax tables is to provide a standardized and efficient method for determining tax liability without the need for complex calculations.

The structure and organization of IRS tax tables, including factors considered in their calculations

IRS tax tables are organized in a matrix format with rows representing taxable income ranges and columns representing filing status and the number of dependents. The tax rates within the table are calculated based on the progressive tax system, where higher income levels are subject to higher tax rates. Factors considered in the calculations include:

Taxable income: This is the amount of income that remains after subtracting allowable deductions from adjusted gross income (AGI).

Filing status: This refers to the taxpayer's marital status and whether they are filing individually, jointly, or as a head of household.

Number of dependents: This is the number of individuals the taxpayer supports financially.

Using IRS tax tables to calculate federal income tax manually

To manually calculate federal income tax using IRS tax tables, follow these steps:

Determine your taxable income: Subtract allowable deductions from your AGI to find your taxable income.

Identify your filing status: Are you filing individually, jointly, or as a head of household?

Count your dependents: How many individuals do you support financially?

Locate your corresponding tax table: Find the tax table that matches your filing status and the number of dependents.

Identify the tax rate bracket: Find the tax rate bracket that corresponds to your taxable income.

Apply the tax rate: Multiply your taxable income by the tax rate to determine your tax liability.

The role of IRS tax tables in tax preparation software and online tools

Tax preparation software and online tools often incorporate IRS tax tables to streamline the tax calculation process. These tools allow users to input their tax information and automatically generate their tax liability based on the applicable tax tables. This simplifies the process and reduces the risk of errors.

Limitations of IRS tax tables and the need for adjustments in certain cases

While IRS tax tables provide a convenient method for calculating tax liability, they have certain limitations. They do not account for complex tax situations, such as those involving phase-outs, credits, or alternative minimum tax (AMT). In these cases, adjustments may be necessary to accurately determine tax liability. Additionally, IRS tax tables are updated annually, and taxpayers may need to make adjustments if their tax situation changes from one year to the next.

It is important to note that IRS tax tables are designed for general use and may not be applicable to all taxpayers. For complex tax situations or specific circumstances, it is advisable to consult with a tax professional to ensure accurate tax calculations and compliance with IRS regulations.