What is the forgiveness program for student loans?

Student loan forgiveness programs are government initiatives that allow borrowers to have a portion or the entirety of their student loans forgiven, meaning they are no longer required to repay the remaining balance of their loans. These programs are typically based on specific criteria, such as the borrower's employment, repayment plan, and the type of loans they have. Some of the key student loan forgiveness programs in the United States include:

Public Service Loan Forgiveness (PSLF):

- This program forgives federal student loans for individuals who work full-time for a qualifying public service or nonprofit organization while making 120 on-time payments (usually over ten years) under an income-driven repayment plan.

Teacher Loan Forgiveness:

- Designed for teachers working in low-income schools or educational service agencies, this program forgives up to a specific amount of federal student loans after five years of teaching. The amount forgiven varies depending on the subject taught and the type of loan.

Income-Driven Repayment (IDR) Forgiveness:

- Federal student loans can be forgiven after 20 or 25 years of on-time payments under certain income-driven repayment plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Closed School Discharge:

- Borrowers who were attending a school when it closed or who withdrew shortly before it closed may be eligible for loan forgiveness on their federal student loans.

Total and Permanent Disability Discharge (TPD):

- Borrowers with total and permanent disabilities, as certified by the Department of Veterans Affairs, the Social Security Administration, or a physician, may qualify for a discharge of their federal student loans.

Death Discharge:

- Federal student loans are discharged upon the death of the borrower. Parent PLUS loans may also be discharged upon the death of the student on whose behalf the loan was taken.

Perkins Loan Cancellation and Discharge:

- Special programs exist to forgive or discharge Federal Perkins Loans for teachers, military service members, and certain public service employees.

State-Based Loan Forgiveness Programs:

- Some states offer their own loan forgiveness programs for in-state residents working in specific fields or regions, such as healthcare, education, and public service.

It's important to note that eligibility and the specific terms of forgiveness programs can vary, and not all borrowers may qualify for these programs. Additionally, the landscape of student loan forgiveness is subject to changes in government policies and regulations, so it's essential to stay informed about the most current programs and requirements. If you're interested in loan forgiveness, contact your loan servicer and review official government websites for the latest information.

Exploring Student Loan Forgiveness Programs in the United States

There are a number of student loan forgiveness programs available to borrowers in the United States. These programs can help borrowers to reduce or eliminate their student loan debt, depending on their eligibility and qualifications.

Some of the most common student loan forgiveness programs include:

- Public Service Loan Forgiveness (PSLF): PSLF is a federal program that forgives the remaining balance of federal student loans for borrowers who have worked full-time for a qualifying public service employer for 10 years and made 120 qualifying monthly payments.

- Teacher Loan Forgiveness: Teacher Loan Forgiveness is a federal program that forgives up to $5,000 in federal student loans for borrowers who have taught full-time for five consecutive years in a low-income school or educational service agency.

- Income-Driven Repayment (IDR) Plans and Loan Forgiveness: IDR plans are federal repayment plans that base monthly payments on a borrower's income and family size. Borrowers who make 20 or 25 years of qualifying payments under an IDR plan may be eligible for loan forgiveness.

Public Service Loan Forgiveness (PSLF): A Comprehensive Guide

PSLF is a federal program that forgives the remaining balance of federal student loans for borrowers who have worked full-time for a qualifying public service employer for 10 years and made 120 qualifying monthly payments.

To be eligible for PSLF, borrowers must:

- Have federal direct loans.

- Work full-time for a qualifying public service employer.

- Make 120 qualifying monthly payments under an IDR plan.

Qualifying public service employers include:

- Federal, state, local, or tribal government agencies.

- Nonprofit organizations that provide public services.

- AmeriCorps or Peace Corps.

Borrowers who are interested in PSLF should apply for the program after making 120 qualifying monthly payments. Borrowers can use the PSLF Help Tool to determine if they are eligible for the program and to track their progress towards forgiveness.

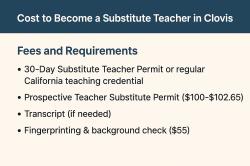

Teacher Loan Forgiveness: Qualifications and Benefits

Teacher Loan Forgiveness is a federal program that forgives up to $5,000 in federal student loans for borrowers who have taught full-time for five consecutive years in a low-income school or educational service agency.

To be eligible for Teacher Loan Forgiveness, borrowers must:

- Have federal direct loans.

- Teach full-time for five consecutive years in a low-income school or educational service agency.

- Meet certain other requirements, such as being highly qualified and teaching a core academic subject.

Borrowers who are interested in Teacher Loan Forgiveness should apply for the program after teaching full-time for five consecutive years in a low-income school or educational service agency. Borrowers can use the Teacher Loan Forgiveness application to determine if they are eligible for the program and to apply for forgiveness.

4. Income-Driven Repayment (IDR) Plans and Loan Forgiveness

IDR plans are federal repayment plans that base monthly payments on a borrower's income and family size. Borrowers who make 20 or 25 years of qualifying payments under an IDR plan may be eligible for loan forgiveness.

To be eligible for IDR loan forgiveness, borrowers must:

- Have federal student loans.

- Make 20 or 25 years of qualifying payments under an IDR plan.

Borrowers who are interested in IDR loan forgiveness should apply for the program after making 20 or 25 years of qualifying payments under an IDR plan. Borrowers can use the IDR Loan Forgiveness Application to apply for forgiveness.

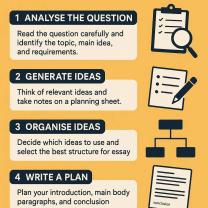

Applying for Student Loan Forgiveness: Step-by-Step Process

To apply for student loan forgiveness, borrowers can follow these steps:

- Review the eligibility criteria for the program that they are interested in.

- Gather the required documentation. This may include proof of employment, income, and loan payments.

- Submit an application to the federal government.

- Follow up with the federal government to track the status of their application.

Borrowers can find more information about student loan forgiveness programs on the Federal Student Aid website.

It is important to note that student loan forgiveness programs can be complex and eligibility requirements may change. Borrowers who are interested in student loan forgiveness should consult with a financial advisor or student loan counselor to learn more about their options.