What does EFC mean that equal financial aid?

EFC stands for Expected Family Contribution. It's a term commonly used in the context of financial aid for college or higher education.

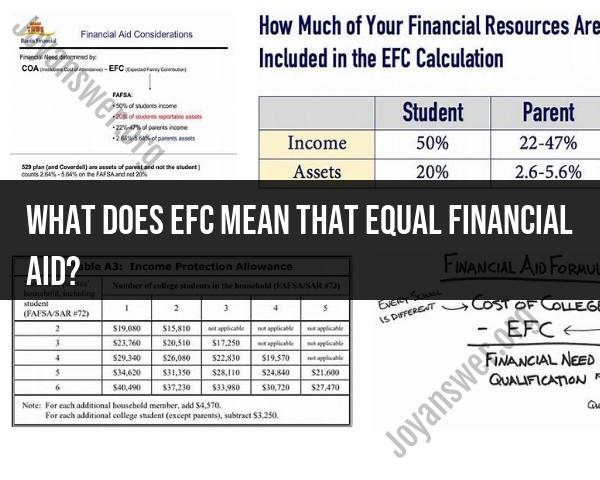

The Expected Family Contribution (EFC) is the amount of money that the federal government expects a student's family to contribute toward the cost of attending college for one academic year. It's calculated based on the information provided on the Free Application for Federal Student Aid (FAFSA) or other financial aid applications.

The EFC is used by colleges and universities to determine a student's eligibility for financial aid, including grants, scholarships, work-study programs, and federal student loans. It's important to note that the EFC is not necessarily the amount of money that a family will actually have to pay for college. It's more like a starting point for determining financial need and eligibility for aid.

Equal financial aid, on the other hand, refers to the concept of distributing financial aid resources fairly among eligible students based on their financial need, as determined by factors like the EFC. It aims to provide equitable opportunities for students from different socioeconomic backgrounds to access higher education.

How is Expected Family Contribution (EFC) defined in relation to financial aid?

The Expected Family Contribution (EFC) is a number used to determine your eligibility for federal student financial aid in the US. It's essentially an index that estimates how much your family can be expected to contribute towards your college costs.

Here's a breakdown of how EFC works in financial aid:

- Calculation: The US Department of Education calculates your EFC based on a formula established by law. This formula considers your family's taxed and untaxed income, assets, and benefits (like unemployment or Social Security). The information you provide on the Free Application for Federal Student Aid (FAFSA) is used for this calculation.

- Not the actual amount: It's important to remember that the EFC is not the exact amount your family will pay for college. It's simply an estimate used by colleges to determine your financial need and award package.

- Financial aid eligibility: Schools use your EFC along with other factors like the cost of attendance to determine what type and amount of federal financial aid you're eligible for. This can include grants, scholarships, and loans. Generally, a lower EFC indicates a greater financial need and qualifies you for more aid.

Here are some resources for further info on EFC and financial aid:

- Federal Student Aid website: Expected Family Contribution (EFC): https://studentaid.gov/help-center/answers/article/what-is-efc)

- How Financial Aid Is Calculated: https://studentaid.gov/complete-aid-process/how-calculated