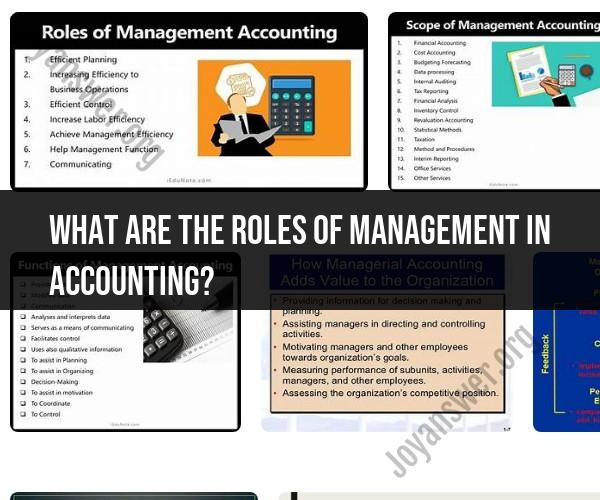

What are the roles of Management in accounting?

Management plays several important roles in the field of accounting within an organization. These roles encompass various functions and responsibilities to ensure that financial information is accurately recorded, analyzed, and used to make informed business decisions. Here are some of the key roles of management in accounting:

Financial Planning: Management is responsible for setting financial goals, creating budgets, and developing financial forecasts. This involves estimating revenues, expenses, and capital requirements for the organization.

Budgeting: Managers collaborate with the accounting department to create budgets that allocate resources effectively and control costs. They monitor budget performance and make adjustments as needed to stay on track.

Financial Reporting: Management oversees the preparation and presentation of financial statements, such as the income statement, balance sheet, and cash flow statement. These reports provide an overview of the organization's financial health.

Internal Controls: Management is responsible for establishing and maintaining internal controls to safeguard the organization's assets and prevent fraud or financial mismanagement.

Decision-Making: Management uses accounting information to make strategic decisions. They analyze financial data to assess the profitability of different projects, investments, or business activities.

Performance Evaluation: Management evaluates the performance of various departments and individuals within the organization based on financial metrics. This can include comparing actual results to budgeted figures and key performance indicators (KPIs).

Tax Compliance: Management ensures that the organization complies with tax laws and regulations. They oversee tax planning strategies to minimize tax liabilities while remaining in compliance with tax laws.

Auditing: Management works with external auditors to facilitate financial audits, ensuring that the organization's financial statements are accurate and conform to accounting standards and regulations.

Cost Management: Managers monitor and control costs within the organization. They may use cost accounting techniques to analyze the cost structure of products or services and identify opportunities for cost savings.

Financial Strategy: Management develops financial strategies that align with the organization's overall objectives. This may involve securing financing, managing investments, and optimizing capital structure.

Risk Management: Managers assess financial risks faced by the organization and implement strategies to mitigate these risks. This can include managing currency risk, interest rate risk, and other financial exposures.

Compliance: Management ensures that the organization adheres to accounting standards (such as Generally Accepted Accounting Principles or International Financial Reporting Standards) and regulatory requirements relevant to financial reporting.

Communication: Management communicates financial information and performance to stakeholders, including shareholders, board members, creditors, and employees, to maintain transparency and build trust.

In summary, management plays a crucial role in accounting by overseeing financial planning, reporting, controls, and decision-making processes to support the organization's financial well-being and strategic objectives. These roles are essential for effective financial management and decision-making within any organization.

The Roles of Management in the Field of Accounting

Management plays a vital role in the field of accounting. Accountants are responsible for recording and reporting financial information, but it is management that uses this information to make informed decisions about the business.

Some of the specific roles of management in accounting include:

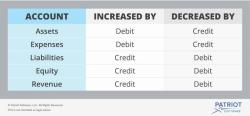

- Setting accounting policies and procedures: Management establishes the accounting policies and procedures that will be used to record and report financial information. This includes determining the accounting method for revenue and expense recognition, the method of inventory valuation, and the method of depreciation.

- Overseeing the accounting department: Management is responsible for overseeing the accounting department and ensuring that financial information is accurately recorded and reported. This includes approving financial statements, reviewing internal controls, and authorizing payments.

- Using accounting information to make decisions: Management uses accounting information to make a wide range of decisions, including budgeting, pricing, investment, and financing decisions. For example, management may use accounting information to determine how much money to spend on advertising or how much to invest in new equipment.

How Management Interacts with Accounting Practices

Management interacts with accounting practices in a number of ways. For example, management may:

- Provide input to the accounting department on the development of accounting policies and procedures.

- Review and approve financial statements before they are released to external stakeholders.

- Meet with accountants to discuss financial performance and trends.

- Ask accountants to prepare specific financial reports or analyses.

Management should also be aware of the latest accounting standards and regulations, and ensure that the accounting department is complying with these requirements.

The Collaborative Relationship Between Management and Accounting

Management and accounting have a collaborative relationship. Accountants provide management with the financial information they need to make informed decisions, and management uses this information to guide the business.

This collaborative relationship is essential for the success of any business. When management and accounting work together effectively, they can help the business to achieve its financial goals and objectives.

Here are some examples of how management and accounting can collaborate:

- Budgeting: Management and accounting work together to develop budgets that align with the business's strategic goals.

- Financial reporting: Management and accounting work together to prepare financial statements that accurately and fairly represent the financial performance of the business.

- Performance evaluation: Management and accounting work together to develop and implement performance evaluation systems that track the progress of the business towards its goals.

- Risk management: Management and accounting work together to identify, assess, and manage the risks facing the business.

By working together, management and accounting can help the business to make better decisions, improve its performance, and achieve its goals.