Does accounts payable have a normal debit balance?

In accounting, accounts payable is a liability account, and its normal balance is a credit balance, not a debit balance.

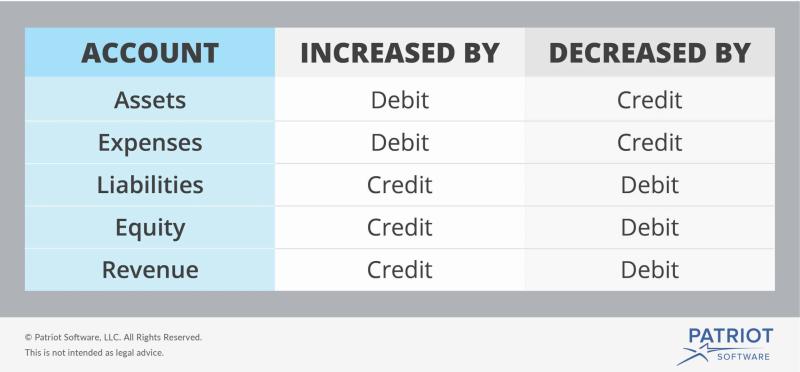

The normal balance of an account refers to the side where increases in that account are recorded and is based on the nature of the account. For liability accounts like accounts payable, increases or additions to the account are recorded as credits, while decreases or reductions are recorded as debits.

Here's a breakdown:

- Accounts Payable (Liability Account):

- Normal Balance: Credit

- Increases: Recorded as credits (e.g., when goods or services are purchased on credit)

- Decreases or Payments: Recorded as debits (e.g., when payments are made to suppliers or vendors)

When a company purchases goods or services on credit, an entry is made to increase accounts payable (credit) to reflect the amount owed to suppliers or vendors. Subsequently, when payments are made to settle these obligations, accounts payable is decreased (debited) to reduce the amount owed.

Remember, while accounts payable has a normal credit balance, it's just one part of the accounting equation. When looking at the balance sheet, liabilities (like accounts payable) are listed on the right-hand side, and the balance sheet equation remains in balance by adhering to the fundamental accounting equation: Assets = Liabilities + Equity.

1. Debit Balance of Accounts Payable Account

Yes, the accounts payable account typically maintains a debit balance. This indicates that the company owes money to its vendors or suppliers for goods or services purchased on credit. The debit balance represents the amount of money the company is obligated to pay in the future.

2. Accounting Principle of Normal Balances

The accounting principle of normal balances states that asset accounts typically have debit balances, liability accounts typically have credit balances, equity accounts typically have credit balances, revenue accounts typically have credit balances, and expense accounts typically have debit balances.

In accordance with this principle, the accounts payable account, being a liability account, should have a credit balance. However, in practice, the accounts payable account usually maintains a debit balance due to the nature of credit purchases.

3. Instances of Credit Balance in Accounts Payable

There are a few instances when accounts payable might have a credit balance:

Prepayment for Goods or Services: If a company receives a prepayment for goods or services that they have not yet provided, the accounts payable account would have a credit balance. This represents the amount of money the company owes the customer for the undelivered goods or services.

Return of Goods or Services: If a company returns goods or services to a vendor, the accounts payable account would have a credit balance. This represents the amount of money the vendor owes the company for the returned goods or services.

Errors or Adjustments: In some cases, a credit balance in the accounts payable account may result from accounting errors or adjustments. These errors need to be identified and corrected to ensure the accuracy of the financial statements.