What are the levels of accounting jobs?

Accounting jobs encompass a hierarchical structure with various levels of responsibility and expertise. The specific titles and hierarchy can vary between organizations, but here is a general outline of the levels of accounting jobs:

Entry-Level Positions:

- These positions are typically for individuals who are new to the accounting profession or have limited experience.

- Accounting Clerk: Performs basic accounting tasks, such as data entry, bookkeeping, and clerical duties.

- Accounts Payable/Receivable Clerk: Specializes in managing accounts payable (outgoing payments) or accounts receivable (incoming payments).

- These positions are typically for individuals who are new to the accounting profession or have limited experience.

Staff Accountant:

- Staff accountants have more responsibility than entry-level positions and may be involved in tasks such as preparing financial statements, reconciling accounts, and analyzing financial data.

Senior Accountant:

- Senior accountants take on a more supervisory role, overseeing the work of staff accountants. They may also be involved in more complex financial analysis, budgeting, and reporting.

Accounting Supervisor/Manager:

- Accounting supervisors or managers are responsible for leading and managing accounting teams. They ensure that financial processes are efficient, accurate, and comply with regulations.

Assistant Controller:

- Assistant controllers support the controller in overseeing the entire accounting function of an organization. They may be involved in financial reporting, budgeting, and internal controls.

Controller:

- Controllers, or financial controllers, are responsible for the overall financial management of an organization. They oversee financial reporting, budgeting, and internal controls. The controller often reports to the Chief Financial Officer (CFO).

Director of Finance:

- The Director of Finance is a senior leadership position that oversees the entire finance department, including accounting. They play a key role in strategic financial planning and decision-making.

Chief Financial Officer (CFO):

- The CFO is the highest-ranking financial executive in an organization. They are responsible for the overall financial strategy, planning, and management. The CFO often reports directly to the CEO and is a key member of the executive team.

In addition to these traditional roles, individuals may specialize in areas such as tax, audit, or forensic accounting, leading to titles like Tax Manager, Audit Manager, or Forensic Accountant. The specific titles and hierarchy can also vary by industry, with certain sectors having unique roles such as Healthcare Finance Manager or Manufacturing Cost Accountant.

As professionals gain experience and expertise, they may move up the hierarchy or transition into roles with broader responsibilities. It's important to note that job titles can vary between organizations, and some organizations may use different titles to describe similar roles. Additionally, the hierarchy outlined here is a general guideline, and some organizations may have additional levels or variations in their structure.

Advancing through the accounting career ladder involves a progressive journey of acquiring knowledge, developing skills, and assuming increasing levels of responsibility. Each level presents unique challenges and opportunities for growth, allowing individuals to showcase their expertise and contribute to the financial well-being of organizations.

1. Entry-level Accounting Jobs:

Entry-level accounting positions serve as the starting point for aspiring accountants, providing an opportunity to gain foundational knowledge and practical experience. These roles typically require a bachelor's degree in accounting and a strong understanding of accounting principles and practices.

Common Entry-level Accounting Jobs:

Staff Accountant: Responsible for recording financial transactions, preparing financial statements, and performing basic accounting tasks.

Junior Tax Accountant: Assists with tax return preparation, tax research, and client communication under the guidance of a senior tax accountant.

Financial Reporting Analyst: Prepares financial reports, analyzes financial data, and supports the financial reporting process.

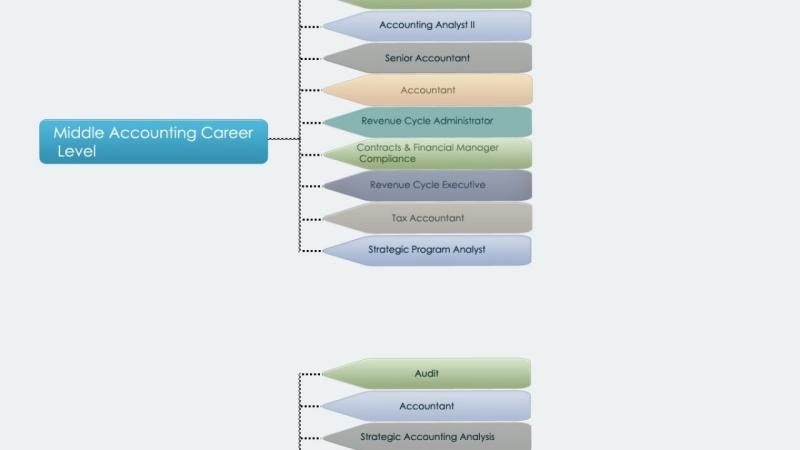

2. Mid-level Accounting Jobs:

Mid-level accounting positions offer opportunities to expand expertise and take on greater responsibilities. At this level, accountants typically possess strong technical skills and have demonstrated their ability to handle complex accounting tasks independently.

Common Mid-level Accounting Jobs:

Senior Accountant: Oversees the work of staff accountants, manages accounting systems, and provides financial analysis.

Tax Manager: Supervises tax preparation and planning for a portfolio of clients, manages tax engagements, and resolves tax-related issues.

Financial Analyst: Conducts in-depth financial analysis, develops financial models, and provides recommendations to support business decisions.

3. Senior-level Accounting Jobs:

Senior-level accounting positions require a high level of expertise, leadership skills, and the ability to provide strategic financial insights. At this level, accountants typically hold significant influence within the organization and play a crucial role in shaping financial policies and strategies.

Common Senior-level Accounting Jobs:

Controller: Oversees the entire accounting department, manages financial reporting, and provides strategic financial guidance to senior management.

Director of Tax: Leads the tax department, oversees tax planning and compliance, and manages tax-related risks.

Chief Financial Officer (CFO): Serves as the organization's top financial executive, responsible for financial strategy, budgeting, and managing financial risks.

4. Executive-level Accounting Jobs:

Executive-level accounting positions represent the pinnacle of the accounting career ladder, requiring exceptional leadership skills, strategic thinking, and the ability to influence the organization's overall financial direction.

Common Executive-level Accounting Jobs:

- Chief Executive Officer (CEO): Responsible for the overall direction and operation of the organization, including financial strategy and performance.