How to calculate the gross pay per paycheck?

Calculating gross pay per paycheck involves adding up the total earnings before any deductions are taken out. The formula for calculating gross pay depends on whether the pay is hourly or salaried.

For Hourly Employees:

Hourly Rate: Determine the employee's hourly rate of pay. For instance, if an employee earns $15 per hour.

Hours Worked: Determine the number of hours the employee worked during the pay period. For example, if the employee worked 40 hours in a week.

Calculation: Multiply the hourly rate by the number of hours worked to find the gross pay for that pay period.

Example: Gross Pay = Hourly Rate x Hours WorkedGross Pay = $15/hour x 40 hours = $600

For Salaried Employees:

Annual Salary: Determine the employee's annual salary. For instance, if an employee earns an annual salary of $50,000.

Pay Frequency: Determine the pay frequency, such as monthly, bi-weekly, or semi-monthly.

Calculation: Divide the annual salary by the number of pay periods in a year to find the gross pay per paycheck.

- For Monthly: Gross Pay = Annual Salary / 12 months

- For Bi-weekly: Gross Pay = Annual Salary / 26 pay periods

- For Semi-monthly: Gross Pay = Annual Salary / 24 pay periods

Example: For a bi-weekly salary:Gross Pay = $50,000 / 26 = $1,923.08 (rounded)

Considerations:

- Gross pay doesn't include deductions such as taxes, retirement contributions, or health insurance premiums.

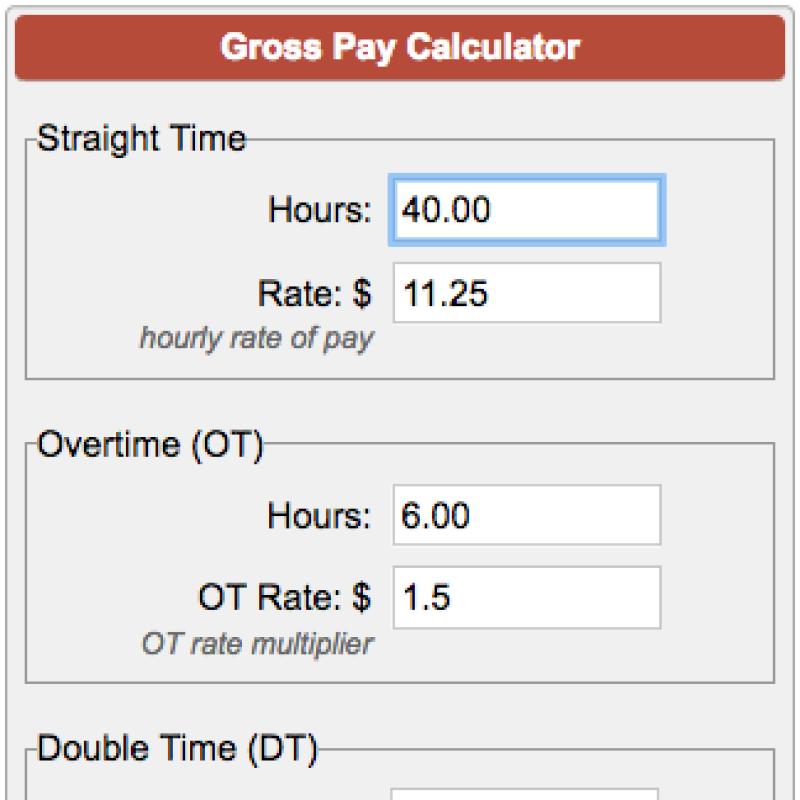

- Overtime pay for hourly employees working more than 40 hours in a workweek is calculated differently based on the overtime rate (usually 1.5 times the regular hourly rate).

- Bonuses, commissions, or other additional earnings should be added to the gross pay for the respective pay period.

Always ensure you're following the relevant employment laws and regulations while calculating gross pay, as these might vary by location and industry. Consult with a payroll professional or use payroll software to ensure accuracy and compliance with all applicable laws and regulations.

1. Calculating Gross Pay per Paycheck

The formula for calculating gross pay per paycheck depends on whether you are an hourly employee or a salaried employee.

Hourly Employees:

For hourly employees, gross pay is calculated by multiplying the hourly wage by the number of hours worked. For example, if an hourly employee earns $15 per hour and works 40 hours in a week, their gross pay would be $600 (15 x 40).

Salaried Employees:

For salaried employees, gross pay is typically determined by dividing the annual salary by the number of pay periods in the year. For example, if a salaried employee earns an annual salary of $50,000 and is paid biweekly (every two weeks), their gross pay per paycheck would be $2,308 (50,000 / 26).

2. Components of Gross Pay

Gross pay is the total amount of money an employee earns before any deductions are taken out. The components of gross pay can vary depending on the employer and the employee's individual circumstances, but they typically include:

Base Salary or Hourly Wage: This is the fixed amount of money an employee earns for their work.

Overtime Pay: If an employee works more than the standard number of hours per day or week, they may be entitled to overtime pay, which is typically at a rate of 1.5 or 2 times their regular pay.

Commissions: Some employees earn commissions based on their sales or other performance metrics.

Bonuses: Bonuses are typically discretionary payments that employers may award to employees for their performance or for achieving specific goals.

Tips: Tips are payments that customers voluntarily give to service-oriented employees, such as waiters, bartenders, and taxi drivers.

3. Online Tools for Determining Gross Pay

There are several online tools available that can help you determine your gross pay per paycheck. These tools typically require you to input your hourly wage or salary, the number of hours worked, and any other relevant information. Some popular online gross pay calculators include:

ADP Gross Pay Calculator

PaycheckCity Salary Paycheck Calculator

SmartAsset Free Paycheck Calculator

These calculators can be helpful for estimating your gross pay, but it's always best to check with your employer for the most accurate information. Your employer may have their own internal formula or system for calculating gross pay.