How can you calculate the gross income for each paycheck?

Calculating gross income for each paycheck involves determining the total earnings before any deductions, such as taxes and other withholdings. To calculate gross income, you typically follow these steps:

Identify your hourly rate or salary: If you're paid hourly, determine your hourly wage. If you have a fixed salary, this step may involve dividing your annual salary by the number of pay periods in a year.

Determine the number of hours worked: If you're paid hourly, you'll need to know how many hours you worked during the pay period. If you have a fixed salary, this step may not be applicable, as your salary is usually not tied to specific hours worked.

Calculate gross income for hourly employees:

- For each paycheck, multiply your hourly rate by the number of hours worked during the pay period.

Example:If your hourly rate is $15 and you worked 40 hours in a week, your gross income for that week would be $15/hour * 40 hours = $600.

Calculate gross income for salaried employees:

- For each paycheck, divide your annual salary by the number of pay periods in a year.

Example:If your annual salary is $50,000 and you are paid bi-weekly (every two weeks), your gross income for each paycheck would be $50,000 / 26 (number of bi-weekly pay periods in a year) = $1,923.08.

Consider additional income sources:

- If you receive any additional income, such as bonuses or commissions, add these amounts to your calculated gross income for the pay period.

It's important to note that gross income represents your earnings before any deductions. To determine your net income (take-home pay), you would subtract deductions such as taxes, insurance premiums, and other withholdings from your gross income. Keep in mind that tax withholding can vary based on factors such as your filing status and the number of allowances you claim on your W-4 form. If you're uncertain about your specific tax situation, it's advisable to consult with a tax professional.

How to compute gross income for each paycheck?

The formula for calculating gross income per paycheck is:

Gross income = Hourly wage × Hours worked

For hourly employees, this is a straightforward calculation. Simply multiply their hourly wage by the number of hours they worked during the pay period.

For salaried employees, gross income is typically calculated by dividing their annual salary by the number of pay periods per year. For example, if an employee earns an annual salary of $50,000 and they are paid bi-weekly (every two weeks), their gross income per paycheck would be $50,000 ÷ 26 = $1,923.08.

What components constitute gross income in a paycheck?

Gross income is the total amount of money an employee earns before any deductions are taken out. This includes:

Base wages or salary: This is the fixed amount of money an employee is paid for their work, regardless of the number of hours they work.

Commissions or bonuses: These are additional payments that employees may earn based on their performance or sales.

Overtime pay: This is extra pay that employees receive for working more than the standard number of hours per day or week.

Tips: Tips are gratuities that customers voluntarily give to employees for good service.

Other forms of compensation: This could include things like allowances, per diem payments, and honoraria.

Are there deductions to consider when calculating gross income per paycheck?

Yes, there are a number of deductions that may be taken out of an employee's paycheck before they receive their gross income. These deductions can be broadly categorized into two types:

Mandatory deductions: These are deductions that are required by law or government regulations. They include things like:

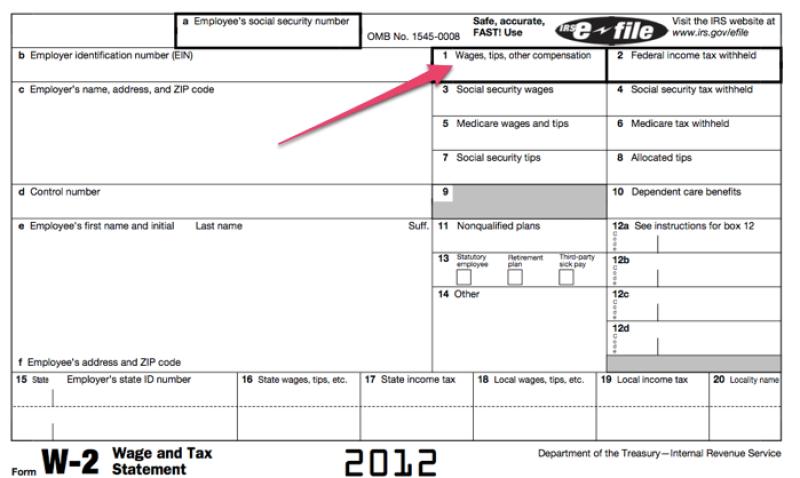

Federal income taxes: These are taxes that are paid to the federal government on an employee's taxable income.

State income taxes: These are taxes that are paid to the employee's state of residence on their taxable income.

Social Security taxes: These taxes are used to fund Social Security, a retirement and disability benefits program.

Medicare taxes: These taxes are used to fund Medicare, a health insurance program for people over the age of 65.

Voluntary deductions: These are deductions that employees choose to make from their paychecks. They include things like:

Health insurance premiums: These are payments made to an insurance company to cover the cost of health insurance.

Retirement plan contributions: These are contributions made to an employee's retirement savings account, such as a 401(k) or IRA.

Union dues: These are payments made to a labor union to support the union's activities.

Charitable donations: These are donations made to charitable organizations.

The specific deductions that are taken out of an employee's paycheck will vary depending on their individual circumstances and employer. Employees can typically see a breakdown of their deductions on their pay stubs.