Can NAB Capital notes 6 be converted or redeemed or resold?

The ability to convert, redeem, or resell NAB Capital Notes 6 depends on the terms and conditions set forth by National Australia Bank (NAB) and the specific features of these financial instruments. Here are some key points to consider:

1. Conversion:

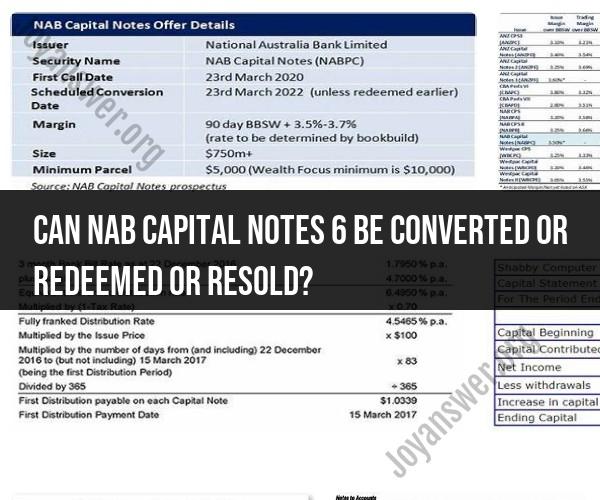

- Typically, convertible notes give the holder the option to convert them into a predetermined number of common shares of the issuing company at a specified conversion price. However, whether NAB Capital Notes 6 are convertible into NAB common shares depends on the terms of the offering. You should refer to the prospectus or offering documents for specific details regarding conversion rights, if any.

2. Redemption:

- Some types of capital notes, including those issued by banks, may have a fixed maturity date. At maturity, the notes are redeemed by the issuer at face value (the original purchase price). It's important to check the terms of NAB Capital Notes 6 to determine if and when they are subject to redemption.

3. Resale:

- The ability to resell NAB Capital Notes 6 on the secondary market depends on market conditions and investor demand. These notes may be traded on the Australian Securities Exchange (ASX) or other secondary markets, if available. Keep in mind that the resale of securities may be subject to regulatory restrictions and market liquidity.

4. Consult Offering Documents:

- To understand the specific conversion, redemption, and resale options associated with NAB Capital Notes 6, it's essential to review the offering documents provided by NAB when the notes were issued. These documents outline the terms and conditions, including any conversion features, redemption provisions, and information on secondary market trading.

5. Seek Professional Advice:

- If you hold NAB Capital Notes 6 and are considering converting, redeeming, or reselling them, it's advisable to consult with a financial advisor or investment professional. They can provide guidance based on your specific investment goals and the terms of the notes.

Keep in mind that the terms and conditions of financial instruments like NAB Capital Notes can vary widely, so it's crucial to have a clear understanding of the terms associated with your particular investment. Additionally, market conditions, interest rates, and other factors can influence the value and liquidity of these notes, so staying informed about market developments is also important.