What expenses does mileage reimbursement cover?

Mileage reimbursement typically covers the costs associated with using a personal vehicle for work-related travel. This can include a range of expenses related to the operation and maintenance of the vehicle. Here are the primary expenses that mileage reimbursement typically covers:

Fuel Costs: Mileage reimbursement often includes compensation for the cost of fuel. Employers can calculate this based on the number of miles driven and the vehicle's fuel efficiency.

Wear and Tear: This includes the general wear and tear on the vehicle that occurs as a result of using it for work-related travel. It encompasses expenses like tire replacement, oil changes, and general maintenance.

Depreciation: The reduction in the value of the vehicle over time is known as depreciation. Mileage reimbursement may include a portion to account for the vehicle's decrease in value due to business use.

Insurance: Some employers include a portion of the vehicle's insurance costs in the reimbursement, especially if the employee is required to carry commercial auto insurance.

Licensing and Registration: Costs associated with vehicle licensing and registration fees are often included in mileage reimbursement.

Tolls and Parking Fees: If an employee has to pay tolls or parking fees while on work-related travel, these expenses are usually covered.

Repairs: Repairs that are directly related to work-related travel, such as fixing damage incurred during business use, may be reimbursable.

Lease or Loan Payments: In some cases, an employer may reimburse a portion of lease or loan payments if the employee's personal vehicle is used for work.

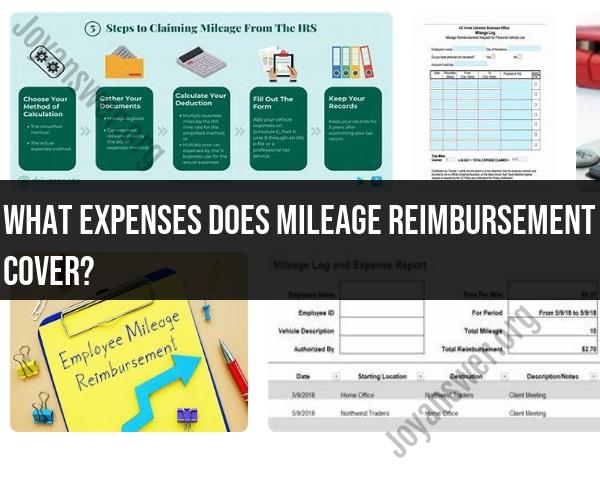

Mileage Rate: Most mileage reimbursement is calculated based on a per-mile rate. Employers can use the standard mileage rate provided by the IRS as a guideline. This rate typically covers fuel, wear and tear, and depreciation.

It's important to note that the specific expenses covered and the reimbursement rate can vary by employer and may depend on company policies, industry standards, and legal requirements. The IRS often sets a standard mileage rate for tax purposes, which is frequently used as a benchmark by employers.

Employees who use their personal vehicles for work-related travel should keep accurate records of their mileage, including the date, purpose of the trip, starting and ending odometer readings, and any expenses like tolls or parking fees. This documentation is usually required for reimbursement and tax purposes.

Employers should have a clear and well-communicated mileage reimbursement policy that outlines what is covered, the reimbursement rate, and the process for submitting mileage claims. Additionally, employers should ensure that their mileage reimbursement practices comply with applicable labor and tax laws.

Mileage Reimbursement Expenses: What's Covered?

Mileage reimbursement is the financial compensation that an employer provides to an employee for driving their personal vehicle for business purposes. It is calculated based on the distance traveled, and typically covers the cost of gas, oil, wear and tear, and depreciation.

Expenses Eligible for Mileage Reimbursement

The following expenses are typically eligible for mileage reimbursement:

- Gas and oil

- Wear and tear

- Depreciation

- Parking fees

- Tolls

- Bridge fees

- Ferry fees

Transparent Reimbursement Policies and Guidelines

It is important for employers to have a clear and transparent mileage reimbursement policy in place. This policy should outline what expenses are eligible for reimbursement, how the reimbursement rate is calculated, and how employees can submit reimbursement requests.

The policy should also be communicated to employees in a clear and concise manner. This will help to ensure that employees are aware of the policy and that they understand how to submit reimbursement requests.

4. Managing Mileage Reimbursement Expenses for Business and Work

Employees can manage their mileage reimbursement expenses by keeping track of their mileage and submitting reimbursement requests promptly. Employees can use a variety of tools to track their mileage, such as a mileage tracking app or a paper mileage log.

Employers can help employees to manage their mileage reimbursement expenses by providing them with easy-to-use mileage tracking tools and by reimbursing employees promptly.

Optimizing Employee Benefits with Mileage Reimbursement

Mileage reimbursement can be a valuable benefit for employees. It can help employees to offset the cost of using their personal vehicles for business purposes. This can be especially beneficial for employees who travel frequently for work.

Employers can optimize employee benefits with mileage reimbursement by offering a competitive reimbursement rate and by making it easy for employees to submit reimbursement requests. Employers can also use mileage reimbursement to attract and retain top talent.

Here are some additional tips for optimizing employee benefits with mileage reimbursement:

- Offer a competitive reimbursement rate: Employers should research the standard mileage rate set by the IRS and offer a reimbursement rate that is at least equal to the standard mileage rate. Employers can also choose to offer a higher reimbursement rate, if desired.

- Make it easy for employees to submit reimbursement requests: Employers should provide employees with an easy way to submit mileage reimbursement requests. This can be done through a web portal, email, or paper forms.

- Reimburse employees promptly: Employers should reimburse employees for their mileage expenses promptly. This will help to ensure that employees are not out of pocket for using their personal vehicles for work.

- Communicate your mileage reimbursement policy to employees: Employers should communicate their mileage reimbursement policy to employees in a clear and concise manner. This will help to ensure that employees are aware of the policy and that they understand how to submit reimbursement requests.

- Use mileage reimbursement to attract and retain top talent: Employers can use mileage reimbursement to attract and retain top talent. By offering a competitive reimbursement rate and making it easy for employees to submit reimbursement requests, employers can show employees that they value their time and their hard work.

By following these tips, employers can create a mileage reimbursement program that is beneficial for both employees and the business.