Can Medicare be a secondary payer?

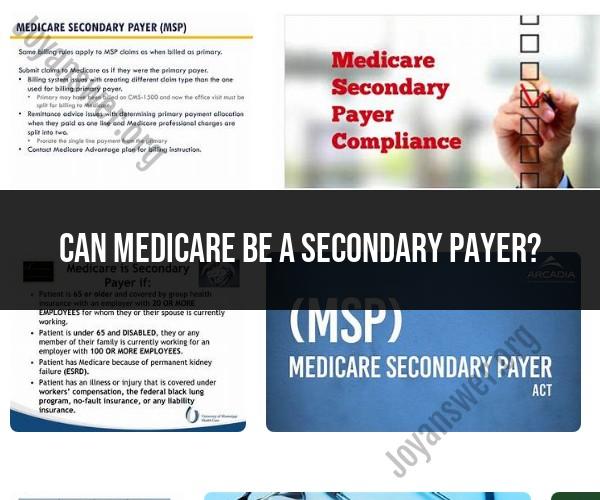

Yes, Medicare can serve as a secondary payer in certain situations. Medicare is considered the secondary payer when an individual has other health insurance coverage in addition to Medicare, such as employer-sponsored group health insurance, retiree health coverage, or coverage through a spouse's employer.

The primary payer is responsible for paying healthcare claims first, and Medicare pays as a secondary payer to cover costs that the primary insurance doesn't pay. Here are some common scenarios in which Medicare serves as a secondary payer:

Employer Group Health Insurance: If you're 65 or older and covered by an employer-sponsored group health plan through your or your spouse's current employment, that plan is usually the primary payer. Medicare becomes the secondary payer. In this case, Medicare typically covers services that the primary plan doesn't, such as deductibles, coinsurance, or services not covered by the primary plan.

COBRA Coverage: If you have COBRA coverage through a former employer or union, Medicare is the primary payer because COBRA isn't considered a group health plan based on current employment.

Workers' Compensation: If you're eligible for both Medicare and workers' compensation benefits, workers' compensation is the primary payer for any work-related medical expenses, and Medicare is the secondary payer.

No-Fault Insurance: In some cases, individuals may have insurance coverage through a "no-fault" insurance policy (e.g., for auto accidents). In such cases, the no-fault insurance is the primary payer, and Medicare is secondary.

Medicaid: If you're eligible for both Medicare and Medicaid, Medicaid may pay Medicare premiums, deductibles, and cost-sharing, making Medicaid the primary payer for these expenses.

It's important to note that the coordination of benefits (COB) rules can be complex, and the specific rules may vary based on the type of coverage you have and your individual circumstances. When you have Medicare as well as other insurance coverage, it's crucial to inform healthcare providers, insurers, and Medicare about your insurance situation so that claims can be processed correctly.

Failure to properly coordinate benefits could result in denied claims or overpayments. If you have questions or need assistance with Medicare as a secondary payer, it's advisable to contact Medicare directly or consult with a Medicare counselor who can provide guidance based on your specific situation.

Medicare as a Secondary Payer: What You Need to Know

Medicare is a government health insurance program that provides coverage to people aged 65 and older, as well as people with certain disabilities. Medicare is the primary payer for most people, but there are some cases where Medicare is the secondary payer.

Medicare is the secondary payer when another payer is primarily responsible for paying for your healthcare services. This can happen if you have health insurance through your employer, your spouse's employer, or another type of private health insurance.

If Medicare is the secondary payer, your other payer will pay first. Medicare will then pay any remaining costs, up to the amount that Medicare would have paid if it had been the primary payer.

Coordinating Healthcare Coverage: Understanding Medicare as Secondary Payer

If you have Medicare and another type of health insurance, it is important to coordinate your coverage. This means working with your insurance companies to make sure that your claims are processed correctly and that you are not paying out-of-pocket for services that should be covered by your insurance.

To coordinate your healthcare coverage, you should:

- Let your doctor's office know that you have Medicare and another type of health insurance.

- Provide your insurance companies with your Medicare information and your other insurance information.

- Review your Explanation of Benefits (EOBs) from your insurance companies to make sure that your claims are being processed correctly.

- Contact your insurance companies if you have any questions about your coverage or if you think that a claim has been processed incorrectly.

Dual Coverage: The Role of Medicare as a Secondary Payer

Dual coverage is the term used to describe the situation when a person has both Medicare and another type of health insurance. Dual coverage can be common for people who are retired and receive health insurance through their former employer, or for people who have health insurance through their spouse's employer.

When a person has dual coverage, Medicare is the secondary payer. This means that Medicare will pay only after the other payer has paid. This can be beneficial for people with dual coverage, as it can help to reduce their out-of-pocket healthcare costs.

However, it is important to note that Medicare has some rules about how it pays for services when a person has dual coverage. For example, Medicare may not pay for services that are not covered by the other payer. Medicare may also not pay for services if the other payer pays less than Medicare would have paid.

If you have dual coverage, it is important to work with your insurance companies to make sure that you understand your coverage and that you are getting the most out of your benefits.