How to spend my money wisely?

Mastering money management is essential for achieving financial stability and meeting your long-term financial goals. Wise spending plays a crucial role in this process. Here are some tips to help you make thoughtful and responsible spending decisions:

Create a Budget:

- Start by creating a monthly budget that outlines your income and expenses. Be thorough in tracking all your sources of income and categorize your expenses, including fixed costs (rent or mortgage, utilities) and variable costs (groceries, entertainment).

Set Financial Goals:

- Define your short-term and long-term financial goals. Whether it's saving for a vacation, paying off debt, or building an emergency fund, having clear objectives will help you prioritize your spending.

Differentiate Needs from Wants:

- Distinguish between essential needs and discretionary wants. Prioritize spending on needs like housing, food, healthcare, and transportation before allocating funds to wants like dining out or entertainment.

Use Cash or Debit for Daily Expenses:

- Consider using cash or a debit card for your day-to-day expenses. This can help you avoid accumulating credit card debt and overspending.

Track Your Spending:

- Keep a record of your daily expenses to monitor where your money is going. Many mobile apps and budgeting tools can help you track your spending habits.

Prioritize Savings:

- Pay yourself first by setting aside a portion of your income for savings. Automate contributions to your savings accounts, such as retirement funds, emergency funds, and investment accounts.

Comparison Shop:

- Before making significant purchases, compare prices and explore different options. Look for discounts, promotions, or special offers to get the best value for your money.

Limit Impulse Purchases:

- Avoid impulsive spending by taking time to consider your purchases. Ask yourself if the item is a true necessity or if it can wait.

Plan Meals and Shop Smart:

- Plan your meals in advance, create shopping lists, and stick to them. Avoid grocery shopping when you're hungry, as this can lead to impulse buying.

Use Coupons and Cashback Rewards:

- Take advantage of coupons, cashback offers, and loyalty programs to save money on your purchases. These small savings can add up over time.

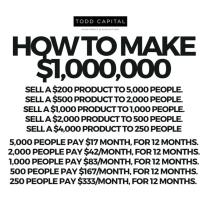

Avoid Lifestyle Inflation:

- As your income increases, resist the temptation to dramatically increase your spending. Instead, use the extra income to boost your savings and investments.

Emergency Fund:

- Build and maintain an emergency fund to cover unexpected expenses. Having a financial safety net will prevent you from relying on credit cards or loans in emergencies.

Review Subscriptions:

- Periodically review your subscriptions, such as streaming services, gym memberships, or magazine subscriptions. Cancel those you no longer use or need.

Set Spending Limits:

- Establish spending limits for specific categories in your budget. For example, allocate a fixed amount for dining out each month and stick to it.

Seek Financial Education:

- Continuously educate yourself about personal finance and money management. Understanding financial concepts and strategies will empower you to make informed spending decisions.

Avoid High-Interest Debt:

- Minimize the use of credit cards for non-essential purchases, and if you do use them, pay off the balance in full each month to avoid accumulating high-interest debt.

Delay Gratification:

- Practice delayed gratification by saving for larger purchases rather than resorting to credit. This discipline can help you make more thoughtful spending choices.

Stay Mindful of Sales Tactics:

- Be aware of sales tactics and marketing strategies designed to encourage impulsive spending. Stick to your budget and shopping list.

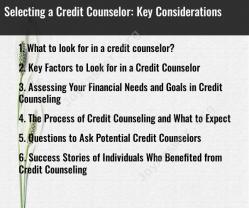

Seek Professional Advice:

- If you're struggling with debt or financial management, consider seeking advice from a financial advisor or counselor who can provide personalized guidance.

Remember that wise spending is a fundamental aspect of effective money management. By following these tips and developing good financial habits, you can make informed spending decisions that align with your financial goals and lead to long-term financial well-being.