Should I save my money or invest my money?

Weighing the decision between saving and investing is a crucial aspect of financial planning. Both saving and investing serve different purposes and come with their own set of considerations. To make informed financial decisions, it's essential to understand the differences between the two and when each is most appropriate:

Saving:

Purpose: Saving involves setting aside money in safe and easily accessible accounts or assets for short-term or emergency needs. The primary purpose is to preserve capital and maintain liquidity.

Safety: Savings are typically held in low-risk, insured accounts such as savings accounts, certificates of deposit (CDs), or money market accounts. These accounts offer protection of principal, making them suitable for emergency funds.

Liquidity: Savings are highly liquid, meaning you can access your money quickly and without penalties. This liquidity is essential for covering unexpected expenses.

Returns: Savings accounts generally offer lower interest rates compared to investments. The returns are typically modest and may not keep pace with inflation over the long term.

Time Horizon: Saving is suitable for short-term financial goals and for creating a financial safety net. Common short-term goals include building an emergency fund, saving for a vacation, or accumulating a down payment for a home.

Risk Tolerance: Saving is appropriate for individuals who prioritize capital preservation and have a low risk tolerance. It's an ideal choice for funds you cannot afford to lose.

Investing:

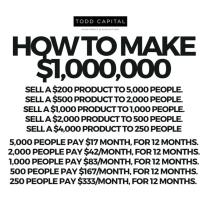

Purpose: Investing involves putting money into assets, such as stocks, bonds, real estate, or mutual funds, with the expectation of generating returns over the long term. The primary purpose is to grow wealth and outpace inflation.

Risk: Investments carry varying degrees of risk, depending on the asset class. While they offer the potential for higher returns, they also come with the risk of losing capital. Diversification can help manage risk.

Liquidity: Investments are generally less liquid than savings. They may require time to sell or convert into cash, which is why they are better suited for long-term goals.

Returns: Investments have the potential for higher returns compared to savings. Historically, well-diversified portfolios of stocks and bonds have provided substantial long-term growth.

Time Horizon: Investing is suitable for long-term financial goals, such as retirement planning, building wealth for the future, or funding education expenses for children.

Risk Tolerance: Investing is appropriate for individuals with a longer time horizon who are willing to accept a higher level of risk in exchange for the potential for greater returns.

Balancing Saving and Investing:

Emergency Fund: Prioritize building an emergency fund in a savings account before considering significant investments. This fund should cover at least three to six months' worth of living expenses.

Goals-Based Approach: Determine your financial goals and allocate funds accordingly. Short-term goals should be funded with savings, while long-term goals can involve investing.

Diversification: When investing, diversify your portfolio to spread risk. Consider a mix of asset classes, such as stocks, bonds, and real estate, based on your risk tolerance and time horizon.

Risk Assessment: Assess your risk tolerance and financial situation before investing. Ensure that you have a stable financial foundation before taking on greater investment risk.

Consult a Financial Advisor: Consider consulting a financial advisor to help you create a personalized financial plan that balances saving and investing based on your unique circumstances and goals.

Ultimately, the decision between saving and investing depends on your financial objectives, time horizon, and risk tolerance. Striking the right balance between the two can help you achieve both short-term security and long-term financial growth.