What to look for in a credit counselor?

Selecting a reputable and effective credit counselor is essential if you're seeking assistance with managing your debt and improving your financial situation. Here are key considerations to keep in mind when looking for a credit counselor:

Accreditation and Certification:

- Look for credit counseling agencies that are accredited by a recognized organization, such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Accreditation ensures that the agency adheres to industry standards and best practices.

Licensing and Compliance:

- Verify that the credit counseling agency is licensed to operate in your state. Ensure they comply with state and federal regulations governing credit counseling and debt management services.

Experience and Reputation:

- Research the agency's history and reputation. How long have they been in business, and what do previous clients say about their services? Look for reviews and ratings online to gauge the agency's credibility.

Nonprofit Status:

- While a nonprofit status doesn't guarantee quality service, many reputable credit counseling agencies operate as nonprofit organizations. They are typically more focused on providing assistance to consumers rather than generating profits.

Free Initial Consultation:

- A good credit counseling agency typically offers a free initial consultation. During this session, they should assess your financial situation, discuss your goals, and provide an overview of their services without charging a fee.

Transparency and Fees:

- Understand the agency's fee structure. Reputable agencies are transparent about their fees, and these fees should be reasonable. Be cautious of agencies that request upfront fees before providing any services.

Services Offered:

- Determine the range of services offered. Credit counseling agencies may provide services beyond basic budgeting and debt management, such as housing counseling, bankruptcy counseling, and education on financial literacy.

Qualified Counselors:

- Ensure that the counselors are trained and certified by recognized organizations. They should have a strong understanding of financial management, budgeting, and debt relief options.

Personalized Financial Plan:

- A good credit counselor will work with you to create a personalized financial plan tailored to your specific needs and goals. The plan should address your debt issues and provide actionable steps for improvement.

Confidentiality:

- Your financial information should be treated with the utmost confidentiality. Confirm that the agency has secure procedures in place to protect your personal and financial data.

Education and Support:

- Look for an agency that not only helps you with your current financial challenges but also provides educational resources and ongoing support to help you build better financial habits.

Red Flags:

- Beware of agencies that make unrealistic promises, pressure you into making decisions, or engage in unethical practices. If something feels off, it's best to seek help elsewhere.

Communication:

- Assess the quality of communication and the agency's responsiveness. A good credit counselor should be approachable, attentive to your questions and concerns, and provide timely responses.

Before making a decision, it's advisable to consult with multiple credit counseling agencies to compare their services, fees, and approach. Take your time to choose an agency that aligns with your financial goals and is committed to helping you achieve a healthier financial future.

Key Factors to Look for in a Credit Counselor

Choosing the right credit counselor is crucial for effective financial guidance and support. Here are some key factors to consider:

Credentials and Experience: Opt for credit counselors certified by reputable organizations like the National Foundation for Credit Counseling (NFCC) or the Association of Independent Credit Counseling Agencies (AICCA). These certifications ensure adherence to ethical standards and expertise in financial counseling.

Areas of Expertise: Assess the counselor's specialization in dealing with your specific financial concerns, such as debt management, credit repair, or budgeting assistance.

Communication Skills and Rapport: Choose a counselor who can clearly explain complex financial concepts, actively listen to your concerns, and establish a comfortable rapport for open communication.

Fees and Services: Understand the counselor's fee structure and the services offered. Ensure the fees are transparent and align with your budget.

Availability and Accessibility: Consider the counselor's availability for in-person or online sessions to suit your schedule and preferences.

Assessing Your Financial Needs and Goals in Credit Counseling

Before seeking credit counseling, it's essential to assess your financial situation and establish clear goals:

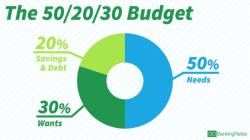

Identify Financial Challenges: Analyze your current financial standing, including income, expenses, and debts. Pinpoint areas of financial strain or difficulty.

Set Realistic Goals: Define your financial objectives, whether it's managing debt, improving credit score, or creating a budget.

Gather Financial Documents: Prepare relevant financial documents, such as credit reports, bank statements, and debt statements, to provide the counselor with accurate information.

The Process of Credit Counseling and What to Expect

The credit counseling process typically involves:

Initial Consultation: The counselor will review your financial situation, goals, and concerns.

Debt and Budget Analysis: The counselor will analyze your debt obligations and income to create a personalized budget plan.

Credit Report Review: The counselor will review your credit report to identify areas for improvement and provide strategies for credit repair.

Debt Management Plan: If applicable, the counselor may assist in establishing a debt management plan to consolidate and pay off debts systematically.

Ongoing Support and Education: The counselor will provide ongoing support, guidance, and financial education resources to help you achieve your goals.

Questions to Ask Potential Credit Counselors

To make an informed decision, consider asking potential credit counselors these questions:

What are your certifications and experience in credit counseling?

What are your areas of expertise in financial counseling?

How do you approach credit counseling for individuals with my specific financial situation?

What are your fees and the services included in each fee structure?

How often will we meet, and what are your communication preferences?

What resources do you provide for ongoing support and financial education?

What are your success rates in helping individuals achieve their financial goals?

Success Stories of Individuals Who Benefited from Credit Counseling

Numerous individuals have successfully improved their financial situation through credit counseling. Here are some examples:

Sarah: Sarah struggled with credit card debt after losing her job. Credit counseling helped her create a budget, reduce her spending, and negotiate a debt management plan to pay off her debts.

David: David wanted to improve his credit score to qualify for a mortgage. Credit counseling helped him identify negative items on his credit report and develop a plan to address them, leading to a significant credit score improvement.

Emily: Emily had difficulty managing her finances and felt overwhelmed by her debts. Credit counseling provided her with budgeting tools, debt management strategies, and financial education, helping her gain control of her finances.