What is the formula for taxable equivalent yield?

The formula for the taxable equivalent yield (TEY) is used to compare the after-tax yield of a tax-free investment with the yield of a taxable investment. This formula is particularly useful when comparing investments such as municipal bonds (which are often tax-free) with taxable bonds. The purpose is to determine the taxable yield that would be equivalent to the tax-free yield after accounting for taxes.

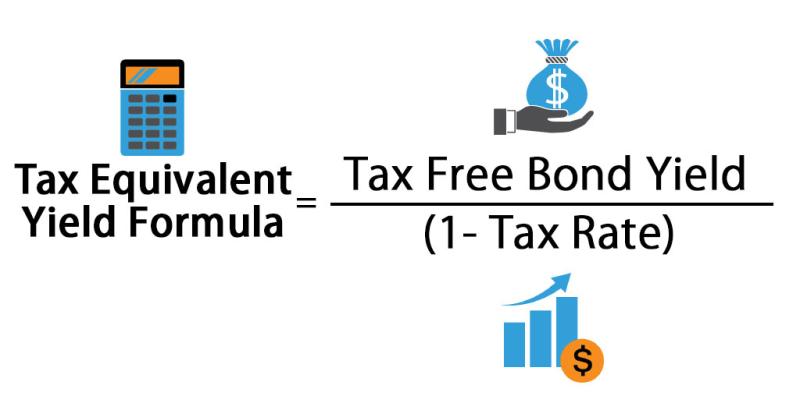

The formula for taxable equivalent yield is given by:

Here:

- Tax-Free Yield: The yield or interest rate of a tax-free investment, such as municipal bonds.

- Tax Rate: The investor's marginal tax rate, representing the percentage of income that is paid in taxes.

The adjustment is made by dividing the tax-free yield by the complement of the tax rate (1 - Tax Rate). This adjustment accounts for the fact that the interest earned on the tax-free investment is not subject to income taxes.

Example:

Suppose you have a tax-free investment with a yield of 3%, and your marginal tax rate is 25%. The taxable equivalent yield would be:

In this example, the taxable equivalent yield is 4%, meaning that a taxable investment with a 4% yield would be equivalent, after taxes, to the tax-free investment with a 3% yield.

Investors use the taxable equivalent yield to compare the attractiveness of tax-free and taxable investments, especially in the context of fixed-income securities like bonds. Tax-free investments may offer lower pre-tax yields than taxable investments, but their after-tax returns can be more competitive for investors in higher tax brackets.

It's important to note that this formula is a useful tool for comparing investments, but other factors such as risk, liquidity, and investment goals should also be considered when making investment decisions. Additionally, individual tax situations can vary, so consulting with a financial advisor is recommended for personalized advice.

What is the formula for calculating taxable equivalent yield?

The formula for calculating taxable equivalent yield (ETY) is as follows:

ETY = Nominal yield / (1 - Tax rate)

where:

- ETY is the taxable equivalent yield

- Nominal yield is the yield of the tax-exempt investment

- Tax rate is the investor's marginal tax rate

How is taxable equivalent yield determined, and what factors influence the calculation?

Taxable equivalent yield is determined by dividing the nominal yield of a tax-exempt investment by one minus the investor's marginal tax rate. The higher the investor's tax rate, the higher the taxable equivalent yield will be. This is because investors with higher tax rates will pay more taxes on their investment income, so they need to earn a higher yield on taxable investments in order to generate the same after-tax return as a tax-exempt investment.

Other factors that can influence the calculation of taxable equivalent yield include the type of investment and the investor's risk tolerance. For example, municipal bonds are generally considered to be low-risk investments, so they typically have lower yields than corporate bonds or stocks. However, municipal bonds are also exempt from federal income tax, which makes them attractive to investors with high tax rates.

Are there practical examples or scenarios illustrating the use of the taxable equivalent yield formula?

Here is a practical example of how to use the taxable equivalent yield formula:

Suppose an investor with a marginal tax rate of 30% is considering investing in a municipal bond with a nominal yield of 5%. The taxable equivalent yield of the municipal bond would be calculated as follows:

ETY = 5% / (1 - 30%) = 7.14%

This means that the investor would need to find a taxable investment with a yield of at least 7.14% in order to generate the same after-tax return as the municipal bond.

Another example:

Suppose an investor with a marginal tax rate of 25% is considering investing in a corporate bond with a nominal yield of 7%. The taxable equivalent yield of the corporate bond would be calculated as follows:

ETY = 7% / (1 - 25%) = 9.33%

This means that the investor would need to find a taxable investment with a yield of at least 9.33% in order to generate the same after-tax return as the corporate bond.

Conclusion

Taxable equivalent yield is a useful tool for investors to compare the yields of taxable and tax-exempt investments. By understanding taxable equivalent yield, investors can make more informed decisions about their investments.