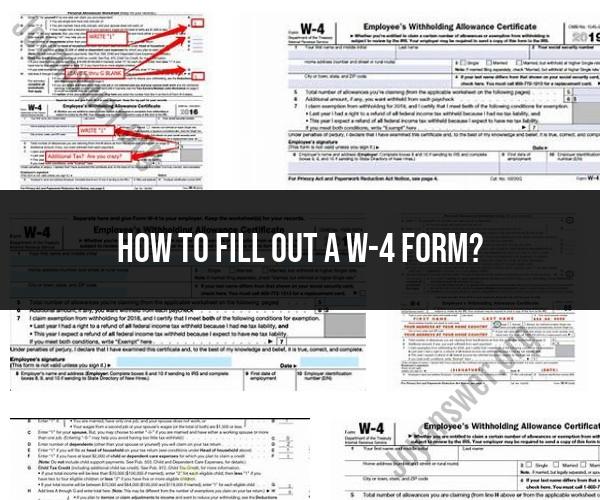

How to fill out a W-4 Form?

Filling out a W-4 form can seem complex, but this simplified walkthrough will guide you through the process. The purpose of the W-4 form is to inform your employer how much federal income tax to withhold from your paycheck. Here are the steps to fill out a W-4 form:

Step 1: Provide Personal Information

- Start by providing your personal information at the top of the form. This includes your name, address, Social Security Number (SSN), and filing status (e.g., Single, Married, Head of Household).

Step 2: Complete Step 2 if Applicable

- Step 2 is for individuals with multiple jobs or those who are married and both spouses work. Use the worksheet provided with the form to determine whether you should complete this step.

Step 3: Claim Dependents

- In Step 3, you can claim allowances for dependents. Each allowance reduces your taxable income. If you have children or dependents, follow the instructions on the form to determine how many allowances to claim. Be sure to check the appropriate box for each dependent.

Step 4: Other Adjustments

- Step 4 allows you to make additional adjustments to your withholding. You can specify an additional dollar amount to withhold from each paycheck if needed. If you have specific circumstances or want to withhold more, you can enter that amount here.

Step 4(c): Other Credits

- In Step 4(c), you can enter additional amounts to withhold for specific tax credits, such as the Child Tax Credit or other dependents' credits.

Step 5: Sign and Date the Form

- Sign and date the W-4 form to certify that the information you provided is accurate.

Step 6: Submit the Form to Your Employer

- Submit the completed W-4 form to your employer or HR department. They will use the information you provided to calculate the appropriate federal income tax withholding from your paychecks.

Step 7: Review and Update Annually

- It's important to review and update your W-4 form annually or whenever significant life changes occur (e.g., marriage, having a child, buying a home). Changes in your deductions and credits may impact your withholding.

Note: If you're uncertain about how to fill out your W-4 form or want to optimize your withholding, consider using the IRS's Tax Withholding Estimator, a free online tool that provides personalized recommendations based on your financial situation.

Keep in mind that the goal is to have the correct amount of federal income tax withheld throughout the year to avoid a significant tax bill or overpaying and receiving a large refund when you file your tax return. Adjust your withholding as needed to align with your financial circumstances.

Filling Out Your W-4 Form: A Step-by-Step Guide

The W-4 form is used by your employer to calculate the amount of federal income tax to withhold from your paycheck. It is important to fill out your W-4 form accurately to avoid having too much or too little tax withheld.

To fill out your W-4 form, follow these steps:

- Enter your personal information. This includes your name, address, social security number, and filing status.

- Claim your dependents. If you have any dependents, you can claim them on your W-4 form. This will reduce the amount of tax withheld from your paycheck.

- Enter your estimated adjustments. This includes any deductions or credits that you expect to claim on your tax return. For example, if you expect to itemize your deductions, you would enter the estimated amount of your deductions on this line.

- Sign and date the form.

W-4 Demystified: How to Complete the Form Accurately

Here are some additional tips for completing the W-4 form accurately:

- Be honest and accurate. The information you provide on your W-4 form is used to calculate the amount of tax withheld from your paycheck. It is important to provide accurate information to avoid having too much or too little tax withheld.

- Review your W-4 form annually. Your financial situation may change throughout the year, so it is important to review your W-4 form annually to make sure that your withholding is accurate.

- Use the IRS's W-4 Withholding Estimator. The IRS's W-4 Withholding Estimator can help you determine how much tax to withhold from your paycheck based on your income, tax bracket, deductions, and other financial obligations.

Tax Withholding Simplified: A Comprehensive Guide to W-4 Form

The W-4 form can be a complex document, but it is important to understand how to fill it out accurately to avoid having too much or too little tax withheld from your paycheck. By following the tips above, you can ensure that your W-4 form is completed accurately and that you are paying the correct amount of tax.

Here are some additional tips for understanding tax withholding and the W-4 form:

- What is tax withholding? Tax withholding is a system where your employer withholds a certain amount of income tax from your paycheck each pay period. This amount of tax is then sent to the IRS on your behalf.

- What is the purpose of tax withholding? The purpose of tax withholding is to ensure that you pay your taxes throughout the year, rather than having to pay them all in one lump sum at the end of the year.

- How is the amount of tax withheld determined? The amount of tax withheld from your paycheck is determined by your W-4 form. The information on your W-4 form is used to calculate your tax withholding based on your income, tax bracket, deductions, and other financial obligations.

If you have any questions about tax withholding or the W-4 form, you can consult with a tax professional for assistance.