How to determine a retirement withdrawal rate?

Determining a retirement withdrawal rate is a critical aspect of financial planning for retirement. It involves deciding how much money you can safely withdraw from your retirement savings each year to cover your living expenses while ensuring your money lasts throughout your retirement. Here's a step-by-step guide to help you determine an appropriate retirement withdrawal rate:

1. Assess Your Retirement Expenses:

- Calculate your anticipated annual retirement expenses, including essentials like housing, food, healthcare, utilities, and discretionary spending like travel and entertainment.

- Consider potential changes in expenses over time, such as healthcare costs, inflation, and any planned major expenses.

2. Estimate Your Retirement Income:

- Determine your sources of retirement income, which may include Social Security benefits, pensions, rental income, annuities, and any other sources of guaranteed income.

- Calculate the expected annual income from these sources.

3. Identify Your Retirement Savings:

- Determine the total amount you have saved for retirement in your retirement accounts (e.g., 401(k), IRAs), taxable investments, and any other savings.

- Take into account the different types of investments you hold and their expected returns.

4. Consider Your Investment Strategy:

- Assess your investment portfolio's asset allocation and risk level. Your investment strategy should be aligned with your retirement goals and risk tolerance.

- Estimate the average annual return on your investments over your retirement years.

5. Factor in Inflation:

- Consider the impact of inflation on your retirement expenses. Inflation erodes the purchasing power of your money over time, so it's important to account for rising costs.

- Use a reasonable inflation rate (historically around 2-3%) in your calculations.

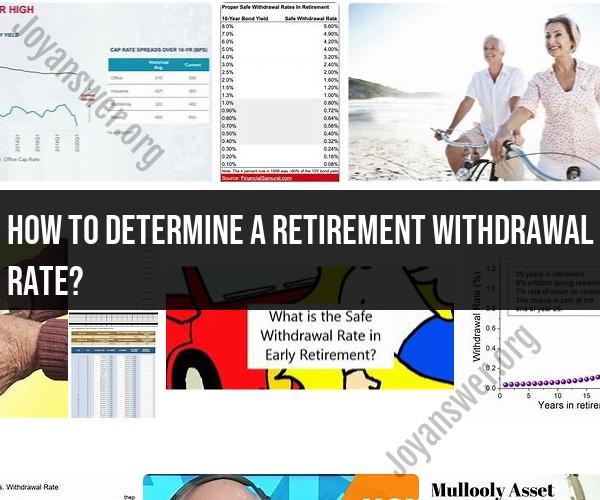

6. Determine Your Withdrawal Rate:

- Decide on a safe withdrawal rate that aligns with your financial goals and risk tolerance. The commonly recommended safe withdrawal rate is around 3-4% of your retirement savings annually.

- Calculate your initial annual withdrawal by multiplying your retirement savings by the chosen withdrawal rate (e.g., if you have $500,000 saved and choose a 4% withdrawal rate, your initial withdrawal would be $20,000).

7. Periodic Adjustments:

- Plan for periodic adjustments to your withdrawal rate based on your financial situation, market performance, and changes in expenses.

- Some retirees adjust their withdrawals for inflation, while others use a fixed percentage of their portfolio each year.

8. Regular Monitoring:

- Continuously monitor your retirement portfolio and financial situation to ensure that your withdrawal rate remains sustainable and aligns with your goals.

- Be prepared to make adjustments if necessary, especially during market downturns or changes in your financial circumstances.

9. Seek Professional Guidance:

- Consider consulting a financial advisor or retirement planner to help you assess your specific situation and create a retirement withdrawal strategy tailored to your needs.

Determining a retirement withdrawal rate is a crucial aspect of retirement planning, and it's essential to strike a balance between enjoying your retirement years and ensuring that your savings last throughout your lifetime. It's important to review and adjust your withdrawal strategy as needed to adapt to changing circumstances and market conditions.

Retirement Withdrawal Rate: How to Determine Your Financial Strategy

Your retirement withdrawal rate is the percentage of your retirement savings that you withdraw each year to live on. It is an important factor to consider when planning for retirement, as it will determine how long your savings will last.

There is no one-size-fits-all answer to the question of what a safe withdrawal rate is. The appropriate withdrawal rate for you will depend on a number of factors, including your age, health, lifestyle, and risk tolerance.

Calculating Safe Withdrawal Rates for a Secure Retirement

A common rule of thumb is to use the 4% rule. This rule suggests that you can withdraw 4% of your retirement savings in the first year of retirement and then adjust that amount each year for inflation. For example, if you have $1 million saved for retirement, you could withdraw $40,000 in the first year of retirement. Then, in the second year, you would withdraw $41,600 (4% of $1 million plus inflation).

However, the 4% rule is just a general guideline. It is important to work with a financial advisor to develop a personalized withdrawal strategy that is based on your individual circumstances.

Financial Planning for Retirement: Withdrawal Rate Considerations

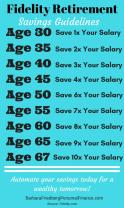

Here are some factors to consider when determining your retirement withdrawal rate:

- Age: Younger retirees have a longer time horizon than older retirees, so they can generally afford to withdraw a higher percentage of their savings each year.

- Health: Retirees with chronic health conditions may need to spend more on healthcare, so they may need to withdraw a lower percentage of their savings each year.

- Lifestyle: Retirees who travel extensively or have other expensive hobbies may need to withdraw a higher percentage of their savings each year.

- Risk tolerance: Retirees with a higher risk tolerance may be able to afford to withdraw a higher percentage of their savings each year, as they are willing to take on more risk in exchange for the potential for higher returns.

It is also important to keep in mind that your withdrawal rate may need to change over time. For example, if you experience a market downturn or your healthcare costs increase, you may need to reduce your withdrawal rate.

By working with a financial advisor, you can develop a personalized retirement withdrawal strategy that will help you to achieve your financial goals and live a comfortable retirement.