What is the best balanced mutual fund?

The best balanced mutual fund for your portfolio depends on your individual investment goals, risk tolerance, and time horizon. However, some factors to consider when choosing a balanced mutual fund include:

- Investment objectives: Balanced mutual funds typically invest in a mix of stocks and bonds, which can help to provide stability and growth potential. However, the specific allocation to stocks and bonds will vary from fund to fund. If you are primarily focused on preserving capital, you may want to choose a fund with a higher allocation to bonds. If you are willing to accept more risk in exchange for the potential for higher returns, you may want to choose a fund with a higher allocation to stocks.

- Risk tolerance: Balanced mutual funds are generally considered to be less risky than all-stock funds, but they are still subject to some risk. If you are not comfortable with the possibility of losing money, you may want to consider a more conservative fund with a lower allocation to stocks.

- Time horizon: Balanced mutual funds can be a good choice for investors with a longer time horizon, such as those saving for retirement. This is because they can ride out short-term fluctuations in the market. However, if you need your money in the near term, you may want to consider a less risky investment.

Here are some of the top-rated balanced mutual funds according to Morningstar:

- Vanguard Wellington Fund (VWELX)

- Fidelity Advisor Balanced Fund (FAIGX)

- T. Rowe Price Balanced Fund (TRPBX)

- American Funds Balanced Fund (ABALX)

- Dodge & Cox Balanced Fund (DODBX)

These funds have a history of strong performance and low fees. However, it is important to do your own research and speak to a financial advisor before investing in any mutual fund.

Here are some additional tips for choosing a balanced mutual fund:

- Read the fund's prospectus: This document will provide you with detailed information about the fund's investment objectives, risk factors, and fees.

- Compare fees: Mutual funds charge a variety of fees, including management fees, expense ratios, and loads. Be sure to compare the fees of different funds before making a decision.

- Consider the fund's track record: Look at the fund's historical performance to get an idea of how it has performed in different market conditions.

- Talk to a financial advisor: A financial advisor can help you choose a balanced mutual fund that is right for your individual needs.

Investing in a balanced mutual fund can be a great way to build a diversified portfolio and reach your long-term financial goals. However, it is important to do your research and choose a fund that is right for you.

Exploring the Characteristics of the Best Balanced Mutual Funds:The best-balanced mutual funds typically exhibit several characteristics:

- Asset Allocation: They maintain a balanced mix of stocks and bonds to manage risk and provide stability.

- Consistent Performance: These funds demonstrate a track record of delivering steady, competitive returns over time.

- Low Expense Ratios: They have lower fees, ensuring more of your investment goes toward returns.

- Experienced Management: Skilled fund managers make strategic asset allocation decisions.

- Diversification: They spread investments across various sectors, industries, and geographic regions.

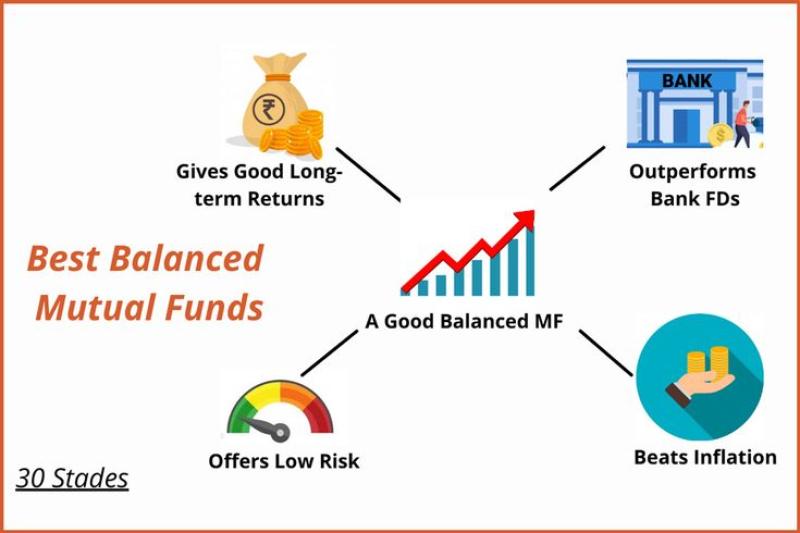

What Are the Benefits of Investing in a Balanced Mutual Fund:

- Diversification: Balanced mutual funds offer a diversified portfolio, reducing risk.

- Steady Returns: They aim for stable returns, appealing to investors seeking a balanced risk-return profile.

- Convenience: One fund can provide exposure to both equities and fixed income, simplifying your investment strategy.

- Risk Management: These funds manage risk through asset allocation and rebalancing.

- Income Generation: Balanced funds can provide regular income through bonds and potential capital appreciation through stocks.

Top Balanced Mutual Funds for Diversified Investment:Specific balanced mutual funds considered "top" can change over time due to market conditions. Research current funds with strong track records and consult with a financial advisor to identify the best options for your investment goals.

How to Assess the Risk and Return Potential of Balanced Funds:To assess balanced fund risk and return potential, consider:

- Historical Performance: Analyze past returns, but remember that past performance does not guarantee future results.

- Asset Allocation: Understand how the fund allocates assets between stocks and bonds.

- Expense Ratios: Lower expenses are generally more favorable for long-term investors.

- Economic Outlook: Consider how the economic environment might affect the fund's holdings.

- Risk Tolerance: Match your risk tolerance with the fund's asset allocation.

Balancing Act: Tips for Selecting the Right Balanced Mutual Fund for Your Portfolio:

- Define Goals: Clearly outline your investment goals and time horizon.

- Assess Risk Tolerance: Determine how much risk you're willing to take.

- Research Fund Managers: Evaluate the track record and experience of the fund's management team.

- Diversify Further: Complement a balanced fund with other assets to achieve a truly diversified portfolio.

- Monitor and Rebalance: Regularly review your portfolio to ensure it aligns with your objectives and rebalance if necessary.