How are closed-end funds different from open-ended funds?

Closed-end funds and open-end funds are two common types of investment vehicles, but they differ in several key ways:

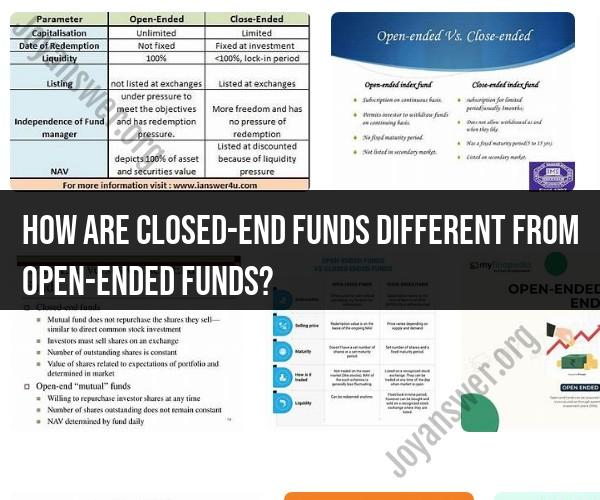

Structure:

Closed-End Funds (CEFs): These are publicly traded investment funds with a fixed number of shares. Once the initial shares are issued through an initial public offering (IPO), new investors can only buy shares from existing shareholders on a secondary market, such as a stock exchange. The fund's share price is determined by supply and demand in the secondary market and can trade at a premium or discount to its net asset value (NAV).

Open-End Funds: Also known as mutual funds, these funds continuously issue new shares and redeem existing ones at the NAV price. Investors can buy or sell shares directly with the fund company at the end-of-day NAV. There is no secondary market trading, and the number of shares can fluctuate based on investor demand.

Liquidity:

Closed-End Funds: Liquidity depends on the trading volume and investor interest in the secondary market. Investors may not always be able to buy or sell shares at NAV, and they might incur a premium or discount to NAV.

Open-End Funds: Investors can buy or sell shares at the NAV price on any business day, making them highly liquid. The fund company must meet redemptions regardless of market conditions.

Pricing:

Closed-End Funds: The share price is determined by supply and demand in the secondary market and can trade at a premium or discount to NAV. This market-driven pricing can result in price volatility.

Open-End Funds: Shares are bought or redeemed at the NAV price at the end of the trading day, ensuring that investors receive the intrinsic value of the underlying assets. There is no premium or discount to NAV.

Management Style:

Closed-End Funds: Managers of closed-end funds have a more fixed pool of capital to manage. They do not need to worry about inflows or outflows of money from investors, allowing them to take a longer-term investment approach.

Open-End Funds: Mutual funds have to accommodate the constant buying and selling of shares by investors. Fund managers must meet redemptions and allocate new investments, potentially impacting their investment strategies.

Expense Ratios:

Closed-End Funds: Typically, closed-end funds have lower expense ratios than open-end funds because they do not have to deal with the operational costs associated with inflows and outflows of capital.

Open-End Funds: Mutual funds often have higher expense ratios due to the costs of managing continuous inflows and outflows of money.

Dividend Policies:

Closed-End Funds: These funds often have more flexibility in how they distribute income to shareholders. They can retain income and build reserves for distribution during lean years.

Open-End Funds: Mutual funds usually distribute income to shareholders regularly, often on a quarterly basis.

In summary, closed-end funds and open-end funds differ in their structure, liquidity, pricing mechanisms, management styles, expense ratios, and dividend policies. Investors should carefully consider these differences when choosing between the two types of investment vehicles based on their investment objectives and preferences.

Closed-End vs. Open-End Funds: Key Differences in Investment Structures

| Characteristic | Closed-End Fund | Open-End Fund |

|---|---|---|

| Number of shares | Fixed | Variable |

| Trading | Traded on exchanges | Traded directly with the fund company |

| Price | Determined by supply and demand | Determined by the net asset value (NAV) |

| Leverage | May use leverage to boost returns | Generally does not use leverage |

| Liquidity | Can be less liquid than open-end funds | Generally more liquid than closed-end funds |

| Fees | May have higher fees than open-end funds | Generally has lower fees than closed-end funds |

Understanding Investment Funds: The Contrast Between Closed-End and Open-End Funds

Closed-End Funds

- Closed-end funds have a fixed number of shares that are issued once and traded on an exchange like a stock.

- The price of closed-end funds is determined by supply and demand, which means it can trade at a premium or discount to the fund's net asset value (NAV).

- Closed-end funds may use leverage to boost their returns, which can increase potential rewards and risks.

- Closed-end funds can be less liquid than open-end funds, meaning it may be more difficult to buy and sell shares.

Open-End Funds

- Open-end funds have a variable number of shares, meaning that new shares can be created or redeemed whenever an investor buys or sells.

- Open-end funds trade directly with the fund company at their NAV, which is calculated at the end of each trading day.

- Open-end funds generally do not use leverage, which means they tend to be less risky than closed-end funds.

- Open-end funds are generally more liquid than closed-end funds, meaning it is easier to buy and sell shares.

Choosing the Right Investment: Comparing Closed-End and Open-End Funds

Both closed-end and open-end funds can be good investment options, depending on your individual needs and goals.

- If you are looking for a fund that is actively managed by a professional investment team, both closed-end and open-end funds can be good options.

- If you are looking for a fund that is diversified and provides exposure to a variety of asset classes, both closed-end and open-end funds can be good options.

- If you are concerned about liquidity, open-end funds are generally a better option than closed-end funds.

- If you are looking for a fund with lower fees, open-end funds are generally a better option than closed-end funds.

Ultimately, the best way to decide whether to invest in a closed-end or open-end fund is to carefully consider your individual needs and goals, and to do your research to find a fund that is a good fit for you.

Here are some additional things to consider when choosing between closed-end and open-end funds:

- Investment objectives: What are your investment goals? Are you looking for income, growth, or a combination of both?

- Risk tolerance: How much risk are you comfortable with? Closed-end funds can be more risky than open-end funds, especially if they use leverage.

- Time horizon: How long are you planning to invest for? If you are investing for the short term, liquidity may be more important to you.

- Fees: How much are you willing to pay in fees? Closed-end funds may have higher fees than open-end funds.

If you are unsure which type of fund is right for you, it is a good idea to speak with a financial advisor.