Is current ratio good or bad?

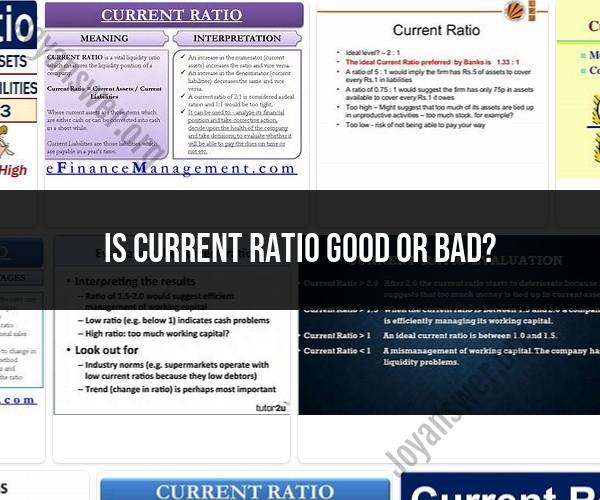

The current ratio is a financial metric used to assess a company's short-term liquidity and ability to cover its short-term liabilities with its short-term assets. It's an important indicator of a company's financial health and its ability to manage its obligations. The current ratio is calculated by dividing a company's current assets by its current liabilities. The formula is:

Current Ratio = Current Assets / Current Liabilities

The interpretation of whether a current ratio is "good" or "bad" for a business depends on the context and industry norms. Here's how to decode the current ratio:

Interpretation:

Current Ratio > 1: This suggests that a company's current assets are greater than its current liabilities, which indicates a potential ability to cover its short-term obligations. A current ratio significantly above 1 may indicate that a company has a comfortable buffer to meet its obligations.

Current Ratio = 1: A current ratio of 1 indicates that a company's current assets are equal to its current liabilities. While this might seem neutral, it doesn't leave much room for unexpected changes in cash flows.

Current Ratio < 1: A current ratio less than 1 implies that a company's current liabilities exceed its current assets. This could indicate potential difficulty in meeting short-term obligations and might suggest liquidity issues.

Industry Considerations:It's important to consider industry standards when assessing whether a current ratio is favorable. Different industries have varying business models and working capital requirements. For instance:

- Industries with high inventory turnover (like retail) might have lower current ratios.

- Industries with longer cash collection cycles (like manufacturing) might require higher current ratios.

Limitations:While the current ratio provides valuable insights, it has limitations:

- It doesn't consider the timing of cash flows.

- It includes both liquid and less-liquid current assets, which might not all be readily convertible to cash.

- It doesn't account for the quality of assets or the ability to sell them quickly without significant loss.

Comparative Analysis:To get a clearer picture, it's useful to compare a company's current ratio to its historical data and to competitors within the same industry. A rising or stable current ratio over time might indicate improving liquidity management.

Conclusion:Whether a current ratio is considered good or bad depends on the company's specific circumstances, industry benchmarks, and overall financial strategy. It's important to analyze the current ratio in conjunction with other financial ratios and metrics to get a comprehensive understanding of a company's financial health.