What is the current interest rate for automobile loans?

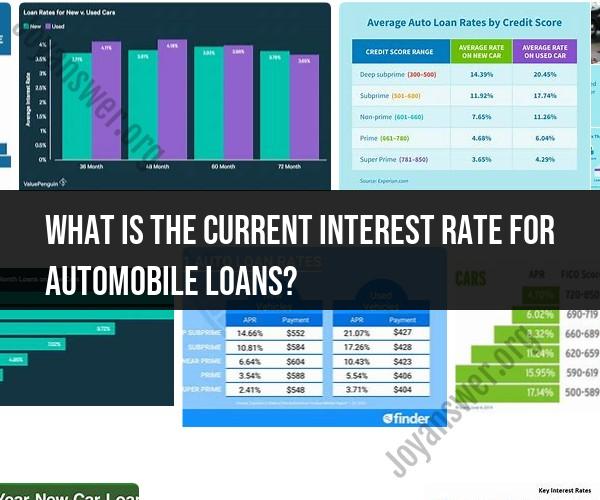

The current interest rate for automobile loans varies depending on the lender, the borrower's credit score, and the type of vehicle being purchased. However, as of September 15, 2023, the average interest rate for a new car loan is 7.46% APR and the average interest rate for a used car loan is 8.06% APR, according to Bankrate.com.

Borrowers with excellent credit (781-850 FICO score) can typically qualify for the lowest interest rates, while borrowers with poor credit (501-600 FICO score) may have to pay significantly higher interest rates. The type of vehicle being purchased can also affect the interest rate. For example, SUVs and pickup trucks typically have higher interest rates than sedans.

Borrowers can shop around with different lenders to compare interest rates and find the best deal. It is also important to read the loan agreement carefully before signing to understand all of the terms and conditions, including any fees that may be associated with the loan.

Here are some tips for getting a good interest rate on an auto loan:

- Shop around with multiple lenders. Compare interest rates from banks, credit unions, and online lenders to find the best deal.

- Get pre-approved for a loan. This will give you an idea of what interest rate you qualify for and how much you can borrow before you start shopping for a car.

- Make a large down payment. The larger your down payment, the lower your monthly payments and the less interest you will pay over the life of the loan.

- Get a shorter loan term. Shorter loan terms typically have lower interest rates than longer loan terms.

- Have a good credit score. Lenders are more likely to offer lower interest rates to borrowers with good credit scores.

If you have poor credit, there are still steps you can take to improve your chances of getting a good interest rate on an auto loan. For example, you can try to improve your credit score by paying your bills on time and keeping your credit utilization low. You may also want to consider getting a cosigner on your loan.