What type of risk is associated with annuities?

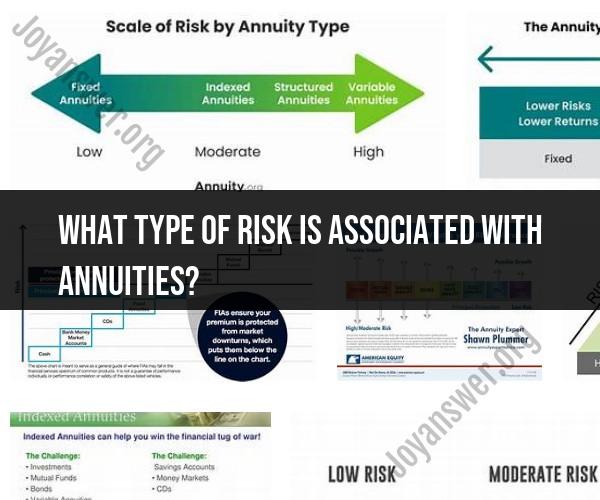

Annuities, like many financial products, are associated with various types of risks. The specific risks that apply to annuities depend on the type of annuity and the terms of the contract. Here are some common types of risks associated with annuities:

Investment Risk: With certain types of annuities, such as variable annuities, the value of the underlying investments can fluctuate. This means that the performance of the investments in the annuity's portfolio can impact the future payments you receive. If the investments perform poorly, your annuity payments may decrease.

Longevity Risk: Annuities are designed to provide regular payments for a specified period, often for the rest of your life. One risk is that you might outlive your annuity, meaning you receive payments for longer than anticipated. In this case, you may not have enough income in your later years.

Inflation Risk: Fixed annuities offer a set payment amount, which means the purchasing power of those payments can erode over time due to inflation. You may find that the fixed payments are insufficient to cover your expenses as prices rise.

Interest Rate Risk: For fixed and fixed indexed annuities, the interest rates at the time of purchase determine the level of future payments. If interest rates are low when you buy the annuity, your payments may be relatively small compared to what you could have received in a higher interest rate environment.

Liquidity Risk: Most annuities have limited liquidity. If you need access to a significant portion of your money before the annuity's surrender period or before a certain age, you may face penalties and fees.

Credit Risk: If you have a fixed annuity or a guaranteed income stream component, you are relying on the insurance company's ability to make future payments. If the insurance company experiences financial difficulties or becomes insolvent, your payments could be at risk.

Surrender Charges: Many annuities have surrender periods during which you may incur charges if you want to withdraw a large portion of your money. Surrender charges can limit your access to your funds.

Tax Implications: The tax treatment of annuity withdrawals and payments can be complex. Depending on the type of annuity and the timing of your withdrawals, you may face tax consequences that can impact your overall financial plan.

Market Risk (for Variable Annuities): Variable annuities are directly linked to the performance of underlying investments. If the market performs poorly, the value of the annuity can decrease, affecting future payments.

It's essential to carefully consider these risks and understand the terms of any annuity contract you are considering. Different annuities have varying levels of risk, and the right choice for you depends on your financial goals, risk tolerance, and individual circumstances. Before purchasing an annuity, it's advisable to consult with a financial advisor who can help you assess the potential risks and rewards and determine if an annuity aligns with your overall financial plan.