How to convert a pension to a lump sum?

Converting a pension to a lump sum is a complex financial decision that should be made carefully, considering your individual circumstances, goals, and the rules and options associated with your specific pension plan. Here are the steps to consider if you are thinking about converting a pension to a lump sum:

Understand Your Pension Plan:

- Review the terms and conditions of your pension plan. Different pension plans have various rules and options for converting to a lump sum. Understanding the specifics of your plan is essential.

Consult a Financial Advisor:

- Seek advice from a qualified financial advisor who specializes in retirement planning and pension options. They can help you evaluate the pros and cons of converting to a lump sum in your particular situation.

Request a Pension Benefit Estimate:

- Contact the pension plan administrator or your employer's HR department to request an estimate of the lump sum value of your pension. This estimate will help you understand the financial implications of your decision.

Evaluate Your Financial Goals:

- Consider your overall financial goals, retirement needs, and risk tolerance. Converting to a lump sum may be suitable if you want more control over your investments or have specific financial objectives.

Compare Annuity and Lump Sum Options:

- Compare the projected annual income from the pension with the income you could generate from the lump sum, taking into account factors like investment returns and inflation. Assess which option aligns better with your financial needs.

Understand Tax Implications:

- Be aware of the tax consequences of taking a lump sum. The tax treatment may vary based on factors like your age, the nature of the pension, and your country's tax laws.

Consider Your Health and Longevity:

- Your health and expected longevity can influence your decision. If you have a shorter life expectancy, taking a lump sum may be more appealing, whereas a traditional pension annuity may provide more financial security for a longer retirement.

Explore Roll-Over Options:

- If you choose to convert to a lump sum, investigate whether you can roll over the funds into a tax-advantaged retirement account, such as an Individual Retirement Account (IRA), to defer taxes and continue growing your retirement savings.

Review Survivor Benefits:

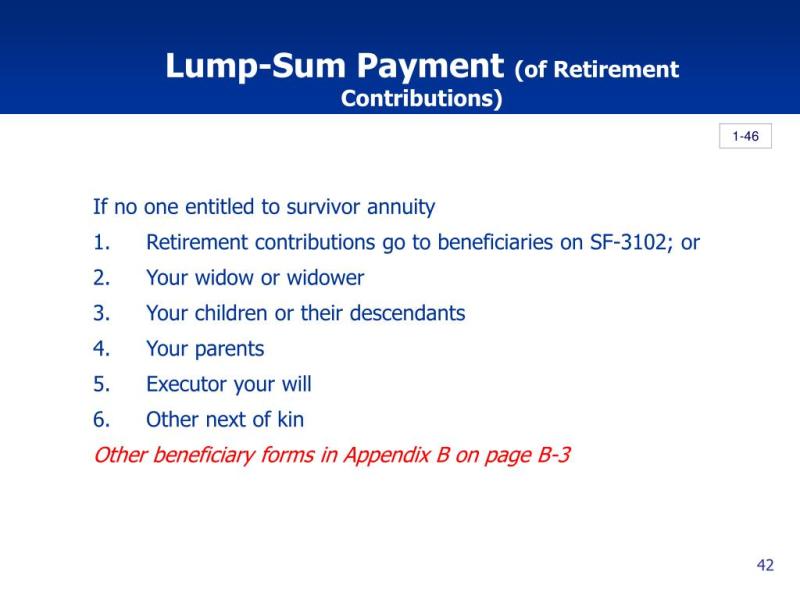

- Consider how your decision may affect your spouse or beneficiaries. Converting to a lump sum might reduce or eliminate survivor benefits that a traditional pension would provide.

Make an Informed Decision:

- Once you have thoroughly reviewed your pension options, consult with your financial advisor to make an informed decision that aligns with your financial objectives.

Complete the Necessary Paperwork:

- If you decide to convert to a lump sum, follow the procedures outlined by your pension plan administrator or employer to request the distribution of the lump sum.

Review the Legal and Administrative Process:

- Understand any legal or administrative requirements and deadlines associated with converting your pension to a lump sum.

Remember that converting a pension to a lump sum is a significant financial decision with long-term implications, and there may be irrevocable consequences. It is crucial to consider your individual circumstances and seek professional guidance to make an informed choice that suits your retirement needs and goals.

Converting Your Pension to a Lump Sum: A Financial Decision

When transitioning into retirement, you may face the choice of receiving your pension benefits as a lump sum payment or as periodic payments. While both options offer distinct advantages, the decision ultimately depends on your individual circumstances and financial goals. Let's explore the factors to consider when converting your pension to a lump sum.

Steps to Take When Considering a Lump Sum Pension Payout

If you're contemplating converting your pension to a lump sum, here are some crucial steps to take:

Understand the Terms of Your Pension Plan: Carefully review your pension plan documents to grasp the specific terms and conditions associated with a lump sum payout. This includes understanding the potential impact on your monthly benefits, any applicable fees or penalties, and the taxation implications.

Assess Your Financial Situation: Conduct a thorough evaluation of your overall financial situation. Consider your current income sources, living expenses, debt obligations, and retirement goals. This assessment will help you determine if a lump sum payment aligns with your financial needs and long-term plans.

Seek Professional Advice: Consult with a qualified financial advisor to gain expert guidance on your pension options. They can help you analyze your financial situation, assess the potential risks and benefits of a lump sum payout, and develop a personalized retirement plan tailored to your specific needs.

Consider Your Risk Tolerance: Evaluate your comfort level with investment risk. A lump sum payment provides greater control over your retirement funds, allowing you to invest and potentially grow your savings. However, it also carries the risk of making investment decisions that could lead to losses.

Plan for Taxes: Understand the tax implications of receiving a lump sum pension payout. Consult with a tax advisor to determine the potential tax liability and how it may impact your overall financial plan.

Evaluating Your Retirement Options: Lump Sum or Periodic Payments?

To make an informed decision, carefully weigh the pros and cons of both lump sum and periodic payment options:

Lump Sum Payment

Pros:

Greater Control: Provides greater control over your retirement funds, allowing you to make investment decisions aligned with your risk tolerance and financial goals.

Investment Opportunities: Offers the potential to grow your retirement savings through investments.

Debt Consolidation: Can be used to consolidate debt, potentially reducing your monthly expenses and improving your financial standing.

Cons:

Investment Risk: Carries the risk of making investment decisions that could lead to losses, potentially jeopardizing your retirement security.

Tax Implications: May be subject to a higher tax rate compared to periodic payments.

Financial Management: Requires careful financial management skills to ensure your savings last throughout your retirement years.

Periodic Payments

Pros:

Guaranteed Income: Provides a steady stream of guaranteed income throughout your retirement, reducing the risk of outliving your savings.

Reduced Investment Risk: Eliminates the need for investment decisions, minimizing the risk of financial losses.

Predictable Cash Flow: Provides predictable cash flow, making it easier to budget and plan for future expenses.

Cons:

Less Control: Offers less control over your retirement funds, limiting your ability to make investment decisions that could potentially grow your savings.

Inflation Erosion: The purchasing power of periodic payments may erode over time due to inflation.

Longevity Risk: May not provide sufficient income if you live longer than expected, potentially leading to financial difficulties in later years.

Conclusion

The decision of whether to convert your pension to a lump sum or receive periodic payments is a significant financial one that requires careful consideration. It's crucial to evaluate your individual circumstances, financial goals, risk tolerance, and tax situation before making a choice. Seeking professional advice from a qualified financial advisor can provide valuable guidance in navigating this important decision.