How do you confirm a bank is FDIC insured?

Verifying whether a bank is FDIC insured is a straightforward process. You can confirm a bank's FDIC insurance status through several methods:

FDIC Website: The easiest way is to visit the FDIC's website and use the "BankFind" tool. You can search for the bank by its name or location to verify its FDIC insurance status.

Bank's Website: Many banks display the FDIC logo or information about their FDIC insurance coverage on their websites. Look for terms like "Member FDIC" or details about deposit insurance.

Contact the Bank: You can directly contact the bank's customer service or visit a branch and ask a representative to confirm the FDIC insurance status of the institution.

FDIC's Call Center: You can call the FDIC's Call Center at 1-877-275-3342 (1-877-ASK-FDIC) and inquire about the FDIC insurance coverage of a specific bank.

FDIC Certificate: Banks are required to display their FDIC certificate in their branches. You can look for this certificate near the teller area or customer service desks.

Always ensure that any institution where you're planning to deposit funds is FDIC insured. This insurance protects depositors against loss in case the bank fails, up to certain limits per depositor, per ownership category, per bank.

How to confirm that a bank is FDIC insured.

Ensuring that your bank is FDIC insured is crucial for safeguarding your deposits against potential financial losses. Here are three ways to verify a bank's FDIC membership status:

Check the FDIC's BankFind tool: The FDIC provides a comprehensive online tool called BankFind, allowing you to search for FDIC-insured banks by name, location, or FDIC certificate number. This tool also displays the bank's official website and operating status.

Look for the FDIC sign: FDIC-insured banks are required to display the FDIC sign prominently in their lobbies and at customer service areas. The sign typically features the FDIC logo and the phrase "Member FDIC."

Contact the FDIC directly: If you have any doubts or need further assistance, you can directly contact the FDIC by phone at 1-877-275-3342 or by using their online contact form. They can verify a bank's FDIC membership status and provide additional information about deposit insurance coverage.

The significance of FDIC insurance in protecting bank deposits.

FDIC insurance plays a vital role in protecting the financial interests of bank customers. Here's how it safeguards your deposits:

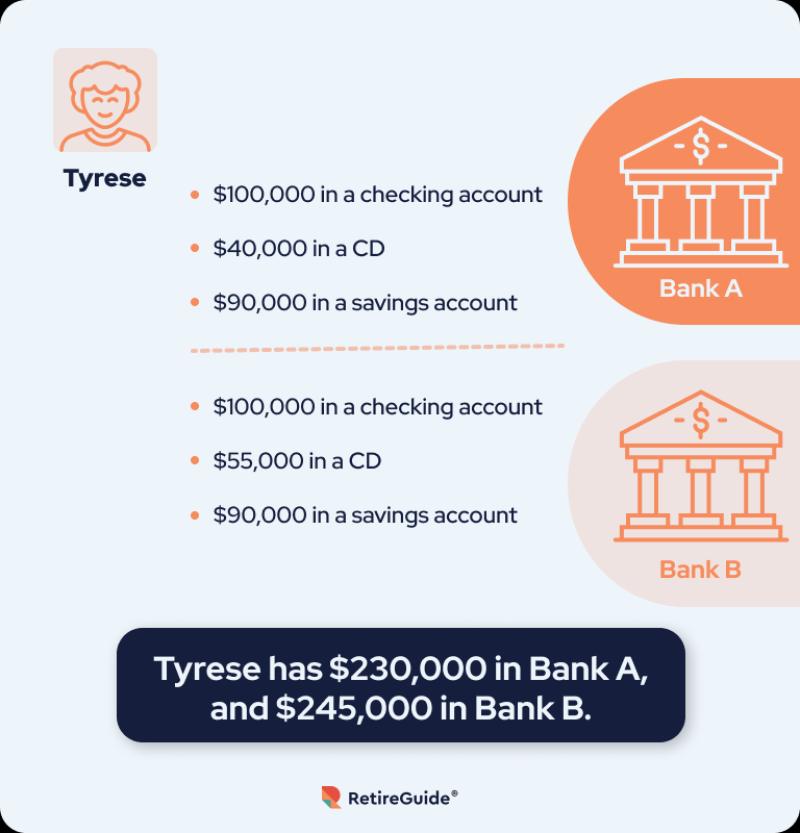

Insurance Coverage: FDIC insurance covers up to $250,000 per depositor, per institution type (such as checking, savings, or money market accounts). This means that even if the bank fails, your deposits up to this limit are insured and will be reimbursed.

Deposit Stability: FDIC insurance promotes stability in the banking system by preventing bank runs, which occur when depositors rush to withdraw their funds simultaneously, causing the bank to collapse.

Peace of Mind: FDIC insurance provides peace of mind for customers, knowing that their hard-earned money is protected against bank failures. This confidence in the banking system encourages financial stability and economic growth.

Verifying a bank's FDIC membership and coverage for your accounts.

To confirm that a bank is FDIC insured and to determine the coverage for your specific accounts, follow these steps:

Identify the bank: Obtain the bank's name, location, or FDIC certificate number.

Use the FDIC's BankFind tool: Access the FDIC's BankFind tool and search for the bank using the information you gathered.

Review the search results: The BankFind tool will display the bank's FDIC membership status, coverage limits, and other relevant details.

Check your account statements: For existing accounts, review your recent account statements to verify the bank's FDIC membership and the insured amount for each account type.

Resources and tools to check FDIC insurance status for financial institutions.

Apart from the FDIC's BankFind tool, here are additional resources for verifying FDIC insurance status:

FDIC website: The FDIC's website provides comprehensive information about FDIC insurance, including a list of FDIC-insured banks, FAQs, and educational resources.

Mobile banking apps: Many banks provide FDIC insurance information within their mobile banking apps. Check your bank's app for details.

Bank customer service: Contact your bank's customer service representatives. They can verify FDIC insurance status and answer any questions regarding deposit protection.

Understanding the benefits and limits of FDIC insurance for bank customers.

FDIC insurance offers significant benefits for bank customers, but it's important to understand its limitations:

Benefits:

Protects deposits up to $250,000 per depositor, per institution type

Promotes stability in the banking system

Provides peace of mind and encourages financial stability

Limitations:

Does not cover all types of deposits (e.g., investments, brokerage accounts)

Coverage is per depositor, not per household

Does not guarantee against market fluctuations or investment losses

Does not protect against fraud or unauthorized transactions

In summary, FDIC insurance plays a crucial role in safeguarding bank deposits and promoting financial stability. It's essential for customers to verify their bank's FDIC membership status and understand the coverage limits to ensure their money is protected.