How to compute mortgage amortization?

Mortgage amortization is the process of calculating how a mortgage loan is gradually paid off over time, with each monthly payment applied to both the principal and interest. To compute mortgage amortization, follow these steps:

Step 1: Gather Loan Details

- Collect the key details of your mortgage loan, including the loan amount (principal), interest rate, loan term (in months or years), and the start date of the loan.

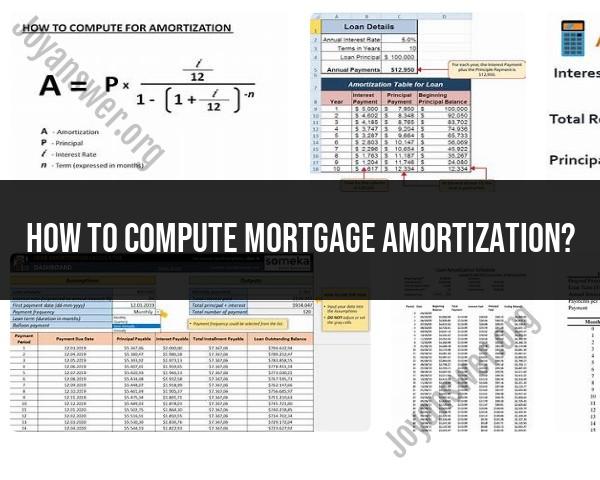

Step 2: Use the Amortization Formula

The formula for calculating the monthly mortgage payment (PMT) can be derived from the amortization formula:

Where:

- = Monthly payment

- = Principal loan amount

- = Monthly interest rate (annual rate divided by 12 and expressed as a decimal)

- = Total number of payments (loan term in months)

Step 3: Calculate the Monthly Payment (PMT)

- Using the formula, plug in the values for , , and . This will give you the fixed monthly payment required to fully amortize the loan over the specified term.

Step 4: Create an Amortization Schedule

An amortization schedule is a table that shows the breakdown of each monthly payment into principal and interest. It also tracks the remaining loan balance after each payment. You can create an amortization schedule manually or use a mortgage calculator or spreadsheet software.

For the first month, apply the PMT to the loan. Calculate the interest for that month by multiplying the monthly interest rate () by the remaining loan balance from the previous month.

Subtract the interest from the monthly payment to determine how much of the payment goes toward the principal.

Subtract the principal portion from the previous month's balance to find the new loan balance.

Repeat these calculations for each subsequent month, updating the remaining balance accordingly.

Step 5: Review the Amortization Schedule

- Examine the amortization schedule to see how each monthly payment is distributed between principal and interest. Over time, you'll notice that the amount applied to the principal increases while the interest decreases. The schedule also shows how many payments are required to fully pay off the loan.

Step 6: Scenario Analysis (Optional)

- If you want to explore different scenarios, you can use the amortization schedule to see the impact of making extra payments, refinancing, or changing the loan term. Adjust the inputs (e.g., principal, interest rate, extra payments) and recalculate the schedule to assess how these changes affect the loan.

Step 7: Use Online Tools or Software (Optional)

- You can also use online mortgage calculators or spreadsheet software like Microsoft Excel to streamline the computation of mortgage amortization. These tools often generate an amortization schedule with minimal manual calculations.

Creating an amortization schedule helps you understand how your mortgage works, track your progress in paying down the loan, and make informed financial decisions related to your home loan. It's a valuable tool for budgeting and long-term financial planning.

How to calculate mortgage amortization for loan repayment

There are two main ways to calculate mortgage amortization for loan repayment:

- Manually: This involves using a financial calculator or a spreadsheet to perform the necessary calculations.

- Using a mortgage calculator: There are many online mortgage calculators that can calculate amortization schedules for different loan terms and interest rates.

To calculate mortgage amortization manually, you will need to use the following formula:

Monthly payment = P * (r * (1 + r)^n / ((1 + r)^n - 1))

where:

- P is the principal loan amount

- r is the monthly interest rate (annual interest rate / 12)

- n is the number of monthly payments in the loan term

Once you have calculated the monthly payment, you can use the following formula to calculate the principal and interest paid each month:

Principal paid = Monthly payment - Interest paid

Interest paid = Principal * r

Components and structure of a mortgage amortization schedule

A mortgage amortization schedule is a table that shows how each monthly payment is allocated to principal and interest over the life of the loan.

Most amortization schedules include the following columns:

- Month: The month of the loan payment

- Beginning balance: The principal balance of the loan at the beginning of the month

- Payment: The monthly payment

- Principal paid: The amount of the payment that goes towards reducing the principal balance of the loan

- Interest paid: The amount of the payment that goes towards paying interest

- Ending balance: The principal balance of the loan at the end of the month

Using mathematical formulas and software for amortization calculations

There are a number of mathematical formulas and software programs that can be used to perform amortization calculations. Some common formulas include the following:

- Loan balance formula: P = L * (1 + r)^n

- Monthly payment formula: M = P * (r * (1 + r)^n / ((1 + r)^n - 1))

- Principal paid formula: PP = M - I

- Interest paid formula: I = P * r

There are also a number of software programs that can be used to calculate mortgage amortization schedules. Some common software programs include the following:

- Microsoft Excel: Excel has a built-in function called PMT() that can be used to calculate mortgage amortization schedules.

- Google Sheets: Google Sheets also has a built-in function called PMT() that can be used to calculate mortgage amortization schedules.

- Amortization calculators: There are also a number of online amortization calculators that can be used to calculate amortization schedules for different loan terms and interest rates.

The importance of understanding mortgage amortization for borrowers

It is important for borrowers to understand mortgage amortization so that they can make informed decisions about their loan terms and interest rates. By understanding how mortgage amortization works, borrowers can:

- Estimate their monthly payments

- Determine how long it will take to pay off their loan

- Calculate the total amount of interest they will pay over the life of the loan

- Make informed decisions about refinancing their loan

Strategies for optimizing loan repayment through amortization

There are a number of strategies that borrowers can use to optimize their loan repayment through amortization. Some common strategies include the following:

- Making extra payments: Making extra payments on a mortgage loan can help to reduce the principal balance of the loan faster and save money on interest.

- Refinancing: Refinancing a mortgage loan to a lower interest rate can also help to reduce the principal balance of the loan faster and save money on interest.

- Choosing a shorter loan term: Choosing a shorter loan term, such as a 15-year mortgage instead of a 30-year mortgage, can also help to reduce the total amount of interest paid over the life of the loan.

By understanding mortgage amortization and using the strategies outlined above, borrowers can save money and pay off their loan faster.