How do you calculate principal interest?

Calculating principal and interest is an essential aspect of understanding loans, mortgages, and investments. These calculations are often used to determine monthly payments, loan balances, and interest earned. Here's a comprehensive guide on how to calculate principal and interest:

1. Understand Key Terms:

- Principal (P): The initial amount borrowed or invested.

- Interest Rate (R): The annual percentage rate (APR) or annual interest rate expressed as a decimal.

- Time (T): The number of time periods, typically in years.

- Interest (I): The amount paid or earned in addition to the principal.

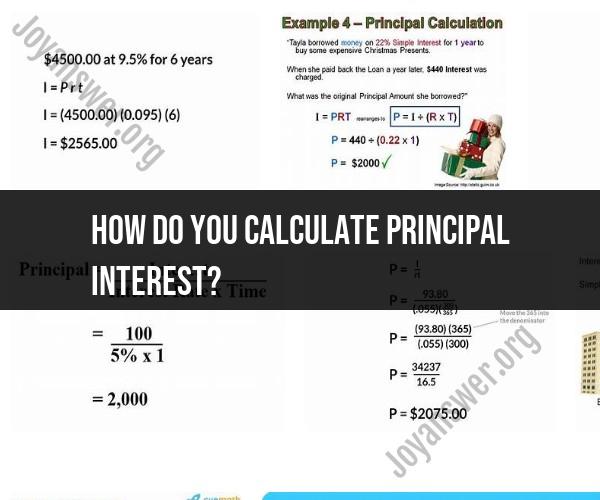

2. Simple Interest Calculation:

Simple Interest Formula: I = P * R * T

- To calculate simple interest, multiply the principal (P) by the annual interest rate (R) as a decimal and the number of years (T).

3. Compound Interest Calculation:

Compound Interest Formula: A = P * (1 + R/n)^(n*t) - P

- A: The total amount after interest.

- P: The principal amount.

- R: The annual interest rate (expressed as a decimal).

- n: The number of times interest is compounded per year.

- t: The number of years.

4. Amortization of Loans:

For loans, monthly payments often include both principal and interest. To calculate the monthly payment (M), you can use the formula for amortization:

Monthly Payment Formula: M = [P * R * (1 + R)^T] / [(1 + R)^T - 1]

This formula takes into account the principal, annual interest rate (R), and the loan term (T) in years.

5. Mortgage Payment Calculation:

To calculate mortgage payments, you can use a similar formula:

Mortgage Payment Formula: M = [P * (R/n) * (1 + R/n)^nt] / [(1 + R/n)^nt - 1]

Here, n represents the number of times interest is compounded per year, and t is the number of years (loan term).

6. Interest Earned on Investments:

- To calculate interest earned on investments, you can use the compound interest formula mentioned earlier. In this case, P is the initial investment, R is the annual interest rate for the investment, n is the number of compounding periods per year, and t is the number of years the money is invested.

7. Online Calculators:

- To simplify these calculations, many online calculators and financial software tools are available. These tools allow you to input the relevant values and quickly compute principal and interest.

8. Excel/Spreadsheets:

- You can also use spreadsheet software like Microsoft Excel or Google Sheets to perform these calculations. Excel functions such as PMT (for loan payments) and FV (for future value) can be useful for these calculations.

It's important to understand these calculations when dealing with loans, mortgages, investments, or any financial transaction involving interest. Accurate calculations can help you make informed financial decisions and manage your money effectively.

Principal and Interest Calculation: A Step-by-Step Guide

To calculate principal and interest, you will need to know the following information:

- Principal: The amount of money that was borrowed.

- Interest rate: The annual percentage rate charged on the loan.

- Loan term: The length of time in years that the loan will be repaid.

Once you have this information, you can follow these steps to calculate principal and interest:

- Calculate the monthly interest rate. Divide the annual interest rate by 12.

- Calculate the total interest paid over the life of the loan. Multiply the monthly interest rate by the principal amount by the loan term in years.

- Calculate the total amount paid back. Add the principal amount to the total interest paid.

Here is an example:

Principal: $100,000Interest rate: 5%Loan term: 30 years

Monthly interest rate: 5% / 12 = 0.4167%

Total interest paid over the life of the loan: 0.4167% * $100,000 * 30 years = $125,010

Total amount paid back: $100,000 + $125,010 = $225,010

Calculating Principal and Interest: Financial Formulas and Methods

There are a number of different financial formulas and methods that can be used to calculate principal and interest. One common method is to use the following formula:

A = P(1 + r)^n

Where:

- A is the total amount paid back

- P is the principal amount

- r is the annual interest rate

- n is the loan term in years

This formula can be used to calculate the total amount paid back over the life of the loan, as well as the monthly payment amount.

Another common method for calculating principal and interest is to use a loan amortization schedule. A loan amortization schedule is a table that shows how the principal and interest payments on a loan will be allocated over the life of the loan.

Managing Loans: How to Calculate Principal and Interest Payments

Knowing how to calculate principal and interest payments is essential for managing loans. By understanding how principal and interest are calculated, you can make informed decisions about your loan options and repayment terms.

Here are some tips for managing loans:

- Compare loan offers from different lenders. Be sure to compare the interest rates and terms of different loan offers before choosing a lender.

- Create a budget for your loan payments. Make sure that you can afford the monthly loan payments before you take out a loan.

- Make your loan payments on time. Making your loan payments on time will help you to avoid late fees and damage to your credit score.

- Consider making extra loan payments. If you can afford to make extra loan payments, you can pay off your loan faster and save money on interest.

If you are struggling to manage your loan payments, you may want to consider talking to a financial advisor. A financial advisor can help you to develop a plan to manage your debt and reach your financial goals.