How do you calculate the present value formula?

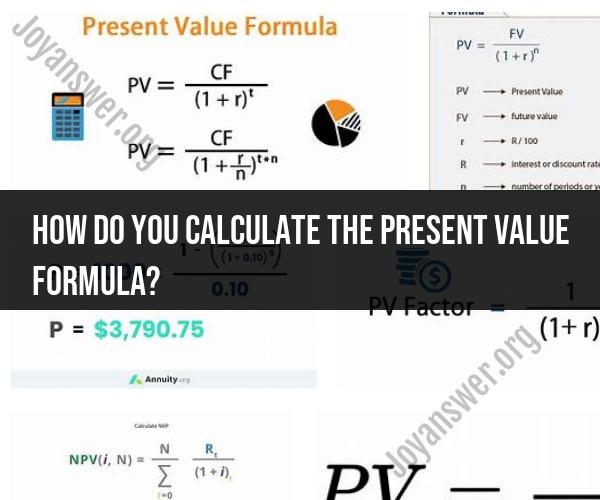

Calculating the present value (PV) using the formula requires following a step-by-step process. The formula for calculating the present value is:

Here's a step-by-step guide on how to calculate present value using this formula:

Step 1: Gather the Required Information

Before you can calculate the present value, you'll need the following information:

Future Value (FV): This is the amount of money you expect to receive or pay in the future.

Discount Rate (r): The discount rate is the rate of return, interest rate, or discount rate that represents the opportunity cost of not investing the money elsewhere. It's typically expressed as a decimal (e.g., 0.05 for 5%).

Number of Periods (n): This is the number of time periods over which the future cash flow will occur.

Step 2: Plug Values into the Formula

Now, substitute the values you gathered in Step 1 into the present value formula:

goes in the numerator (top) of the fraction.

represents the discount rate and goes in the denominator (bottom) of the fraction within parentheses.

represents the number of periods and also goes in the denominator (bottom) within parentheses.

Step 3: Perform the Calculations

Calculate the present value by performing the mathematical operations:

- Add 1 to the discount rate ().

- Raise the result to the power of the number of periods ().

- Divide the future value () by the result from step 2.

Here's a breakdown of these calculations:

For example, if you have the following values:

- Future Value (): $1,000

- Discount Rate (): 0.05 (5% expressed as a decimal)

- Number of Periods (): 3

Your calculations would look like this:

- (rounded to six decimal places)

- (rounded to two decimal places)

So, the present value of $1,000 to be received in 3 periods at a discount rate of 5% is approximately $862.61 in today's dollars.

Keep in mind that this formula assumes a constant discount rate over the entire period, which is suitable for simple cases. For more complex scenarios with varying cash flows or changing discount rates, you may need more advanced financial models.