How to calculate the interest per annum on a monthly basis?

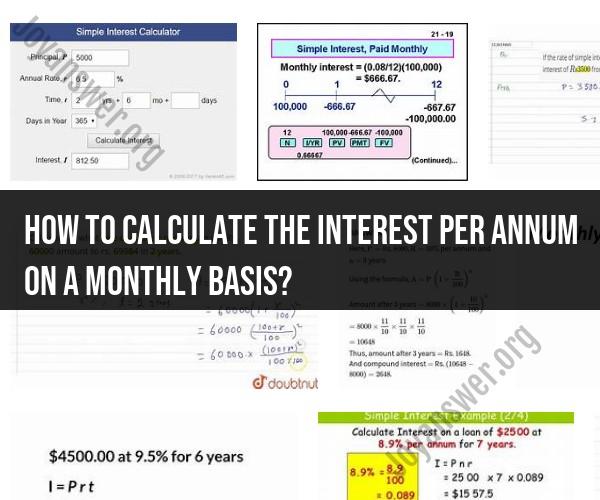

To calculate the monthly interest on a loan or investment per annum (year), you can use the formula for monthly interest, which takes into account the annual interest rate and the number of compounding periods in a year. The formula is:

Monthly Interest = (Annual Interest Rate / Number of Compounding Periods) x Principal

Here's how to calculate monthly interest per annum on a monthly basis:

Determine the Annual Interest Rate: This is the annual interest rate expressed as a decimal. For example, if the annual interest rate is 6%, you would convert it to decimal form as 0.06.

Identify the Number of Compounding Periods: In this case, you are compounding interest monthly, so there are 12 compounding periods in a year.

Know the Principal Amount: This is the initial amount of the loan or investment.

Apply the Formula: Plug the values into the formula:

Monthly Interest = (0.06 / 12) x Principal

If your principal is $1,000, the calculation would be:

Monthly Interest = (0.06 / 12) x $1,000 = (0.005) x $1,000 = $5

So, the monthly interest on a $1,000 loan or investment with a 6% annual interest rate, compounded monthly, would be $5.

This calculation is commonly used for loans, mortgages, and investments where interest is compounded monthly. Keep in mind that if interest is compounded more frequently (e.g., daily or quarterly), you would use a different formula that takes the compounding frequency into account.

To calculate the monthly interest rate on an annual basis, you simply need to divide the annual interest rate by 12. For example, if you have a 10% annual interest rate, your monthly interest rate would be 10/12 = 0.83%.

Here is a formula for calculating monthly interest on an annual basis:

Monthly interest rate = Annual interest rate / 12

Once you have calculated your monthly interest rate, you can use it to calculate the amount of interest you will pay on your loan or credit card balance each month.

Here is a formula for calculating the amount of interest you will pay each month:

Monthly interest payment = Monthly interest rate * Loan or credit card balance

For example, if you have a $10,000 loan with a 10% annual interest rate, your monthly interest payment would be 0.83% * $10,000 = $83.33.

It is important to note that this is a simplified formula for calculating monthly interest. There are other factors that can affect your monthly interest payment, such as compounding interest and fees.

Here are some additional tips for calculating and understanding monthly interest:

- Make sure to convert your annual interest rate to a decimal before calculating your monthly interest rate.

- If you are making monthly payments on your loan or credit card, be sure to factor in the compounding interest. Compounding interest is interest that is earned on interest.

- Some loans and credit cards charge fees, such as late payment fees and annual fees. Be sure to factor in these fees when calculating your monthly interest payment.

If you have any questions about calculating or understanding monthly interest, please contact your lender or credit card issuer.