How do you calculate bond yield to maturity?

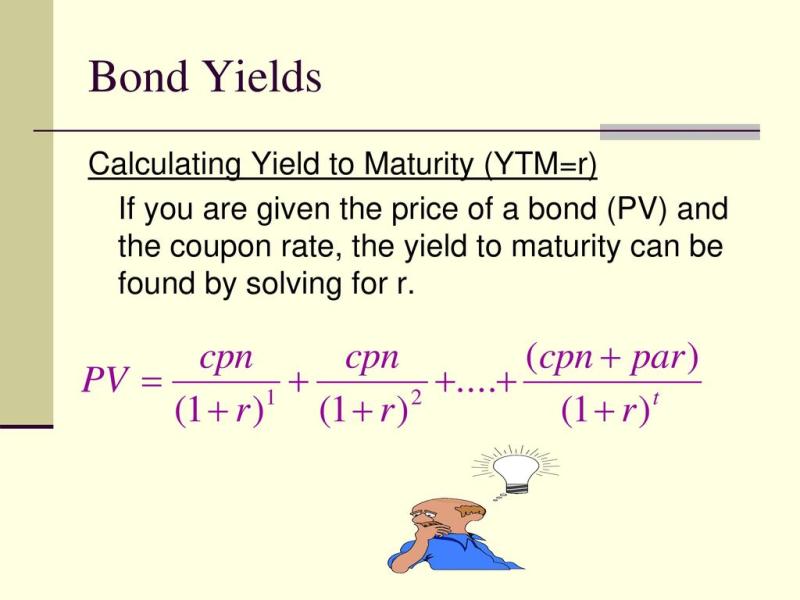

The yield to maturity (YTM) of a bond is a measure of the total return an investor can expect to receive if the bond is held until it matures. It takes into account the bond's current market price, par value, time to maturity, coupon interest payments, and any potential capital gains or losses. The formula for calculating the yield to maturity of a bond is somewhat complex, but it can be approximated as follows:

Where:

- = Yield to Maturity

- = Annual coupon payment

- = Face value of the bond

- = Current market price of the bond

- = Number of years to maturity

It's important to note that this formula assumes that the bond pays annual interest and that the investor will hold the bond until maturity.

Here's a step-by-step guide on how to calculate the yield to maturity:

Determine the Annual Coupon Payment (C):

- This is the annual interest payment the bondholder receives. It's usually a fixed percentage of the bond's face value. If, for example, the bond pays a 5% coupon on a $1,000 face value bond, the annual coupon payment (C) would be $50.

Determine the Number of Years to Maturity (n):

- Calculate the number of years remaining until the bond matures.

Determine the Face Value of the Bond (F):

- This is the value of the bond at maturity. It's typically $1,000 for most bonds.

Determine the Current Market Price of the Bond (P):

- This is the current market value of the bond, which can be obtained from the bond's market quotes.

Plug the Values into the Formula:

- Substitute the values of C, F, P, and n into the formula mentioned earlier.

Calculate the YTM:

- Use the formula to calculate the yield to maturity.

Keep in mind that this formula assumes that the bondholder will hold the bond until maturity and that interest rates remain constant. If interest rates change or if the bond is sold before maturity, the actual yield to maturity may differ from the calculated YTM.

For a more precise calculation, financial calculators, spreadsheet software (such as Excel), or dedicated financial analysis software can be used to find the yield to maturity. Additionally, there are online calculators available that can streamline the process.

How do you calculate bond yield to maturity?

To calculate the yield to maturity (YTM) of a bond, you need to know the following:

- The bond's face value: The face value is the amount that the issuer will repay to the bondholder at maturity.

- The bond's coupon rate: The coupon rate is the interest rate that the issuer will pay to the bondholder on a semi-annual basis.

- The bond's current price: The bond's current price is the amount that you would need to pay to buy the bond on the open market.

- The bond's maturity date: The maturity date is the date on which the issuer will repay the face value of the bond to the bondholder.

Once you have this information, you can use the following formula to calculate the YTM:

YTM = (C + (F - P) / n) / (F + P) / 2

Where:

- C = Coupon payment

- F = Face value

- P = Current price

- n = Number of compounding periods

What is the formula and process for determining the yield to maturity of a bond?

The formula for calculating the YTM of a bond is shown above. The process for determining the YTM is as follows:

- Gather the necessary information: the bond's face value, coupon rate, current price, and maturity date.

- Substitute the information into the YTM formula.

- Solve for the YTM.

Are there factors or considerations that impact bond yield calculations?

Yes, there are a number of factors that can impact bond yield calculations. These include:

- The creditworthiness of the issuer: Bonds issued by more creditworthy issuers will typically have lower yields than bonds issued by less creditworthy issuers.

- The term of the bond: Longer-term bonds will typically have higher yields than shorter-term bonds.

- The interest rate environment: Higher interest rates will typically lead to higher bond yields.

- Supply and demand: If there is more demand for bonds than supply, bond prices will tend to rise and yields will fall. Conversely, if there is more supply of bonds than demand, bond prices will tend to fall and yields will rise.

Investors should be aware of these factors when calculating bond yields and making investment decisions.

Here is an example of how to calculate the YTM of a bond:

A bond has a face value of $1,000, a coupon rate of 5%, a current price of $950, and a maturity date of 5 years. The YTM of the bond would be calculated as follows:

YTM = (C + (F - P) / n) / (F + P) / 2

YTM = (50 + (1000 - 950) / 10) / (1000 + 950) / 2

YTM = 5.26%

Therefore, the YTM of the bond is 5.26%. This means that if you were to buy the bond today and hold it until maturity, you would earn an annualized return of 5.26%.

It is important to note that the YTM is just a theoretical measure of return. The actual return that you earn on a bond will depend on a number of factors, including the bond's price performance, the interest rate environment, and the issuer's creditworthiness.