What is bond market interest rate?

The term "bond market interest rate" refers to the prevailing interest rates in the bond market. It represents the return that investors expect to earn when investing in bonds. Bond market interest rates play a crucial role in determining the pricing and yields of bonds and are influenced by various factors.

Here are key points to understand about bond market interest rates:

Yield and Price Relationship:

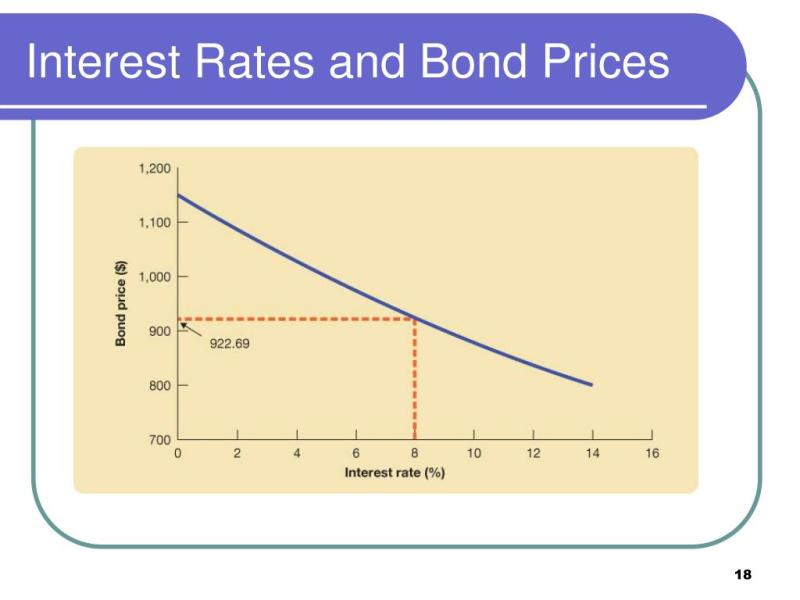

- Bond prices and yields have an inverse relationship. When bond market interest rates rise, bond prices typically fall, and when interest rates fall, bond prices tend to rise. This relationship is fundamental to understanding bond market dynamics.

Coupon Rate vs. Market Interest Rate:

- The coupon rate is the fixed annual interest rate specified in a bond's contract. However, the market interest rate, or yield, may differ based on changes in market conditions. If the market interest rate is higher than the bond's coupon rate, the bond may trade at a discount. If the market interest rate is lower, the bond may trade at a premium.

Current Yield:

- The current yield is a measure of the bond's return based on its current market price. It is calculated by dividing the annual coupon payment by the current market price. Current yield is an indicator of the bond's relative attractiveness in the current market environment.

Yield to Maturity (YTM):

- Yield to maturity represents the total return an investor can expect if the bond is held until maturity, considering both interest payments and any potential capital gains or losses. YTM takes into account the bond's current market price and the difference between the current price and face value.

Market Forces Impacting Interest Rates:

- Various market forces influence bond market interest rates, including changes in inflation expectations, central bank policies, economic indicators, and overall market sentiment. Central banks, such as the Federal Reserve in the United States, can influence short-term interest rates through monetary policy.

Credit Risk and Spreads:

- The credit risk associated with a bond issuer can impact its yield. Bonds with higher credit risk typically offer higher yields to compensate investors for taking on additional risk. The yield spread is the difference between the yield on a bond and the yield on a benchmark, often a government bond.

Term Structure of Interest Rates:

- The term structure of interest rates, often depicted by the yield curve, shows the relationship between interest rates and the time to maturity for bonds. The yield curve can be upward-sloping, flat, or downward-sloping, providing insights into market expectations.

Understanding bond market interest rates is essential for investors, as they affect the returns and risks associated with bond investments. Investors monitor interest rate trends and market conditions to make informed decisions about buying, selling, or holding bonds in their portfolios.

Navigating the complex world of bond markets requires a clear understanding of interest rates. Let's explore the intricacies of bond market interest rates and their impact on investors and the financial landscape:

1. The Concept of Bond Market Interest Rate:

The bond market interest rate, often referred to as bond yield, represents the annualized return an investor expects to receive by holding a bond until maturity. It's not directly paid out but reflects the implied compensation earned per dollar invested.

2. Determining Interest Rates:

Several factors influence bond market interest rates:

- Supply and demand: The interplay between bond issuers seeking funds and investors looking for investments determines the equilibrium price and, consequently, the yield.

- Risk and creditworthiness: Bonds issued by companies with higher credit ratings (lower default risk) typically have lower yields, while those with lower ratings require higher yields to compensate for the increased risk.

- Maturity date: Longer-term bonds generally have higher yields than shorter-term ones due to the increased risk of holding them for longer.

- Market conditions: Overall economic conditions, inflation expectations, and government monetary policy play a significant role in shaping bond market interest rates.

3. Different Types of Interest Rates:

Several types of interest rates exist within the bond market:

- Coupon rate: This is the fixed interest rate set at issuance, paid out periodically until maturity.

- Current yield: This is a simple calculation dividing the annual coupon payment by the current market price, offering a basic estimate of annual return.

- Yield to maturity (YTM): This takes into account all remaining coupon payments and the bond's face value at maturity, factoring in its time to maturity and current market price, and offering a more precise picture of overall return if held until maturity.

- Zero-coupon rate: These bonds don't pay periodic interest but are issued at a discount to their face value and mature at par, providing the return through price appreciation.

4. Impact of Changing Interest Rates:

Changes in bond market interest rates can significantly impact:

- Bond prices: When rates rise, existing bond prices tend to fall, and vice versa. Investors holding bonds might experience capital gains or losses depending on the direction of the change.

- Investment decisions: Rising rates might make investors favor safer assets like government bonds, while falling rates could increase appetite for riskier assets like corporate bonds.

- Borrowing costs: Businesses and governments relying on bond issuance to raise capital could face higher borrowing costs if rates rise, impacting their financial plans.

- Economic activity: Lower interest rates generally stimulate borrowing and investment, potentially boosting economic growth, while higher rates can dampen activity.

5. The Bond Market's Role in Shaping Broader Interest Rate Trends:

The bond market plays a crucial role in shaping broader economic interest rate trends:

- Government influence: Central banks like the Federal Reserve use monetary policy tools like open market operations to influence bond market interest rates, indirectly impacting other interest rates across the economy.

- Market expectations: The bond market serves as a barometer of investor expectations for future economic conditions and inflation, influencing central bank decisions and broader interest rate trends.

- Risk sentiment: Shifts in investor risk appetite can cause fluctuations in bond yields, which can subsequently influence other interest rates and borrowing costs across the financial system.

By understanding the intricacies of bond market interest rates, their determinants, and their impact on investors and the broader economy, you can make informed investment decisions and navigate the complex financial landscape with greater confidence. Remember, staying informed about market trends and economic developments is crucial in navigating the ever-changing world of bonds and interest rates.