What is Apy, and what is Apr?

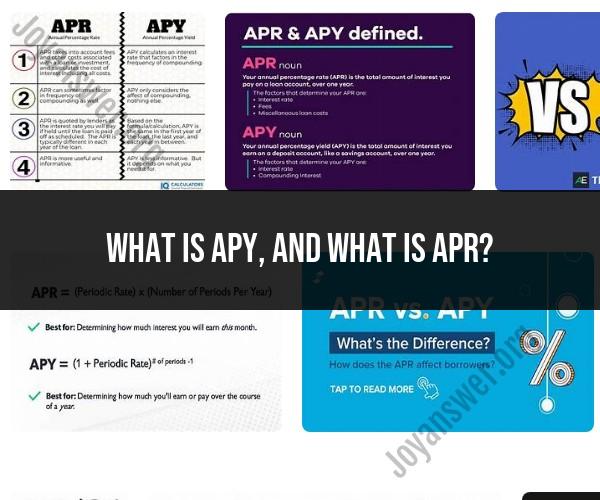

APY (Annual Percentage Yield) and APR (Annual Percentage Rate) are both interest rates used in the world of finance, but they serve different purposes and are applied to different types of financial products. Here's what each term means:

APY (Annual Percentage Yield):

- APY is used to represent the effective annual interest rate that you earn or pay on an investment or savings account. It takes into account the interest rate, the frequency of compounding, and any fees associated with the account.

- APY is typically used for savings accounts, certificates of deposit (CDs), and other investments. It tells you how much your money will grow in a year, considering both the stated interest rate and the effect of compounding.

- APY is always equal to or higher than the stated interest rate because it considers the power of compounding. It provides a more accurate representation of your earnings or costs over time.

APR (Annual Percentage Rate):

- APR is used to represent the annualized interest rate on loans, credit cards, or other forms of borrowing. It accounts for the interest rate and any additional costs or fees associated with the loan, such as origination fees or points.

- APR is designed to provide borrowers with the true cost of borrowing by including all the fees in the calculation. It helps borrowers make informed decisions when comparing loan offers from different lenders.

- Unlike APY, APR does not consider compounding because it deals with loans where the borrower is not earning interest but paying it. However, APR may be calculated differently for different types of loans.

In summary, APY is used for investments and savings accounts to calculate the effective annual return, considering both the interest rate and compounding, while APR is used for loans and credit cards to calculate the annualized cost of borrowing, including interest and fees. Both rates are valuable tools for consumers to understand the terms and costs associated with various financial products.

APY vs. APR: Decoding Interest Rate Acronyms

APY and APR are two acronyms that are commonly used in the financial industry. APY stands for annual percentage yield, while APR stands for annual percentage rate. Both APY and APR measure interest, but they measure it in different ways.

APY is used to calculate the amount of interest that will be earned on a savings account or investment over a year. It takes into account the effect of compounding, which is when interest is earned on interest.

APR is used to calculate the total cost of a loan, including interest and fees. It does not take compounding into account.

The Significance of APY and APR in Financial Transactions

APY and APR are both important factors to consider when making financial decisions. When you are shopping for a savings account, compare the APYs of different banks. When you are shopping for a loan, compare the APRs of different lenders.

APY and APR can also be used to compare different types of investments. For example, if you are considering investing in a certificate of deposit (CD), you can compare the APY of the CD to the APY of a savings account to see which option will earn you more interest.

Calculating and Comparing APY and APR for Better Decisions

To calculate APY, you can use a financial calculator or an online APY calculator. To calculate APR, you can use a financial calculator or an APR calculator.

When comparing APYs and APRs, it is important to make sure that you are comparing apples to apples. For example, if you are comparing the APYs of two different savings accounts, make sure that the accounts have the same compounding period. And if you are comparing the APRs of two different loans, make sure that the loans have the same term.

Interest Rate Clarity and Consumer Empowerment

Understanding the difference between APY and APR is important for making informed financial decisions. When consumers are aware of the different types of interest rates and how they are calculated, they can make more informed choices about their savings and investments.

Harnessing the Power of Interest Rate Knowledge

By understanding APY and APR, you can make better financial decisions. For example, if you are saving for a down payment on a house, you can choose a savings account with a high APY. And if you are considering taking out a loan, you can choose a loan with a low APR.

Here are some tips for harnessing the power of interest rate knowledge:

- Shop around for the best interest rates. Compare APYs and APRs from different banks and lenders before you open a savings account or take out a loan.

- Use a financial calculator. A financial calculator can help you to calculate APY, APR, and other financial metrics.

- Ask questions. If you don't understand something about APY or APR, ask a financial advisor for help.

Understanding APY and APR is essential for making informed financial decisions. By harnessing the power of interest rate knowledge, you can save money and reach your financial goals faster.