Can APY be lower than APR?

No, the Annual Percentage Yield (APY) cannot be lower than the Annual Percentage Rate (APR) for a given investment or loan. The APY is always equal to or higher than the APR, and this difference arises from the way these two interest rates are calculated.

Here's a brief explanation of both terms:

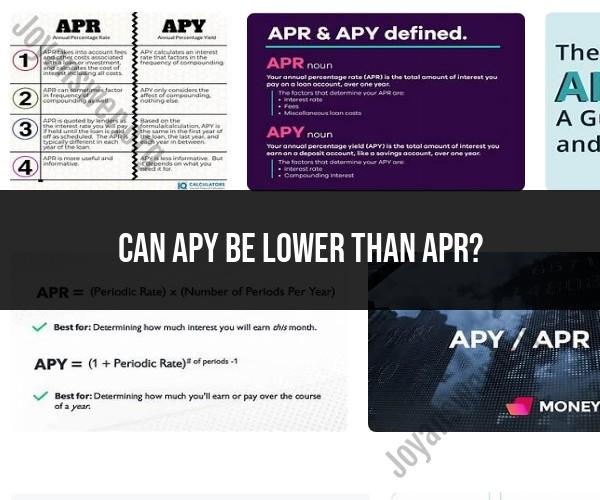

Annual Percentage Rate (APR): The APR is the annual cost of borrowing money or the annualized interest rate on a loan. It is typically used for loans, credit cards, and other forms of borrowing. The APR includes the interest rate plus any additional fees or costs associated with the loan. It is the rate that helps borrowers understand the true cost of borrowing.

Annual Percentage Yield (APY): The APY is the annual rate of return on an investment or savings account. It is commonly used for savings accounts, certificates of deposit (CDs), and investments. The APY takes into account the interest rate and the effect of compounding, which is the process of earning interest on both the initial deposit and any previously earned interest.

Since the APY considers compounding while the APR does not, the APY will always be equal to or higher than the APR. In other words, the APY provides a more accurate representation of the total interest earned or paid over a year, taking into account the compounding frequency.

For example, if you have a savings account with a 5% annual interest rate that compounds monthly, the APY would be slightly higher than 5% because of the monthly compounding. In contrast, the APR would be 5%, which doesn't consider compounding. The exact relationship between the APR and APY depends on the compounding frequency and the specific terms of the investment or loan.

Can APY Be Lower Than APR? Unpacking Interest Rates

Yes, APY can be lower than APR in some cases. This is because APR and APY measure different things. APR is the annual percentage rate charged on a loan, while APY is the annual percentage yield earned on a savings account. APY takes into account the effect of compounding, which is when interest is earned on interest. APR does not take compounding into account.

Understanding APR and APY: Interest Rate Distinctions

APR and APY are both interest rates, but they measure different things. APR is the annual percentage rate charged on a loan, while APY is the annual percentage yield earned on a savings account.

APR:

- APR is used to calculate the total cost of a loan, including interest and fees.

- APR is quoted as a percentage of the loan amount.

- APR is used to compare different loan offers.

APY:

- APY is used to calculate the amount of interest that will be earned on a savings account over a year.

- APY is quoted as a percentage of the deposit amount.

- APY is used to compare different savings account offers.

When APR and APY Differ: Scenarios and Implications

APR and APY will differ when the interest rate compounds more than once a year. For example, if a savings account pays 5% interest compounded monthly, the APY will be slightly higher than 5% because interest is earned on interest.

The difference between APR and APY is usually small, but it can become more significant over time. For example, if you have a savings account with an APY of 5% and you deposit $10,000, you will earn $500 in interest after one year. If the interest were compounded annually, you would only earn $481.25 in interest.

Making Informed Financial Decisions with APR and APY Knowledge

Knowing the difference between APR and APY is important for making informed financial decisions. When you are shopping for a loan, compare the APRs of different lenders. When you are shopping for a savings account, compare the APYs of different banks.

Here are some tips for using APR and APY to make informed financial decisions:

- When comparing loan offers, choose the loan with the lowest APR.

- When comparing savings account offers, choose the account with the highest APY.

- Keep in mind that APR and APY are just two factors to consider when making financial decisions. Other factors, such as fees and terms, are also important.

Demystifying Interest Rates for Savvy Consumers

Interest rates can be confusing, but it is important to understand them if you want to make informed financial decisions. Here are some basic things to know about interest rates:

- Interest rates are expressed as a percentage.

- Interest rates can be fixed or variable.

- Fixed interest rates stay the same over the life of the loan or deposit.

- Variable interest rates can change over time.

- The higher the interest rate, the more interest you will pay on a loan or earn on a deposit.

If you have any questions about interest rates, be sure to ask a financial advisor for help.